Here is what you need to know on Monday, September 15:

Major currency pairs trade in familiar ranges to start the week as investors gear up for key macroeconomic data releases and central bank meetings. The European economic calendar will feature Trade Balance data for July and the Federal Reserve Bank of New York will publish the Empire State Manufacturing Index data for September later in the day.

US Dollar Price Last 7 Days

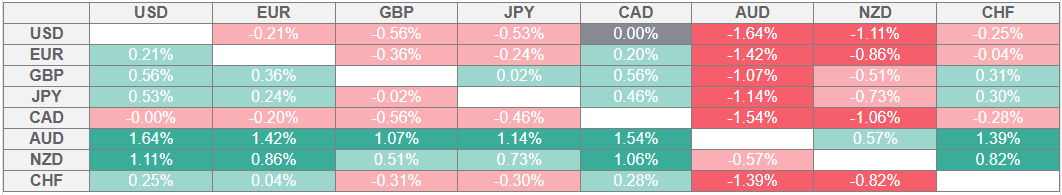

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Credit rating agency Fitch announced late Friday that it downgraded France's sovereign credit score to A+ from AA-, noting that it sees a high likelihood of the political deadlock continuing beyond the election. Fitch also said that it expects the upcoming budget negotiations to produce a more diluted fiscal consolidation package than that proposed by the outgoing administration. After ending the previous week marginally higher, EUR/USD stays in a consolidation phase above 1.1700 in the European session on Monday. During the American trading hours, ECB President Christine Lagarde will speak in the event titled "Conversations for tomorrow" on the occasion of the 25th anniversary of the Institut Montaigne in Paris, France.

The data from China showed early Monday that Retail Sales rose by 3.4% on a yearly basis in August. This print followed the 3.7% increase reported in July and came in weaker than the market expectation of 3.8%. In the meantime, Industrial Production expanded by 5.2% in this period, missing analysts' estimate for a 5.8% growth. AUD/USD showed no reaction to these data and was last seen posting small daily gains above 0.6650.

The US Dollar (USD) Index ended the previous week virtually unchanged. In the European morning on Monday, the index fluctuates in a narrow channel slightly above 97.50. On Wednesday, the Federal Reserve (Fed) will announce monetary policy decisions and publish the revised Summary of Economic Projections (SEP), also known as the dot-plot.

GBP/USD holds its ground and trades comfortably above 1.3550 to start the week. The UK's Office for National Statistics (ONS) will publish the July employment report and August inflation data on Tuesday and Wednesday, respectively, before the Bank of England (BoE) releases the interest rate decision on Thursday.

USD/CAD extends its sideways grind above 1.3800 after failing to make a decisive move in either direction last week. August Consumer Price Index (CPI) data and the Bank of Canada policy meeting will be watched closely by market participants later in the week.

USD/JPY trades in a narrow band at around 147.50 in the European morning on Monday. The Bank of Japan's policy decisions will be announced during the Asian trading hours on Friday.

After setting a new record high in the first half of the previous week, Gold entered a consolidation phase and moved up and down in a tight channel heading into the weekend. XAU/USD remains calm on Monday and holds steady below $3,650.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.