Thinking of investing in SOL? Here's a deep dive into Solana’s price trends and future outlook

Introduction

TradingKey – In October 2025, the Hong Kong Securities and Futures Commission approved Asia’s first Solana spot ETF, a move that could accelerate U.S. SEC approval and provide fresh momentum for SOL’s price. This development has reignited market interest in Solana.

So, will the SOL spot ETF be approved in the U.S. this year? And can SOL reach new highs? Let’s explore.

What Is Solana/SOL?

Just like BTC is the token of Bitcoin and ETH is the token of Ethereum, SOL is the native token of the Solana blockchain. It serves multiple functions: gas fees, payments, staking, liquidity mining, governance proposals, and voting.

Solana is a high-performance Layer 1 blockchain designed to solve scalability and throughput limitations. It uses a hybrid PoH + PoS consensus, capable of processing over 65,000 transactions per second (TPS) with average fees as low as $0.00025. Solana is widely seen as Ethereum’s strongest competitor and has earned the nickname “Ethereum killer.”

SOL Price Performance Review

In March 2020, SOL launched its Initial Coin Offering (ICO) at $0.22, and later debuted on major exchanges at around $1.50. In 2021, the crypto market entered a new bull cycle, and SOL surged alongside the NFT and DeFi boom, reaching a peak near $260.

SOL Price Chart – Source: TradingView.

SOL Price Chart – Source: TradingView.

However, in 2022, the market experienced a sharp correction, and SOL suffered a steep drop due to the FTX collapse, plunging to as low as $8. Throughout 2023, SOL hovered below $25, but the Solana team remained committed to infrastructure development and continued improving network performance.

In 2024, several MEME coins on Solana — such as WIF, BONK, and BOME — gained traction, sparking a meme coin frenzy that helped lift SOL’s price. By early 2025, SOL rallied close to $300, surpassing its previous bull market high. However, in September 2025, a second attempt to break the $300 mark failed, and SOL has since hovered below $200, currently trading at $181.

Time Period | Price Range (USD) | Key Events & Background |

March 2020 | $0.22 | Initial Coin Offering (ICO) |

November 2021 | $260.06 | NFT and DeFi boom; all-time high |

2022–2023 | $8–$25 | FTX collapse and market correction; Solana hit hard |

Q4 2024 | $75–$120 | Ecosystem recovery and institutional inflows |

January 19, 2025 | $293.31 | New high driven by Bitcoin halving and institutional adoption |

Key SOL Price Milestones – Sources: Gate, OKX, BTCC

Key Drivers of SOL Price

The price of SOL is shaped by two primary categories of drivers:

- Fundamentals – including the number of DApps built on Solana and its Total Value Locked (TVL)

- Event-driven catalysts – such as the FTX collapse triggered by SBF, Bitcoin halving cycles, and Donald Trump’s re-election as U.S. President

