Mantle Price Forecast: MNT flashes breakout potential as bullish positions surge

- Mantle bounces off the $1.50 support zone, with bulls preparing for a potential descending triangle pattern breakout.

- A rise in futures Open Interest, funding rate suggests risk-on sentiment resurfacing among investors.

- The monthly DEX volume on Mantle networks holds steady above $700 million for the third consecutive month.

Mantle (MNT) rebounds from the $1.50 psychological support zone for the third time so far this month, eyeing a potential breakout rally. The recovery is underpinned by a rise in bullish positions built up in the Mantle derivatives market and a steady flow of Decentralized Exchange (DEX) trading volume.

Technically, the MNT token trades at a crucial crossroads as the selling pressure declines.

On-chain and derivatives market demand resurfaces for Mantle

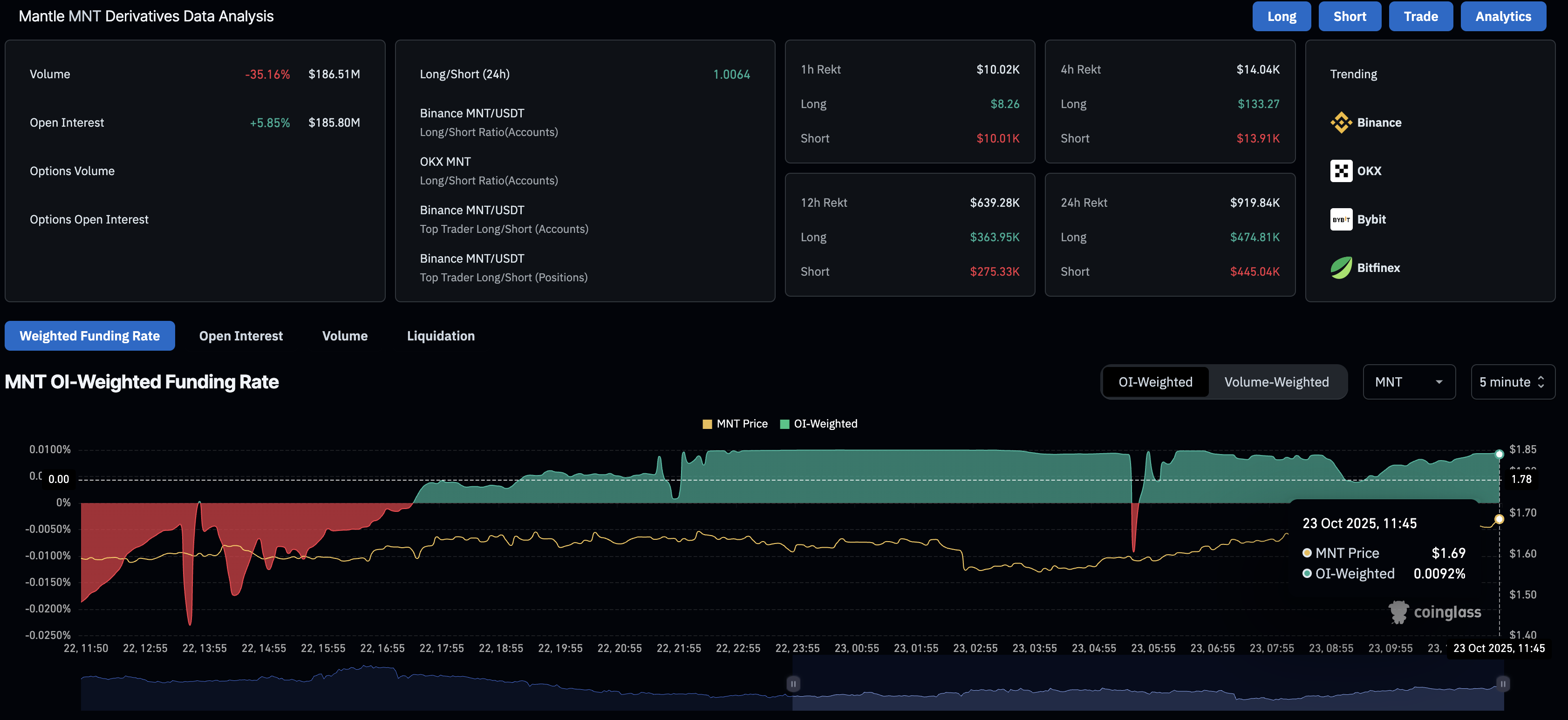

Mantle, one of the few tokens trading in the green at the time of writing on Thursday, is gaining retail interest, as traders anticipate further gains. CoinGlass data shows that the MNT futures Open Interest (OI) has increased by 5.85% in the last 24 hours, reaching $185.80 million.

