Can BNB Overtake Ethereum? 3 Key Signals Fuel the Debate

The competition between Ethereum (ETH) and BNB Coin (BNB) is intensifying as the latter shows remarkable resilience amid a cooling crypto market.

While ETH continues to dominate, multiple signals have sparked the debate over whether BNB could challenge the second-largest cryptocurrency’s position in the market.

BNB vs. Ethereum: Could Network Growth and Market Strength Tip the Balance?

The crypto market has seen many ups and downs over the past years, with the recent crash pulling it below $4 trillion. Despite this volatility, Ethereum has maintained its position as the second-largest crypto asset after Bitcoin (BTC).

However, could this dominance be challenged? Three key signals represent early warnings of a potential shift.

From a technical perspective, the BNB/ETH chart shows a long-term bullish structure shaped by cycles of expansion and correction. While volatility remains, the broader picture still points to BNB holding a structural advantage.

BNB/ETH Chart. Source: TradingView

BNB/ETH Chart. Source: TradingView

Altcoin Vector also noted in a post on X (formerly Twitter) that BNB has outperformed ETH so far this year.

“It’s not just price: BNB maintained a consistent impulse phase, strong enough to forge its own BNB Season. While ETH’s impulse faded, BNB’s stayed alive, sustaining structure even after the deleveraging event,” the post read.

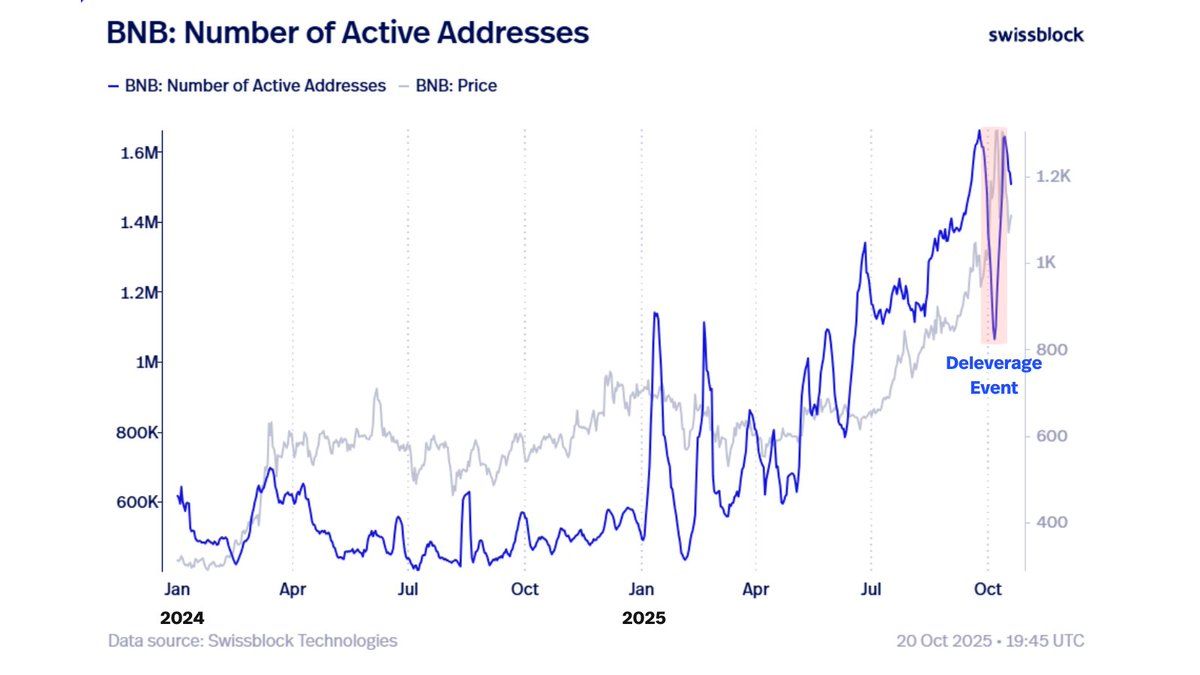

Another signal of BNB’s momentum is the jump in daily active addresses. Altcoin Vector emphasized that BNB’s value goes beyond short-term price moves — it’s backed by strong real-world usage.

The large number of active addresses means many users are transacting on the network, showing steady demand and adoption.

