U.S.-South Korea $350 Billion Investment Deal Faces Impasse — Core Dispute Centers on Liquidity Risk

TradingKey - In July, the U.S. and South Korea reached a verbal agreement on a major trade deal: South Korea would commit $350 billion in investments into the United States in exchange for reduced U.S. tariffs on Korean goods. However, South Korean President Lee Jae-myung recently stated that negotiations over the proposed $350 billion investment pact have stalled.

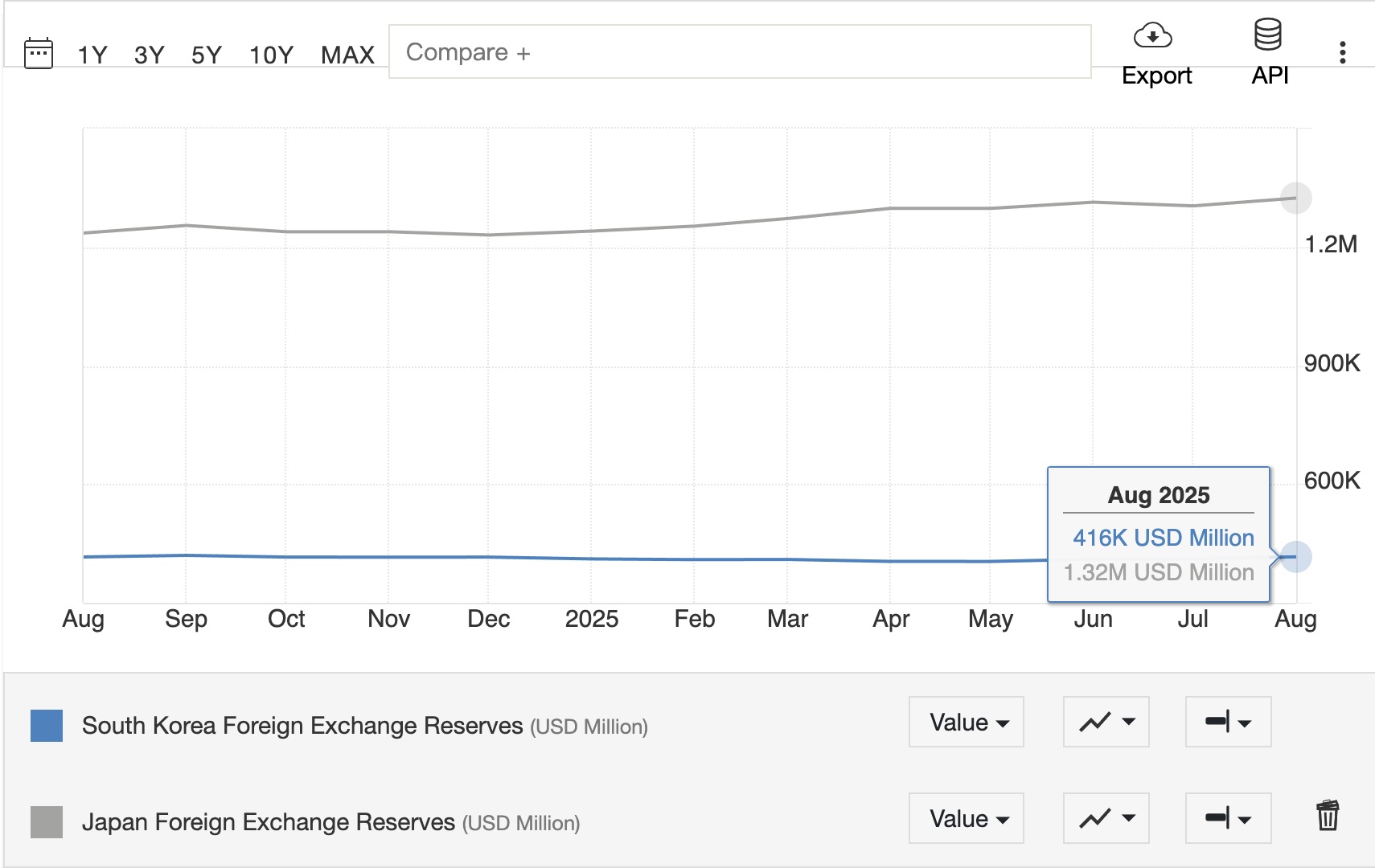

As of August, South Korea’s foreign exchange reserves stood at $416.3 billion. If the full investment were made without safeguards, it would leave the country with minimal foreign currency buffer — exposing it to severe financial risks reminiscent of the 1997 Asian financial crisis.

The core dispute lies in the mechanism for executing the investment. South Korea has proposed establishing a currency swap arrangement with the U.S. Federal Reserve to mitigate the impact of large-scale capital outflows on the won’s exchange rate. However, the U.S. has not yet signaled support for such a mechanism.

“If we are required to transfer $350 billion in cash to the U.S. in one go, without a currency swap agreement in place, South Korea could face the same fate as during the 1997 crisis,” Lee warned. He cautioned that such a move could trigger a sharp depreciation of the won, capital flight, and systemic instability in the financial sector.

Lee also rejected suggestions from U.S. Commerce Secretary Howard Lutnick that South Korea should follow Japan’s example. He pointed out that Japan holds over $1 trillion in foreign reserves, the yen is a global reserve currency, and Tokyo already has an active currency swap line with the U.S. — conditions that South Korea does not currently meet.

Source: Tradingeconomics.com

The bilateral tension has been further strained by other incidents. Earlier this month, U.S. immigration authorities conducted a surprise raid on Hyundai Motor’s battery plant in Georgia, arresting and deporting over 300 South Korean workers. The incident sparked public outrage in South Korea. Lee criticized the U.S. approach as “excessively harsh” and expressed concern that such actions could undermine confidence among Korean firms considering U.S. investments.

This week, Lee is set to travel to New York to attend the United Nations General Assembly. However, there are no plans for a meeting with President Trump, and trade talks will not be on the agenda.