Ripple Price Forecast: XRP breaks out as whales increase exposure amid recovery in on-chain activity

- XRP breaks resistance at $3.00 and holds above the descending trendline on Friday.

- Whales pile into XRP spot positions, increasing exposure as bullish momentum steadies.

- The number of daily active addresses on the XRP Ledger increases, indicating growing adoption of XRP.

Ripple (XRP) takes a breather, holding above $3.00 on Friday after two consecutive days of steady gains. Interest from whales, retail demand and optimism surrounding the 'Uptober' narrative contributed to the rally from September lows around $2.70.

A daily close above the short-term support at $3.00 could bolster XRP’s bullish outlook, increasing the odds of an uptrend targeting its record high of $3.66, reached in mid-July.

XRP whales increase risk exposure

Large-volume holders of XRP have been seeking exposure to the token over the past week as risk-on sentiment improves across the cryptocurrency market. Santiment data shows that wallets holding between 10 million and 100 million XRP currently account for 12.27% of the total supply, up from 12.06% as of September 25.

The whale cohort with between 100 million XRP and 1 billion XRP started piling into spot positions on Monday, increasing their holdings to 14.6% from 13.85%. Investors increase their risk exposure when anticipating a bullish breakout, steady growth or have confidence in the ecosystem.

[15-1759503834943-1759503834944.48.57, 03 Oct, 2025].png)

XRP Supply Distribution | Source: CoinGlass

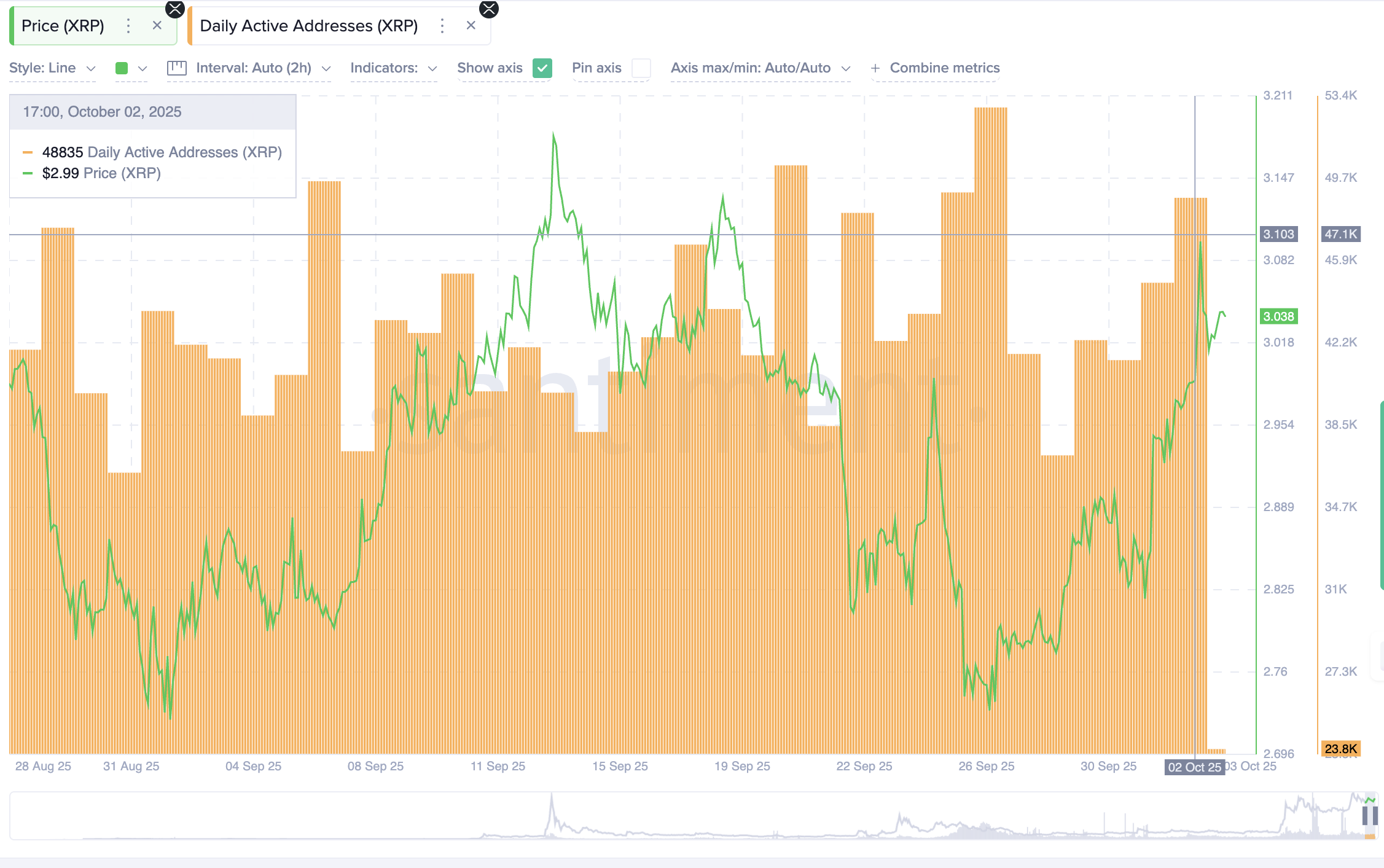

On-chain activity on the XRP Ledger (XRPL) is also gaining momentum alongside the price increase. The chart below shows that the number of daily active addresses interacting with the protocol, either by sending or receiving, averaged approximately 49,000 on Thursday, up from around 37,000 on Sunday.

If network activity persistsently increases, it signals consistent user engagement, as demand for XRP rises, likely driving price growth.

XRP Daily Active Addresses | Source: Santiment

In the meantime, retail interest in XRP derivatives is growing, as reflected by the futures Open Interest (OI) recovering from $7.35 billion, its lowest level in September, to average at $8.47 billion on Friday.

A steady OI also implies increased engagement and conviction in XRP’s ability to sustain the uptrend in the short term.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP nurtures a bullish structure

XRP holds above key technical levels, including the pivotal short-term support at $3.00 and the descending trendline. A buy signal from the Moving Average Convergence Divergence (MACD) indicator has been in place since Thursday, reinforcing the bullish outlook. If the blue MACD line remains above the red signal line, traders would be inclined to increase their exposure, contributing to buying pressure.

The Relative Strength Index (RSI), on the other hand, is stable at 57 after rising from the bearish region. Higher RSI readings approaching overbought territory suggest a stronger bullish structure.

XRP/USDT daily chart

Key areas of interest for traders include the short-term supply level of $3.18, tested in mid-September, the medium-term resistance at $3.38, which was tested in early August and the record high of $3.66.

If investors book early profits and XRP sells off before significantly extending the uptrend above $3.00, attention would shift to the 50-day Exponential Moving Average (EMA) at $2.94, the 100-day EMA at $2.78 and the 200-day EMA at $2.63, all of which serve as tentative support levels.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.