Typically, a rise in futures OI indicates an increase in the notional value of all outstanding contracts as traders increase their risk exposure by acquiring new long positions or increasing their leverage. As the market recently witnessed a massive flush of overleveraged positions, the entry of new bulls or fresh positions seems more likely.

Adding to the bullish sentiment, the OI-weighted funding rate has flipped positive to 0.0092% from -0.0187% on Wednesday. This indicates that traders are willing to pay a hefty premium to hold call-side positions. Generally, funding rates of 0.010% or more signal a bull-side dominance.

Mantle derivatives data. Source: CoinGlass

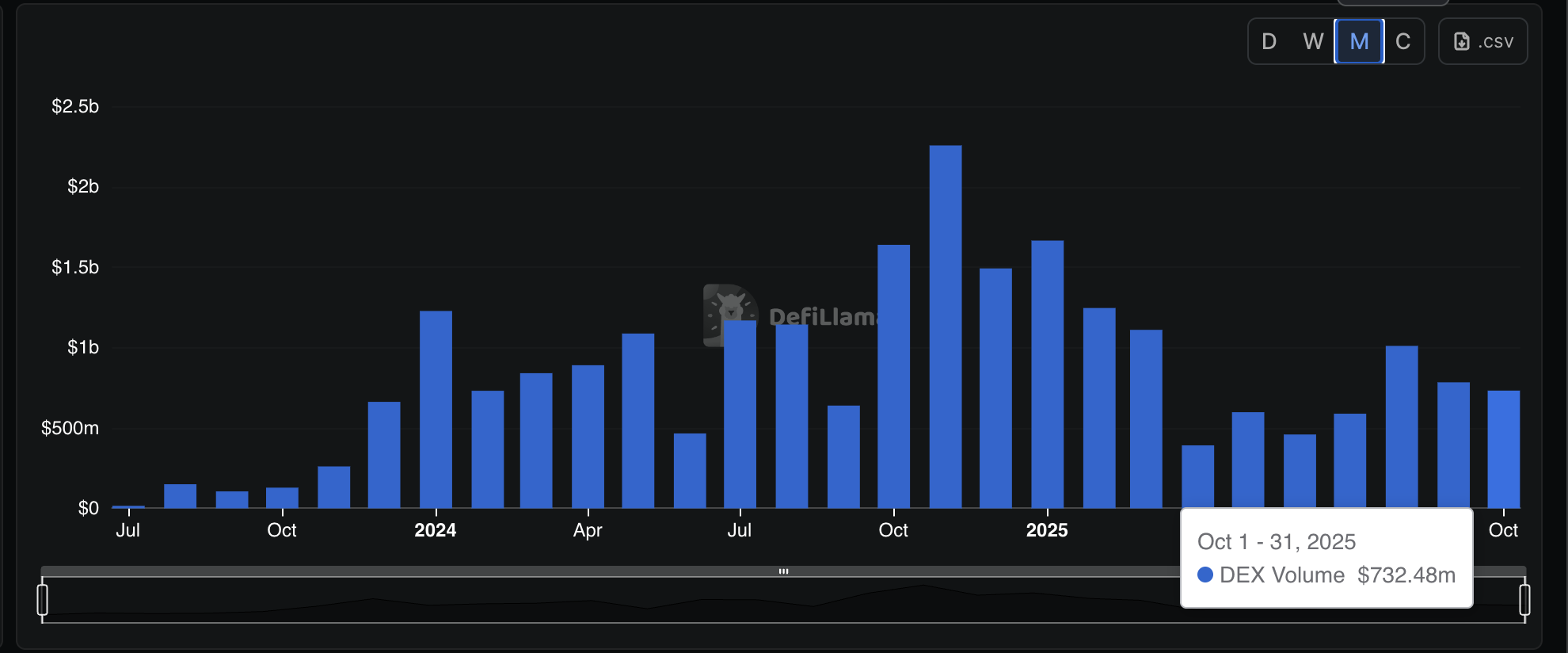

Apart from the derivatives market, a surge in user activity on the Mantle network could boost the demand for MNT, its native token. DeFiLlama data shows that the Manlte has collected $732.48 million in monthly DEX volume so far in October, marking its third straight month above $700 million. Despite a decline from $1 billion in DEX volume in August, demand holds steady in a volatile market.

