Kaia and LINE NEXT Launch ‘Unify,’ Asia’s Stablecoin Super-App

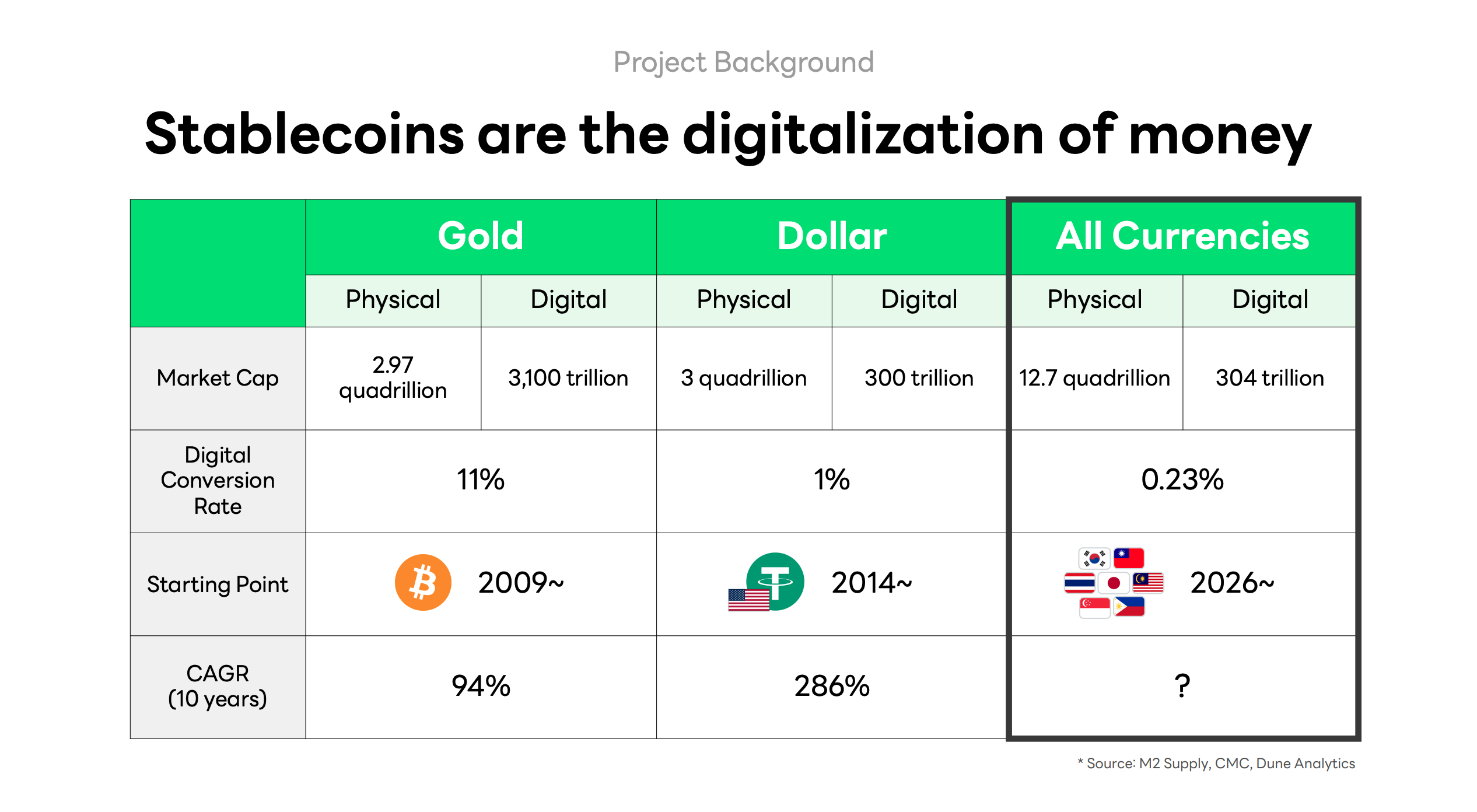

LINE NEXT and the Kaia DLT Foundation announced plans to launch Project Unify, a stablecoin-powered Web3 super-app that will enter beta later this year.

The platform will debut as a Kaia-powered standalone service and as a Mini Dapp within LINE Messenger. One hub will combine stablecoin yield, payments, remittances, on/off-ramps, decentralized finance, and consumer Web3 applications.

Unify Puts Payments First as Asia’s Stablecoin Race Intensifies

The rollout highlights a broader shift: digital finance is moving into platforms consumers already use daily. Rather than pushing another wallet download, LINE NEXT and Kaia embed Unify inside LINE Messenger, one of Asia’s most widely used apps.

“We have seen both the needs and the potential of stablecoins. We plan to lead the expansion of Asia’s stablecoin ecosystem by introducing a super-app that anyone can use easily and safely.”— Youngsu Ko, CEO, LINE NEXT

Unify will include real-time “Easy Saver” rewards, letting users deposit stablecoins and earn instant yield. A Unify Visa card promises up to 5% payback. Stablecoin payments will work at online and offline merchants worldwide. Peer-to-peer transfers can be made through LINE messages in less than a minute.

