Bitcoin Price Forecast: BTC faces rejection despite the highest weekly ETF inflows since mid-July

- Bitcoin price faces resistance near $116,000 on Monday, having recovered nearly 4% last week.

- US-listed spot Bitcoin ETFs record $2.34 billion in weekly inflows, the highest since mid-July.

- Institutional demand rises as firms like Capital B and Prenetics add BTC to their reserves.

Bitcoin (BTC) trades slightly below $115,000 at the time of writing on Monday as it faces resistance near $116,000 after recovering nearly 4% last week. This indecisiveness in pricing comes despite strong institutional demand and robust ETF inflows, with US spot Bitcoin Exchange Traded Funds (ETFs) recording $2.34 billion in weekly inflows, the highest since mid-July. Meanwhile, firms like Capital B and Prenetics are adding BTC to their reserves, and the market shows signs of resilience even amid near-term resistance.

Bitcoin spot ETFs record over $2.3 billion in inflow

Institutional investors have contributed to the recovery of the Bitcoin price. According to SoSoValue data, as shown below, Bitcoin spot Exchange Traded Funds (ETFs) recorded a total of $2.34 billion last week, marking its third consecutive week of positive flows. This inflow was the highest since mid-July, signaling renewed institutional demand. If this inflow continues and intensifies, BTC could experience further price recovery.