Mantle DEX volume. Source: DeFiLlama

Mantle’s rebound could face multiple resistances overhead

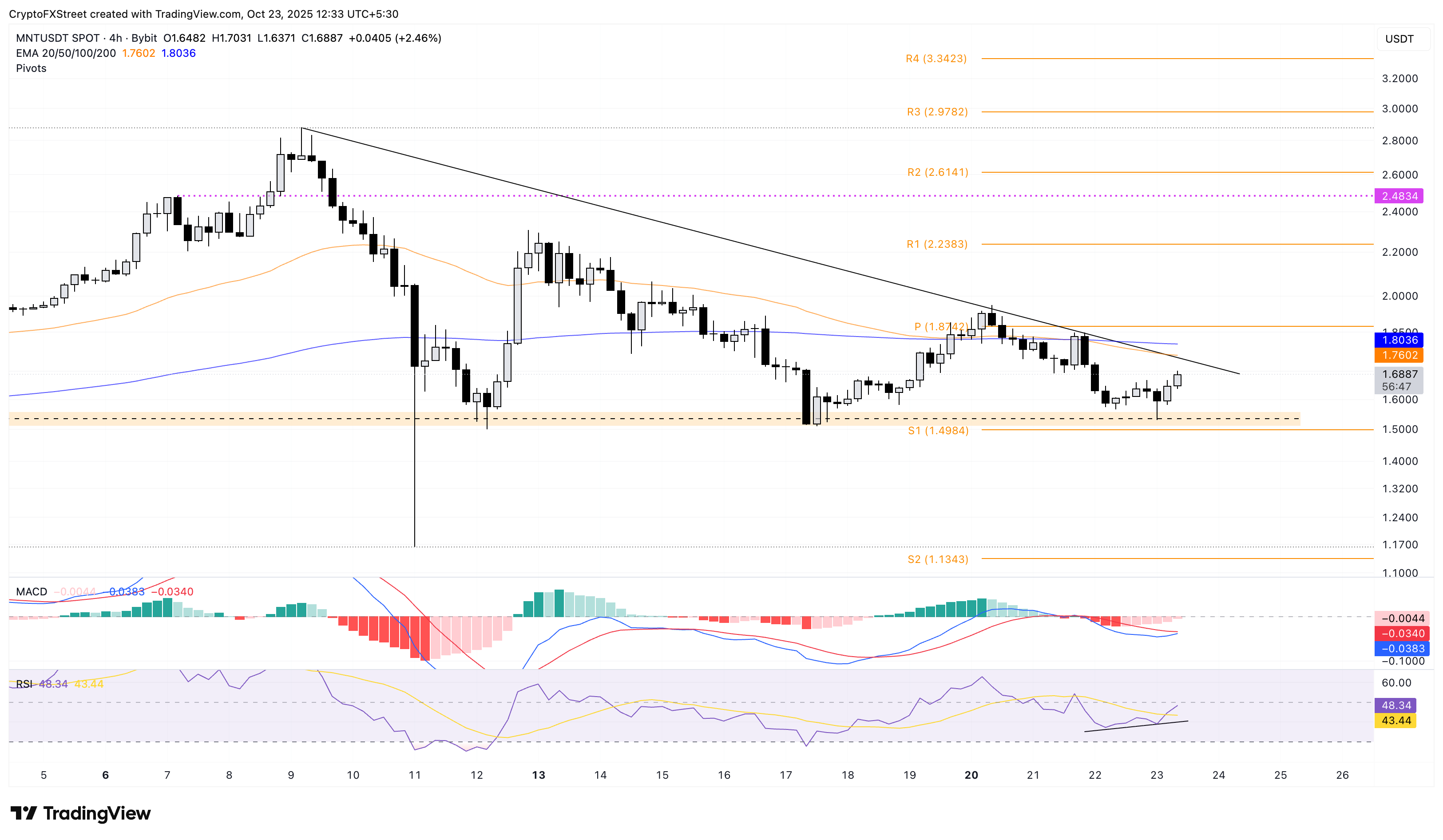

Mantle edges higher by over 5% at press time on Thursday, after three successive days of losses. The bounce back from the $1.50 support zone approaches a local resistance trendline formed by connecting the October 9 and October 21 peaks on the 4-hour price chart.

Technically, the declining trendline and the $1.50 base support form a descending triangle pattern, which generally leads to a downside breakout. However, the tailwinds from retail interest and steady network demand could extend the prevailing trend.

A decisive breakout above the 50-period Exponential Moving Average (EMA) on the 4-hour chart at $1.76 would confirm the pattern breakout. However, the short-term resistance at the 200-period EMA and the Pivot Point at $1.80 and $1.87, respectively, could prove critical.

If MNT surpasses these levels, it could extend the rally by 33% from the current market price to the R2 Pivot Point at $2.23.

The technical indicators on the 4-hour price chart suggest a bullish trend ahead as the Moving Average Convergence Divergence (MACD) approaches the signal line for a potential crossover, which could confirm the increase in bullish momentum.

At the same time, the Relative Strength Index (RSI) reads 48 on the same chart, making a higher low compared to the price bottoms at $1.50, which signals a bullish divergence. This divergence indicates a rise in short-term bullish strength, increasing the chances of a breakout rally.

MNT/USDT 4-hour price chart.

On the downside, if MNT drops below $1.50, it could extend the drop to the $1.13 mark, aligning with the S2 Pivot Point and nullifying the upside potential.