Forex Today: Eyes on the BoE verdict after Fed’s cautious cut

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Thursday, September 18:

Markets remain in a cautiously optimistic mood early Thursday, assessing the US Federal Reserve’s (Fed) prudence on further easing, while gearing for the expected interest rate cut-hold by the Bank of England (BoE) later in the day.

The US Dollar (USD) is building on its post-Fed event recovery, with the US S&P 500 futures up roughly 0.30% so far. The USD Index is bouncing back toward 97.50, as of writing, adding 0.25% on the day.

US Dollar Price Today

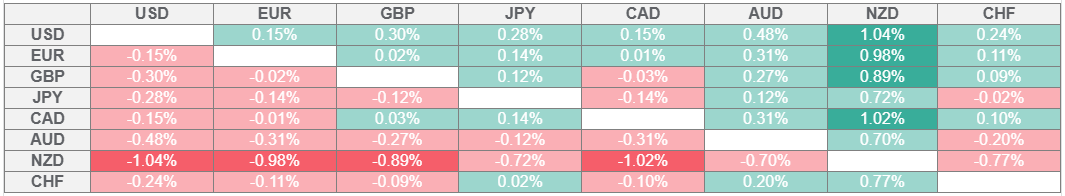

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Greenback plunged to a three-and-a-half-year low of 96.22 against its six major currency rivals on Wednesday after the Fed’s Summary of Economic Projections (SEP), the so-called Dot Plot chart, showed that the Fed policymakers projected two additional rate cuts this year.

The Fed announced the widely expected 25 basis points (bps) interest rate cut to 4%-4.25% for the first time this year.

However, the USD quickly changed course and rebounded alongside US Treasury bond yields after Fed Chairman Jerome Powell, in his post-policy meeting press conference, adopted a measured rhetoric on further rate cuts.

Powell noted that “the policy action as a risk-management cut in response to the weakening labor market and the central bank is in a ‘meeting-by-meeting’ situation,” per Reuters.

Despite the cautious cut, markets price in a 87.7% chance of another 25 bps cut at the Fed's October meeting, compared to a 74.3% probability a day earlier, according to the CME Group's FedWatch tool.

All eyes now turn to the BoE policy announcements. Amid the highest inflation level since early 2024 and slowing pay growth in the United Kingdom (UK), markets are expecting to reiterate its ‘gradual and careful approach" to further cuts in borrowing costs after holding the benchmark rate steady at 4%.

GBP/USD extends its pullback from over two-month highs of 1.3726 to now challenge the 1.3600 barrier. Traders reposition ahead of the BoE event risk.

EUR/USD is also on a corrective decline from the highest levels in four years, trading at around 1.1800, awaiting speeches from a slew of European Central Bank (ECB) policymakers.

USD/CAD flirts with 1.3800 early Thursday, digesting the monetary policy decisions by the Fed and the Bank of Canada (BoC). The BoC lowered its key interest rate by 25 bps to 2.5%, marking its first cut since March, as the central bank moves to stimulate a weakened economy.

USD/JPY rebounds firmly in tandem with the USD, eyeing a sustained move above the 147.50 barrier in the European morning.

Meanwhile, the NZD/USD pair remains the laggard so far, as the New Zealand (NZD) falls hard on New Zealand’s economy contracted 0.9% in the second quarter, following a 0.9% rise in the previous quarter, the statistics department Stats NZ reported Thursday.

Gold has extended the pullback below $3,650, with dip-buying expected to re-emerge at lower levels. Traders look to the US Jobless Claims data for fresh trading impetus.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.