Forex Today: Markets remain choppy ahead of German business sentiment and US housing data

Here is what you need to know on Wednesday, September 24:

Major currency pairs struggle to gather directional momentum midweek as markets await the next catalyst. In the European session, business sentiment data from Germany will be watched closely by investors. Later in the day, the US economic calendar will feature New Home Sales data for August.

US Dollar Price Today

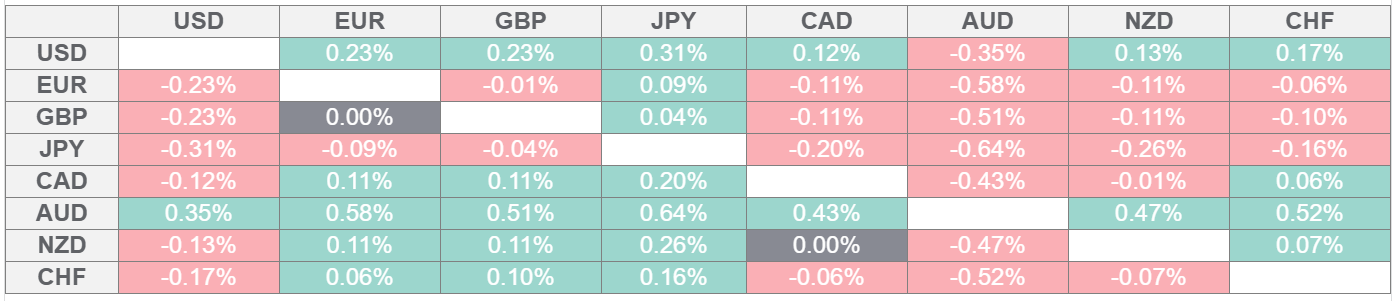

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

While speaking on the economic outlook at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon on Tuesday, Federal Reserve (Fed) Chairman Jerome Powell reiterated that they will make sure a one-time increase in prices does not become an ongoing inflation problem. He further noted that the labor market is less dynamic and "somewhat softer." As Powell refrained from delivering any different remarks from what he said in the post-meeting press conference last week, the market reaction remained muted. The US Dollar (USD) Index ended the day marginally lower before recovering toward 97.50 early Wednesday. In the meantime, US stock index futures rise about 0.2% in the European morning on Wednesday after Wall Street's main indexes closed in negative territory on Tuesday.

Gold hit a new record-high above $3,790 early Tuesday but erased a portion of its daily gains to close marginally higher. XAU/USD holds its ground and fluctuates at around $3,770 in the European morning on Wednesday. Ukraine’s President Volodymyr Zelenskiy said late Tuesday that his relationship with US President Donald Trump has improved and that he was encouraged by Trump’s remarks suggesting Ukraine could fully reclaim all Russian-occupied territory.

EUR/USD stays under modest bearish pressure and trades below 1.1800 after posting small gains on Tuesday.

The data from Australia showed early Wednesday that the Consumer Price Index (CPI) rose by 3% on a yearly basis in August. This reading followed the 2.8% increase recorded in July and came in above the market expectation of 2.9%. AUD/USD gains traction on Wednesday and trades in positive territory above 0.6600.

Canadian Prime Minister Mark Carney noted late Tuesday that ongoing impacts from Donald Trump's trade tariffs are becoming more noticeable, and acknowledged that trade discussions between the US and Canada are still ongoing. After posting gains for two consecutive days, USD/CAD continues to push higher and was last seen trading at its highest level in 10 days near 1.3850.

GBP/USD struggles to build on its recovery gains and trades in the red near 1.3500 in the European morning on Wednesday.

The data from Japan showed early Wednesday that the Jibun Bank Manufacturing Purchasing Managers' Index (PMI) dropped to 48.4 in September's flash reading from 49.7 in August. In this period, Services PMI was virtually unchanged at 53. USD/JPY edges higher in the European session and trades slightly above 148.00.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.