“BNB’s active addresses show sustained user engagement, a sign of network health and adoption.Even after the shock, participation remains structurally strong,” Altcoin Vector wrote.

BNB’s Active Addresses Spike Post-Deleveraging. Source: X/Altcoin Vector

BNB’s Active Addresses Spike Post-Deleveraging. Source: X/Altcoin Vector

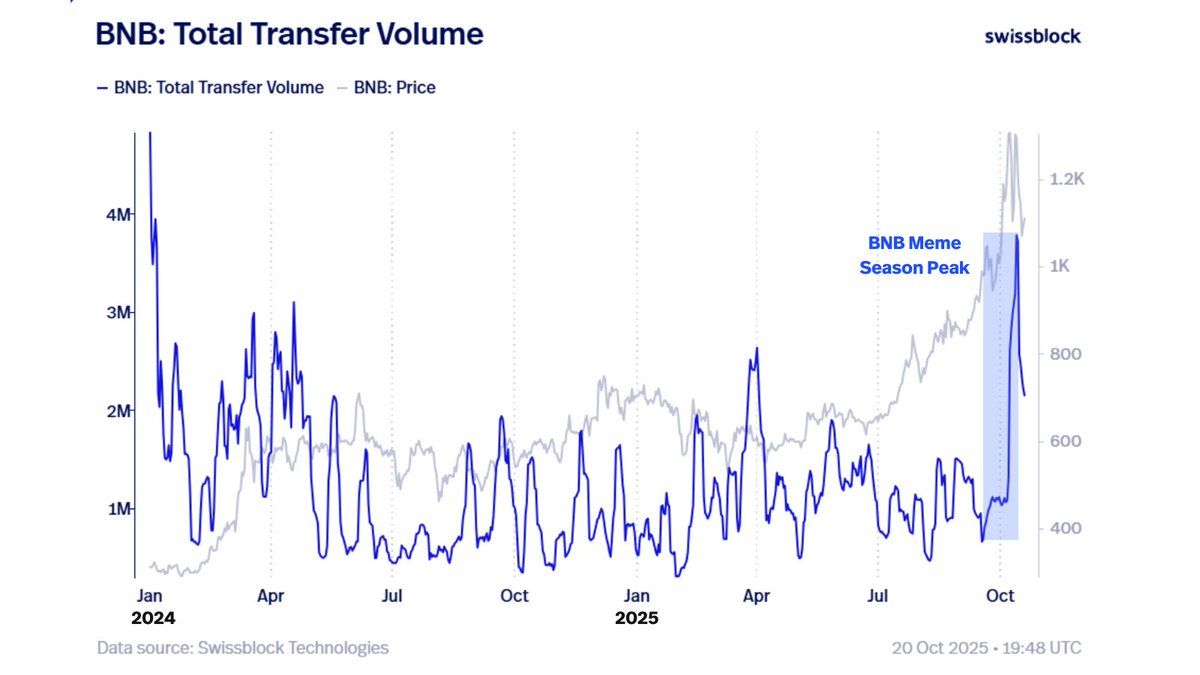

Lastly, BNB has also seen a record surge in on-chain volume, reflecting heightened liquidity and significant ecosystem activity. Altcoin Vector pointed out that,

“BNB’s on-chain volume spiked with daily peaks of coins transferred proving liquidity surges, large transactions, and ecosystem activity. BNB Meme Season? Finished even before it get started. However, on-chain volume is still alive. It’s not only about price action, but fundamentals: liquidity and active participants.”

BNB’s On-Chain Volume. Source: X/Altcoin Vector

BNB’s On-Chain Volume. Source: X/Altcoin Vector

Still, despite BNB’s strong signals, Ethereum’s established lead in smart contract infrastructure, DeFi, and market capitalization remains significant. According to BeInCrypto Markets data, ETH controls a market share roughly three times greater than BNB. Moreover, development and innovation on Ethereum persist.

Thus, challenging Ethereum’s dominance is no easy task. Its deep-rooted ecosystem, developer community, and network effects have kept it firmly in second place for years, making any potential shift a gradual and hard-fought process.

The next few years may further test both sides of this debate. Whether BNB’s ongoing surge can lead to a shift in market capitalization or if Ethereum’s dominance will withstand this latest challenge remains to be seen as crypto markets evolve.