Hyperliquid Price Forecast: HYPE poised for $45 breakout amid bullish momentum

- Hyperliquid extends recovery above the key $40.00 level on Thursday.

- HYPE's DeFi TVL increases by over 4% in the past 24 hours to $2.17 billion.

- Growing retail demand and technical buy signals support Hyperliquid's short-term bullish case.

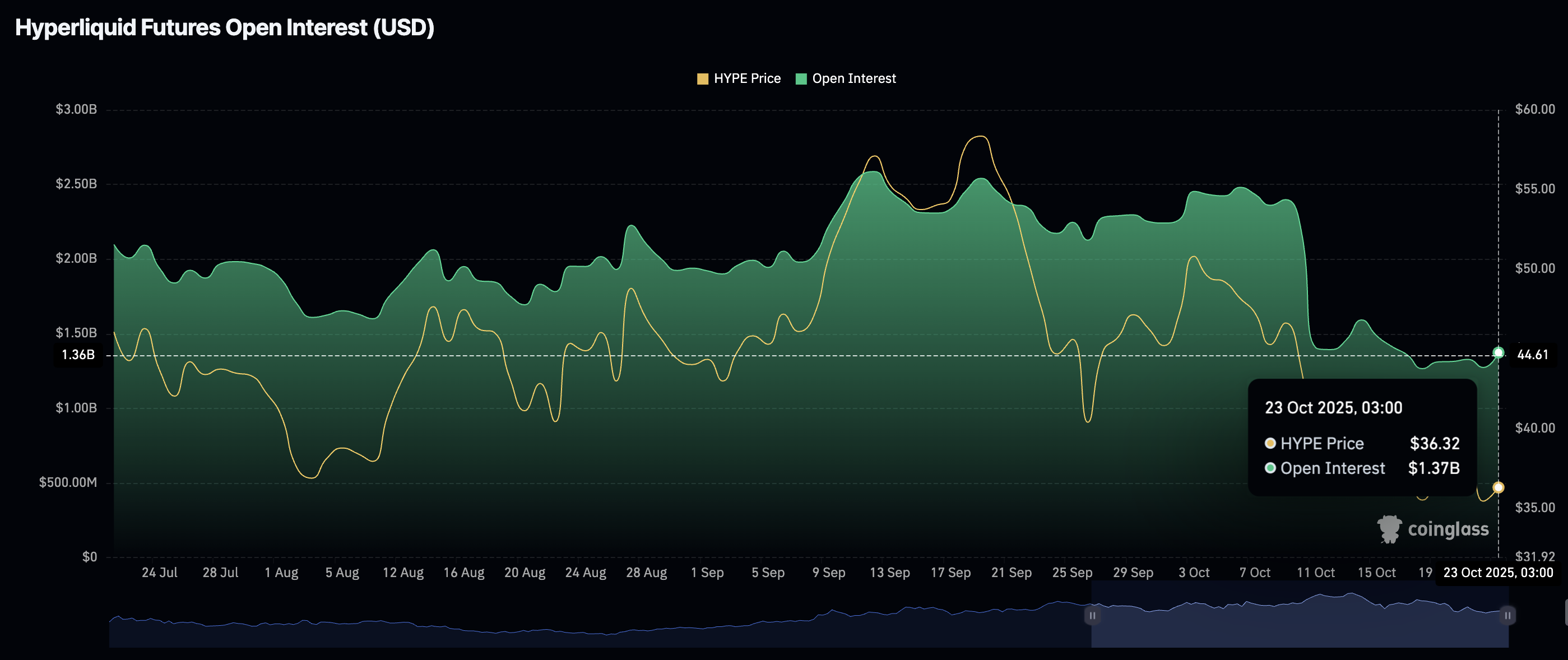

Hyperliquid (HYPE) is trading above $40.00 at the time of writing on Thursday, building on a broader bullish wave in the cryptocurrency market. Interest in the Decentralized Exchange (DEX) perpetual native token is also rising, as evidenced by the futures Open Interest (OI), which averages $1.37 billion.

Hyperliquid rises as retail demand returns

The HYPE derivatives market is stabilizing, as evidenced by the futures OI recovering to $1.37 billion from approximately $1.27 billion on last Saturday. Although minor, the uptick reflects a potential shift in sentiment from bearish to bullish.

The OI peaked at $2.59 billion days before Hyperliquid reached a historical high of $59.57 on September 18, underscoring the impact of steady retail demand and investor confidence in the recovery.