The service expands access points. Its broad on/off-ramp coverage aims to simplify moving between fiat and stablecoins, which is a persistent hurdle for users. Beyond payments, Unify will offer more than 100 Web3 apps, including DeFi, NFTs, and games, with added rewards for engagement.

LINE NEXT and Kaia tested this model in January 2025 by launching Mini Dapps on LINE Messenger. They explain that the rollout drew over 130 million new registered users. With LINE’s 194 million monthly active users in Japan, Taiwan, and Thailand, Unify seeks to turn that traction into a complete consumer platform.

Regional Stablecoin Integration and SDK Expansion

Unify aggregates regional stablecoins into one framework. It will support tokens pegged to the US dollar, Japanese yen, Korean won, Thai baht, Indonesian rupiah, Philippine peso, Malaysian ringgit, and Singapore dollar. By consolidating fragmented payment rails, Kaia positions Unify as Asia’s orchestration layer for issuance, payments, and yield.

Source: Kaia

Source: Kaia

LINE NEXT and Kaia will release a Unify SDK for stablecoin issuers and developers to expand reach. Issuers can distribute tokens across borders, while developers can embed payments and yield features into their apps. This aims to grow liquidity and broaden utility in regional markets.

The company emphasized that Unify will adapt to each jurisdiction’s rules. By linking with LINE’s Dapp Portal, the service can tailor features to local regulations—an essential step in Asia’s diverse legal landscape.

“Project Unify is Kaia’s strategic project to seize the opportunity in dominating the Asian stablecoin market… Another core element is the stablecoin orchestration layer—Asia’s payment infrastructure remains highly fragmented, and Kaia is uniquely positioned to consolidate it and drive cross-border financial inclusion.”— Dr. Sam Seo, Chairman, Kaia DLT Foundation

Coinbase’s Base App vs. Unify: Competing Visions of the ‘Everything App’

Coinbase is pursuing its own super-app vision. The Base App, rebranded from Coinbase Wallet, brings trading, payments, messaging, and social features onto its Layer 2 Base network. It includes AI-powered agents, NFC-enabled USDC payments, and “Flashblocks” technology, which reduces block times from two seconds to 200 milliseconds.

In comments to BeInCrypto, Kaia DLT Foundation Chairman Dr. Sam Seo stressed how Unify diverges from Coinbase’s model.

“Built on Kaia’s layer 1 blockchain, Unify integrates stablecoin remittances, payments, DeFi, DEX, and mini apps for games and NFTs into a messenger people already use every day. Unify’s comprehensive Web3 platform with DEX and DeFi is accessible through a leading messaging app, LINE Messenger, for the first time in the Asian Web3 market.”— Dr. Sam Seo, Kaia DLT Foundation

Seo noted that Coinbase’s Base App has grown from its exchange and wallet in Western markets, while Unify has started with LINE Messenger. That foundation lets Unify reach hundreds of millions of users while serving as a coordination layer for regional stablecoins.

He also said Unify will expand beyond Kaia’s USDT to include stablecoins pegged to currencies such as the yen, won, baht, and ringgit.

“Using LINE’s reach and Kaia’s network, Unify plans to combine regional stablecoins into a single super-app experience. Powered by Kaia’s stablecoin orchestration layer, Unify delivers payments, DeFi, and everyday financial services seamlessly through LINE Messenger.”— Dr. Sam Seo, Kaia DLT Foundation

This contrast shows two paths: Coinbase emphasizes speed and social finance for Western markets, while LINE NEXT and Kaia focus on compliance, payments, and Asian regional currencies. Both want to define the future of Web3 consumer apps, but they start from different foundations.

Regulatory Context and Market Outlook

Unify’s payments-first strategy comes as regulators reevaluate digital finance. The President’s Working Group on Digital Asset Markets issued a report urging more explicit rules for digital assets and stablecoin issuers in the US. Eversheds Sutherland analyzed the report, which calls for the rapid implementation of the GENIUS Act, signed into law in July, which creates a licensing regime for payment stablecoins.

In a previous exclusive interview with BeInCrypto, Kaia Chairman Dr. Sam Seo emphasized that Asia must prepare local-currency stablecoins to balance the growing role of USD-backed tokens under the GENIUS Act. He also suggested that a multi-currency stablecoin alliance could improve cross-border liquidity and strengthen regional financial autonomy.

For Asia, where payment systems remain fragmented, this shift highlights the value of Unify’s orchestration model. By providing compliant and interoperable infrastructure, Unify could open cross-border financial access for both consumers and institutions.

The super-app race will hinge on which model—performance-led social finance or compliance-driven payments integration—proves more compelling for mainstream adoption.