Pi Network Price Forecast: PI consolidates as momentum fades

- Pi Network’s declining trend takes a sideways shift in a consolidation range.

- Pi Network is progressing with the network upgrade to the Stellar protocol version 23.

- Technical indicators suggest a lack of momentum following a descending channel breakout.

Pi Network (PI) price sustains a steady move in a tight range above $0.3500 at press time on Thursday, extending the sideways trend. The consolidation phase marks an end to the prevailing downfall, which holds the fate of the upcoming trend. Meanwhile, Pi Network is progressing with the upgrade to the Stellar protocol version 23.

Pi Network Testnet 1 successfully shifts to version 23

Pi Network announced a successful protocol upgrade by shifting the Testnet 1 blockchain to the Stellar protocol version 23 from version 19. Following this, the core team will now focus on updating the Testnet 2 following the Mainnet upgrade.

The new upgraded version will bring smart contracts functionality, as previously mentioned by FXStreet. However, the community remains in the dark on the progress, while the core team has shared the possibility of planned network outages during the implementation.

The Testnet 1 shifts failed to uplift the investors' sentiment surrounding Pi Network, as PI remains in a steady state around $0.3500. Still, the upcoming upgrade to the Testnet 2 will mark a step closer to the Mainnet receiving smart contract features, which could act as a catalyst.

Pi Network’s channel breakout remains trapped in a range

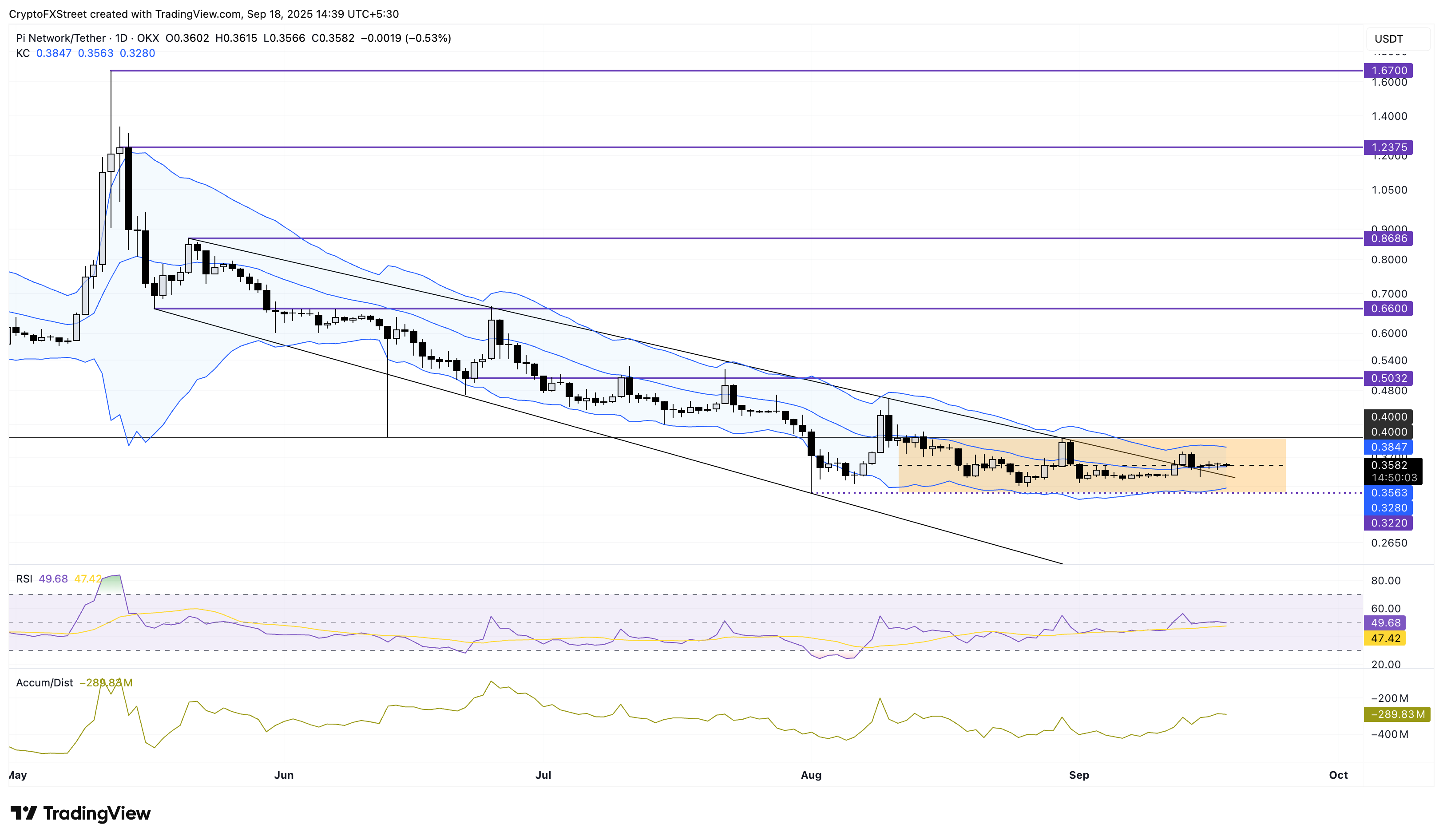

PI trades above $0.3500 at press time on Thursday, following three consecutive indecisive daily candles, which highlight the low volatility movement. The price action displays a range formed between the $0.4000 ceiling and the $0.3220 support floor.

Validating the consolidation, the converging Keltner channels shift from a downward trend, indicating lowered volatility. Furthermore, the Relative Strength Index (RSI) moves flat in the neutral zone at 49, which suggests a lack of momentum and indecisiveness among trades.

Still, the Accumulation/Distribution Line (ADL) increases to -289.83 million from -345 million on Sunday, which indicates a reduction in selling pressure.

Looking up, if PI sustains a daily close above the $0.4000 ceiling, it would mark an end to the streak of lower highs on the daily chart and the consolidation range breakout. More so, the mobile mining cryptocurrency could rebound to the $0.5032 level, last tested on July 22.

However, a drop below $0.3220 would invalidate the previous falling channel pattern breakout and result in a downside conclusion to the consolidation phase. This could extend the decline to the $0.3000 round figure.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.