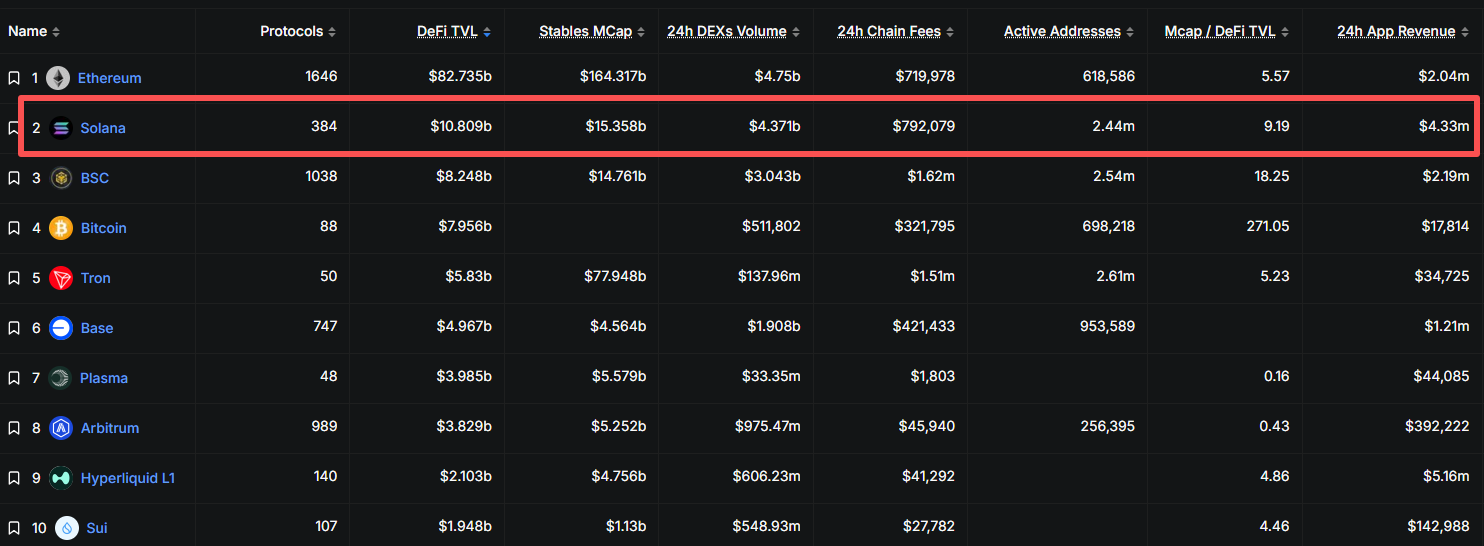

Shortly after its launch, SOL’s market cap surged, consistently ranking among the top 10 crypto assets. This growth is largely attributed to Solana’s robust ecosystem. According to recent data:

- TVL: $10 billion, ranking 2nd among all public chains

- DApps: 380+, ranking 8th

- Stablecoin market cap: $15 billion+, ranking 3rd

- Active addresses: Over 2.4 million, ranking 3rd Overall, Solana’s ecosystem ranks 2nd globally, just behind Ethereum.

Top 10 Public Chains by Ecosystem Strength – Source: DefiLlama.

Top 10 Public Chains by Ecosystem Strength – Source: DefiLlama.

SOL’s price volatility is not only tied to its own fundamentals but also to broader market cycles and external events. In 2021, the crypto market entered a bull run, lifting SOL alongside the broader rally. In 2022, the FTX collapse severely impacted Solana’s reputation and price. By 2024–2025, a wave of positive developments — including the Bitcoin halving, Trump’s re-election, and SOL’s inclusion in the U.S. strategic crypto reserve — helped reignite bullish momentum and push SOL toward new highs.

Institutional Price Forecasts

Institution/Analyst | 2025 Target Price | Long-Term Outlook |

OKX | $450 | — |

Gate | $350 | — |

Bitget | — | $304.56 (2026) |

CryptoPulse | $300–$400 | — |

Lark Davis | $300–$400 | $600 (multi-year) |

VanEck | $200 (2025) | $3,211 (2030) |

21 Share | $336 | $2,000 (multi-year) |

SOL Price Outlook: Can It Break Through Key Resistance and Reach New Highs?

In the near term, SOL faces resistance around the $200 level. Whether it can decisively break through this ceiling will determine the strength of the next bullish leg. The next major resistance zone lies between $260–$290, near its previous cycle highs.

Currently, the odds of SOL retesting its all-time high appear favorable, supported by two key catalysts:

- Solana Spot ETF Approval

- Federal Reserve Interest Rate Policy

Hong Kong has already approved the Solana spot ETF, which may pressure the U.S. SEC to follow suit. VanEck previously forecasted that the SEC would approve the product this year. If that happens, it would be a major bullish catalyst for SOL.

In September, the Federal Reserve cut rates by 25 basis points, officially launching a new phase of monetary easing. Markets now expect another rate cut in October, with odds as high as 98%. This would inject additional liquidity into the system, benefiting risk assets — including mainstream cryptocurrencies like SOL.

SOL Daily Price Chart – Source: TradingView.

SOL Daily Price Chart – Source: TradingView.

Over a longer time horizon, whether SOL can break past its all-time high of $294 will depend on:

- U.S. monetary policy

- Crypto regulatory stance under the Trump administration

So far, the Trump administration has embraced the crypto sector, and Trump continues to pressure the Fed to cut rates — an overall optimistic backdrop. However, growing domestic and international dissatisfaction with President Trump has led to rising protests, such as the recent “No Kings” movement, which could pose challenges to his policy agenda.

Conclusion

Solana has demonstrated strong technical resilience and ecosystem growth in 2025. If it continues expanding use cases, stabilizing network performance, and navigating regulatory hurdles, SOL could become a core Web3 infrastructure asset. Institutions remain bullish on its long-term potential, especially in DeFi, NFTs, and Web3 applications. With favorable regulation and liquidity, SOL may not only retest its previous highs — but set new records.