Total Bitcoin Spot ETF net inflow weekly chart. Source: SoSoValue

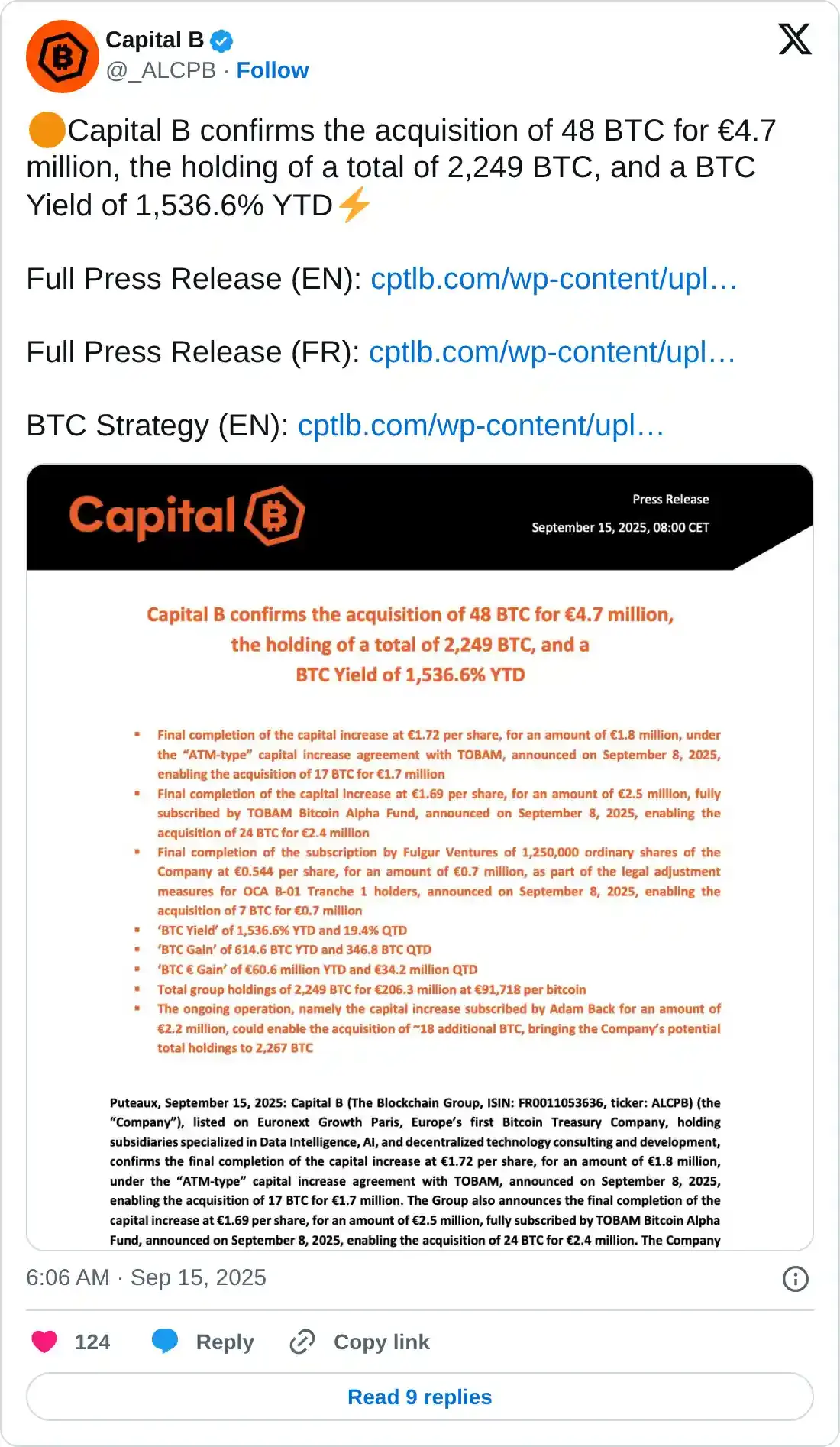

Corporate adds more BTC to reserves

Apart from strong institutional inflows, corporate demand for BTC also remained strong. Capital B announced on Monday that the firm has added 48 BTC, bringing the total holdings to 2,249 BTC. During the same period, BitcoinTreasuries.NET data showed that publicly traded healthcare company Prenetics added 40.6 BTC and announced a plan to accumulate 1 BTC daily – the firm currently holds a total of 228 BTC.

