When is the China CPI and PPI release, and how could it impact AUD/USD?

Chinese CPI/PPI overview

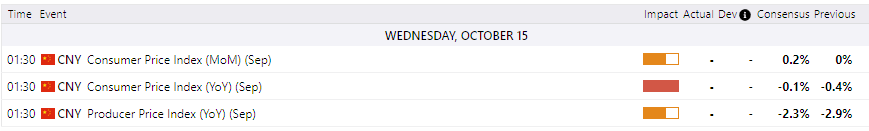

China releases its latest Consumer Price Index (CPI) and Producer Price Index (PPI) inflation metrics early Wednesday at 01:30 GMT, and will be providing markets with a much-needed update on potential trade war fallout between China and the US as trade tensions between the two giants ramps up once again.

While tariff impacts and economic inflation from China don’t impact the Australian Dollar (AUD) directly, Australia’s economic zone is tied tightly to demand growth in domestic Chinese markets, and rapid shifts in Chinese inflation figures will have knock-on consequences for Australian growth prospects.

Chinese CPI inflation is expected to show a 0.2% bump MoM in September, compared to the previous month’s sluggish 0.0%. On an annualized basis, Chinese CPI inflation is still expected to hold on the low side, forecast at a 0.1% contraction, but still an improvement over the previous YoY period of -0.4%.

Chinese PPI tells a vastly different story, expected to clock in at -2.3% YoY in September, but even this represents an improvement from August’s -2.9% YoY print.

How could it impact AUD/USD?

With Australia’s close economic ties to China, what’s good (or bad) for the gander is frequently the same for the goose. As China takes steps to throw off downside economic fallout from the US’s steady ramp-up of trade war rhetoric through 2025, signs of continued domestic growth will help bolster expectations of continued economic expansion in Australia. On the other hand, a steepening economic slump in China could spell doom for Australia, which is already teetering on a wobbly economy.

Healthy inflationary pressures in China would typically provide low-pressure yet sustained bullish pressure for the Australian Dollar (AUD), while a further steepening into a deflationary hole will erode the Aussie’s market position over time.

AUD/USD daily chart

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the National Bureau of Statistics of China on a monthly basis, measures changes in the price level of consumer goods and services purchased by residents. The CPI is a key indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Renminbi (CNY), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 15, 2025 01:30

Frequency: Monthly

Consensus: -0.1%

Previous: -0.4%

Source: National Bureau of Statistics of China