Ethereum Price Forecast: ETH treasuries more sustainable than Bitcoin and Solana DATs - Standard Chartered

Ethereum price today: $4,520

- Ethereum DATs have a higher chance of staying sustainable compared to their Bitcoin and Solana counterparts.

- Bitcoin DATs are saturated, while those of SOL are more pressured by a recent Nasdaq rule.

- ETH looks to find support near the $4,500 key level and 14-day EMA following a weekend-long decline.

Ethereum (ETH) trades around $4,520 on Monday, as Standard Chartered predicts that digital asset treasuries focused on accumulating the top altcoin could be more successful than those acquiring Bitcoin and Solana.

Ethereum DATs have higher chance of survival than Bitcoin and SOL

Digital asset treasuries (DATs) — publicly traded companies that hold a majority of crypto on their balance sheets — focused on Ethereum have a greater chance of success compared to those acquiring Bitcoin or Solana, according to Standard Chartered's global head of digital asset research, Geoffrey Kendrick.

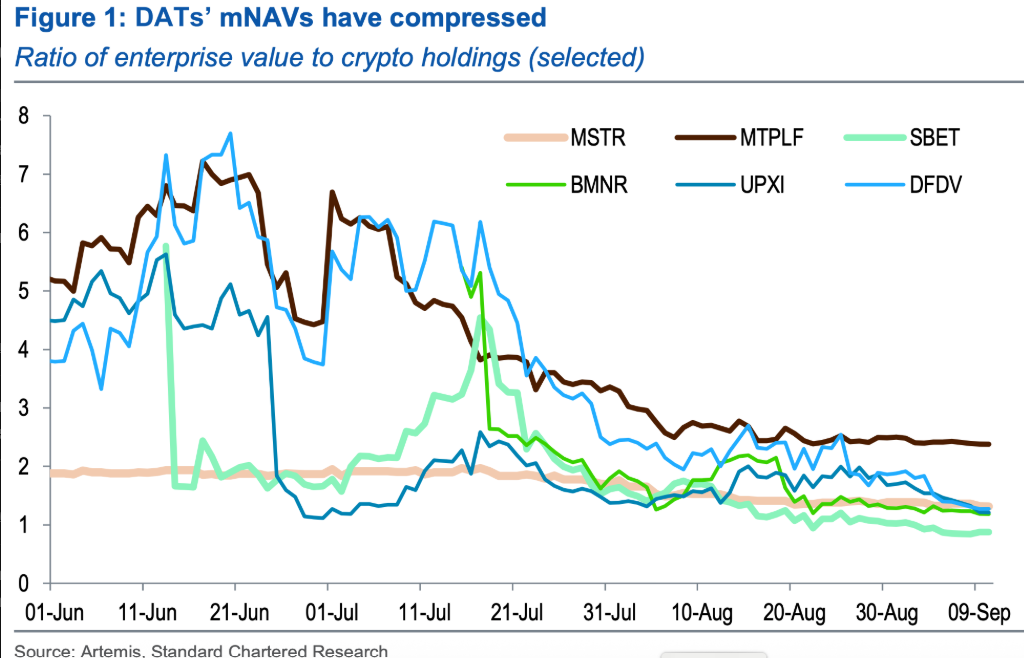

The bank highlighted in a note on Monday that investors are rightly worried about the compression of DATs' stock prices and mNAVs, as it affects their business model of raising cash to expand their crypto holdings. Market to Net Asset Value (mNAV for short) compares a company's market capitalization against the value of its assets. An mNAV greater than 1 shows the company is trading at a premium to its net assets, implying market confidence.

DATs mNAV. Source: Standard Chartered

"This matters because sustainable DATs need an mNAV above 1 if they are to continue buying underlying assets," wrote Kendrick.

Onward, he predicts that the performance of DATs will be differentiated based on their ability to raise funds cheaply, size, and whether their underlying assets can generate yield.

In addition to institutional flows in exchange-traded funds (ETFs), DATs have largely influenced the prices of Bitcoin and Ethereum over the past year.

However, Kendrick argued that Bitcoin DATs could command a lower mNAVs in the long run due to saturation and potential consolidation, reducing new net demand. In comparison, he expects their Ethereum and Solana counterparts to perform better as they can generate yield with their treasuries.

"We think ETH and SOL DATs should be assigned higher mNAVs than BTC DATs due to staking yield," Kendrick said.

Between the two, the note states that Ethereum DATs have a higher likelihood of long-term success. The recent Nasdaq rule requiring companies to gain shareholder approval before raising funds to buy crypto could pressure Solana DATs, which are less developed.

BitMine Immersion (BMNR), which holds the largest ETH treasury, valued at about $9.7 billion, trades on the NYSE and has outlined plans to purchase 5% of ETH's circulating supply.

"I think that ETH DATa have the highest probability of being sustainable, and therefore ETH buying by DATs can continue at pace," said Kendrick.

The bank has previously called ETH DATs "very investable," tipping their mNAVs to outperform Michael Saylor's Bitcoin-focused Strategy.

Ethereum Price Forecast: ETH tests $4,500 and 14-day EMA after weekend decline

Ethereum saw $113.8 million in futures liquidations over the past 24 hours, comprising $93.2 million and $20.6 million in long and short liquidations.

ETH tested the $4,500 key level— strengthened by the 14-day Exponential Moving Average (EMA) — on Monday following a weekend rejection just above $4,700. A firm decline below $4,500 could see ETH find support near the 50-day Simple Moving Average (SMA).

ETH/USDT daily chart

A failure to bounce off the 50-day SMA primes ETH for a decline toward the support near the $4,000 psychologically important level.

On the upside, ETH must overcome its all-time high resistance at $4,956 to initiate another major uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are on the verge of declining below their respective neutral levels, with the former testing its moving average line.