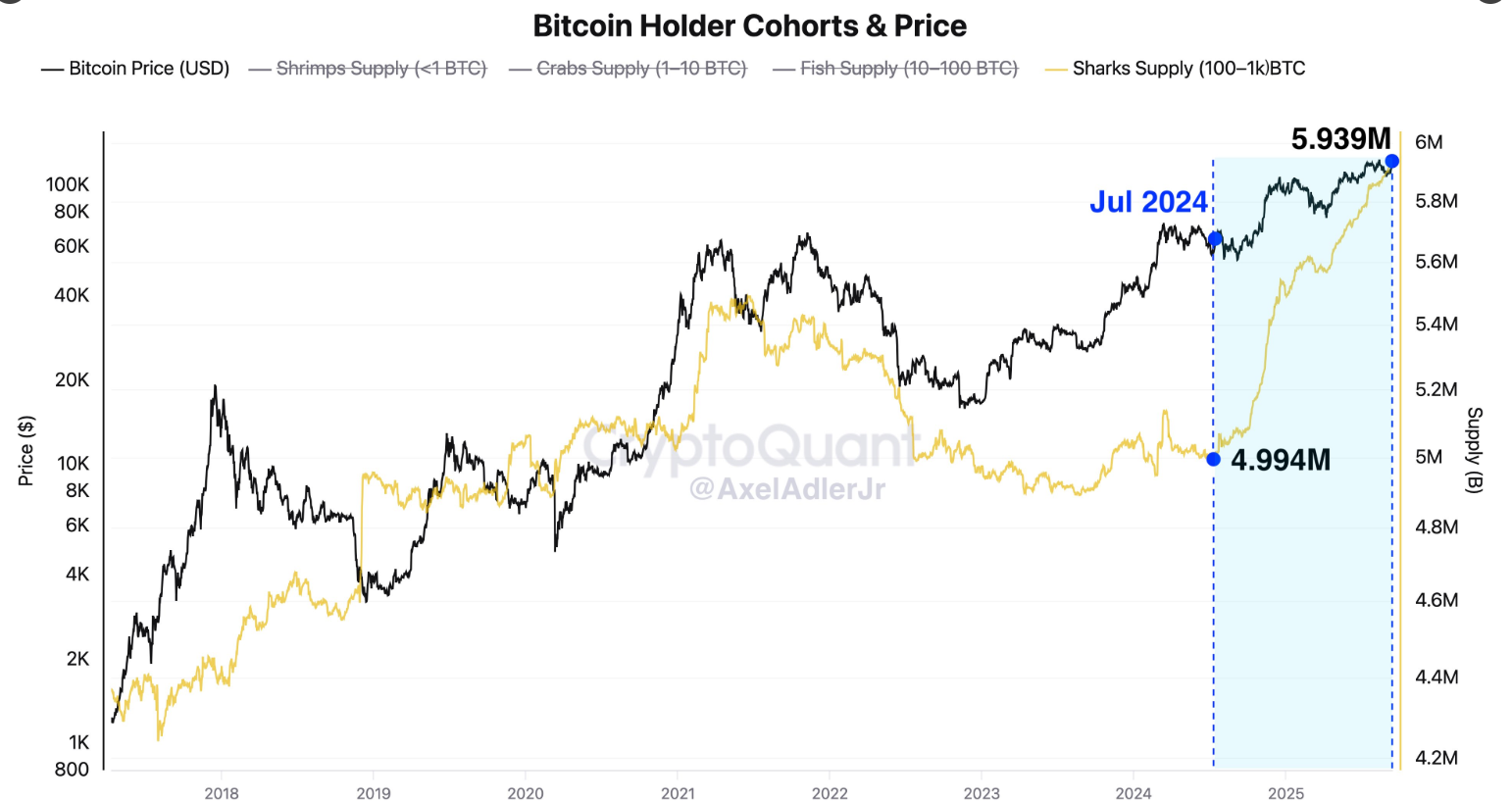

CryptoQuant data indicate that since July 2024, Shark wallets (holding between 100 and 1,000 BTC) have accumulated nearly 1 million BTC, bringing their total balance to approximately 5.9 million BTC, which highlights growing confidence among mid-sized investors.

The market prepares for a huge move on the horizon

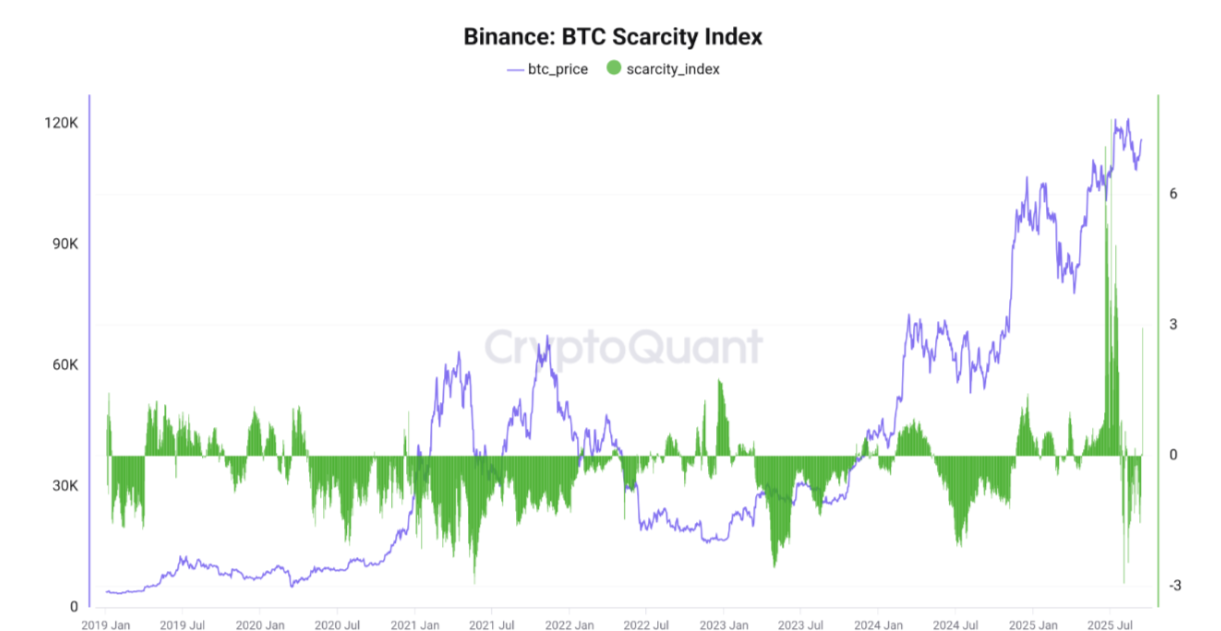

CryptoQuant data show that the Bitcoin Scarcity Index on Binance experienced a sudden positive spike on Sunday, marking the first time since last June. A sudden spike often means that a large amount of Bitcoin was withdrawn from the platform or that sell orders dropped significantly, making the available supply suddenly scarce. Historically, when the metric spikes and remains positive for several consecutive days, the BTC price has rallied sharply, as seen during June, when BTC rallied toward $120,000 for the first time.

Bitcoin Price Forecast: BTC could head toward $120K if it closes above key resistance

Bitcoin price continued its second consecutive week of recovery, increasing by 3.72% last week. However, it found resistance around the $116,000 daily level on Saturday and declined slightly the next day. At the time of writing on Monday, it continues to face rejection from the daily resistance at $116,000.

If BTC closes above the daily resistance level at $116,000 on a daily basis, it could extend the rally toward its psychological level at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 54, indicating bullish momentum but pointing downwards to its neutral level of 50. The Moving Average Convergence (MACD) indicator on the same chart displayed a bullish crossover on September 6, which remains in effect, indicating sustained bullish momentum and an upward trend ahead.

BTC/USDT daily chart

On the contrary, if BTC fails to close above the $116,000 resistance level and continues to correct, it could extend the decline toward its 50-day Exponential Moving Average (EMA) at $113,393.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.