Bitcoin Capitulation Intensifies As STHs Lose $750 Million Daily — Time To Buy The Dip?

The price performance of Bitcoin over the past two weeks has been a major source of concern, as the coin’s value continues to drift away (about 15% down now) from its all-time high. As the flagship cryptocurrency slows down, the latest on-chain data suggests that a group of investors is exiting the market en masse.

More Short-Term Holders Are Giving Up Their Holdings

In an October 18 post on the X platform, on-chain analyst Darkfost revealed that a significant number of Bitcoin’s short-term investors have started to close their positions and realize their losses.

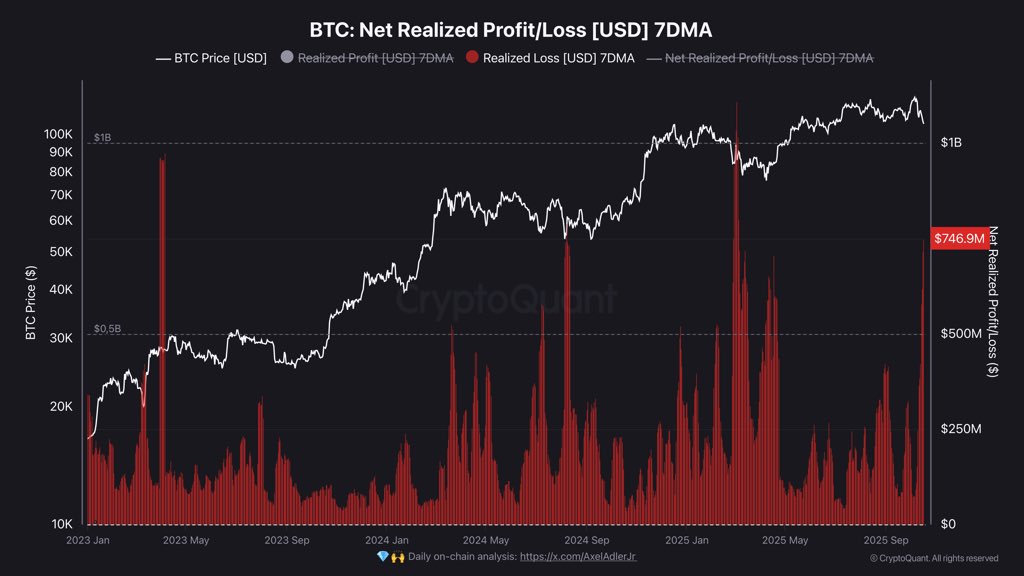

Darkfost’s analysis was hinged on the Net Realized Profit/Loss metric, which tracks the net amount (in USD) of profits or losses that are realized on-chain. This metric measures the net profit or loss on a daily basis, averaged, in this case, over seven days. It provides insight into whether more investors are selling at losses or with their heads still above water..

According to the crypto pundit, the realized losses of BTC investors have surged to an approximate level as high as $750 million per day, one of the highest levels this current cycle has seen. Interestingly, Darkfost explained that the magnitude of these capitulation events stands easily comparable to those seen during the 2024 summer correction.

What’s worth noting about this capitulation phase is what may likely follow. According to the analyst, events like this usually precede local bottoms. What this means is that after short-term holders (known as the “weak hands”) have surrendered their holdings to the more-confident long-term holders (the “diamond hands”), the cryptocurrency stands a chance of seeing a price rebound — an expectation in congruence with historical trends.

However, on the more cautious side, Darkfost offered a subtle warning that the dreary opposite could also be the case in a situation where the market stands at an early bearish phase.

Bitcoin Whales Might Be Accumulating Again

Supporting the positive redistribution theory, a Quicktake post on the CryptoQuant platform by Abramchart offers a glimmer of hope for Bitcoin market participants. Referencing the Inflows To Accumulation Addresses (Dynamic Cohort) metric, the analyst highlighted a significant inflow of more than 26,500 BTC into whale accumulation wallets.

When large amounts of Bitcoin — such as this magnitude — are moved, it usually signals an underlying institutional or whale accumulation, as coins are typically transferred from exchanges to these wallets for long-term holding.

Following historical patterns, it is very likely that this accumulation event will precede a continued bullish expansion of the flagship cryptocurrency. As Abramchart explained, this trend all serves as a hint that smart money is “quietly buying the dip.”

As of this writing, Bitcoin holds a valuation of about $106,870, with no significant movement seen over the past 24 hours.