Hyperliquid Futures Open Interest | Source: CoinGlass

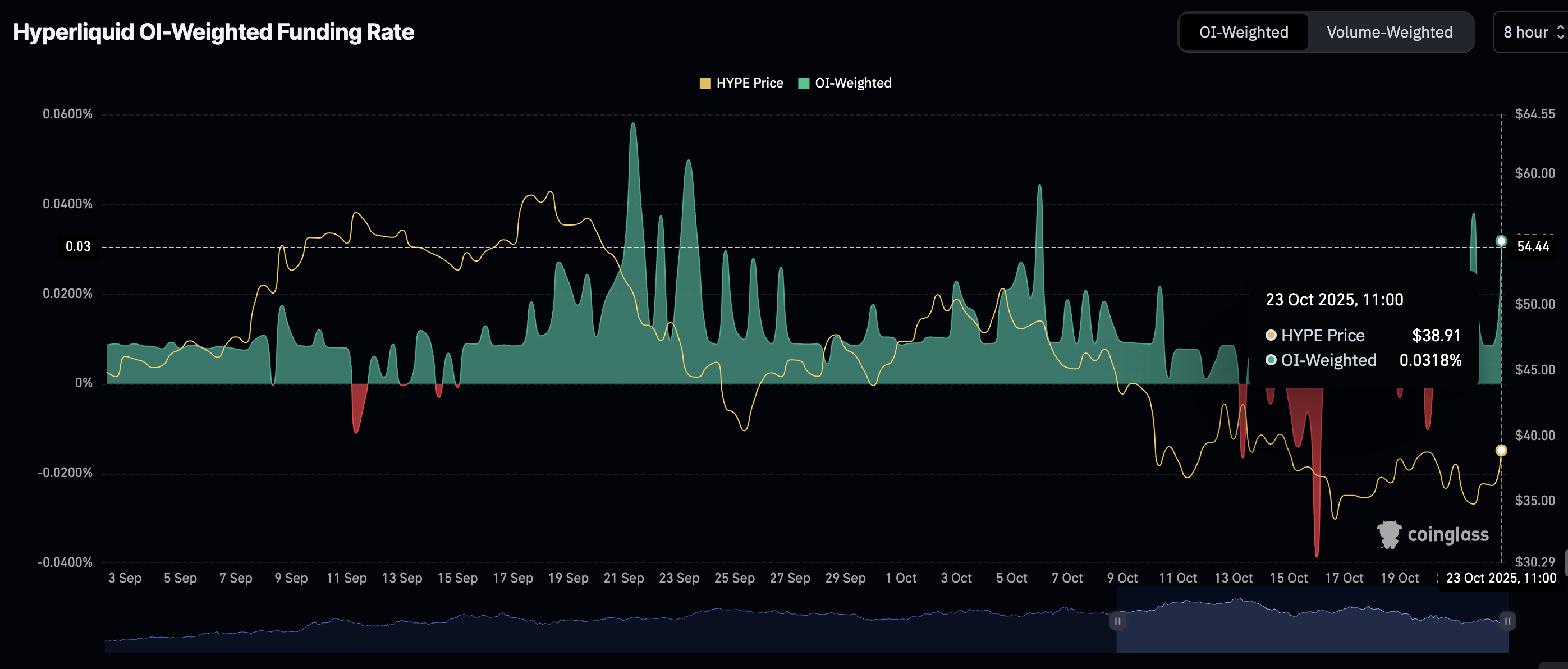

Hyperliquid faced extreme volatility over the last two weeks, fluctuating between the October low of $27.50 and the $44.00 resistance, which was tested on October 13.

According to CoinGlass data, the OI-Weighted Funding Rate metric averages 0.0318% at the time of writing, after plunging to -0.0102% on Sunday and -0.0386 on October 16.

The OI-weighted funding shows the level of interest among traders. A steady rise indicates that traders are increasingly seeking exposure to long positions as confidence improves.

Hyperliquid OI-Weighted Funding Rate metric | Source: CoinGlass

Meanwhile, the risk appetite for Hyperliquid's Decentralized Finance (DeFi) products is growing, as evidenced by the protocol's Total Value Locked (TVL) rising. According to DefiLlama, TVL stands at $2.17 billion, up 4.4% over the past 24 hours. Investors often transfer their holdings to staking protocols to hold for longer and earn rewards. This shows they are confident in the token and its ecosystem's future.

Hyperliquid DeFi TVL | Source: DefiLlama

Technical outlook: Can Hyperliquid sustain recovery?

Hyperliquid edges higher, trading above $40.00 at the time of writing on Thursday, supported by the 200-day Exponential Moving Average (EMA) at $36.11. The engulfing green candle on the daily chart mirrors positive sentiment in the broader crypto market.

Hyperliquid's bullish outlook is supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator, also in the same daily range. Investors will continue increasing their risk exposure if the MACD line in blue remains above the red signal line.

The Relative Strength Index (RSI), which has recovered to 47, indicates that bullish momentum is increasing. Higher RSI readings toward overbought territory would confirm a significant shift from a bearish to a bullish technical outlook.

HYPE/USDT daily chart

A daily close above $40.00 would validate risk-on sentiment, increasing the odds of a breakout past $45.00. Other key areas of interest for traders are the 100-day Exponential Moving Average (EMA) at $42.58 and the 50-day EMA at $43.29, all of which could dampen the uptrend. Profit-taking at these levels may result in a sweep below $40.00 as Hyperliquid seeks more liquidity before another breakout attempt.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.