Ethereum fees drops to lowest level since October, ETH sustains above $3,200

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

■Ethereum supply is inflating despite relatively high throughput.

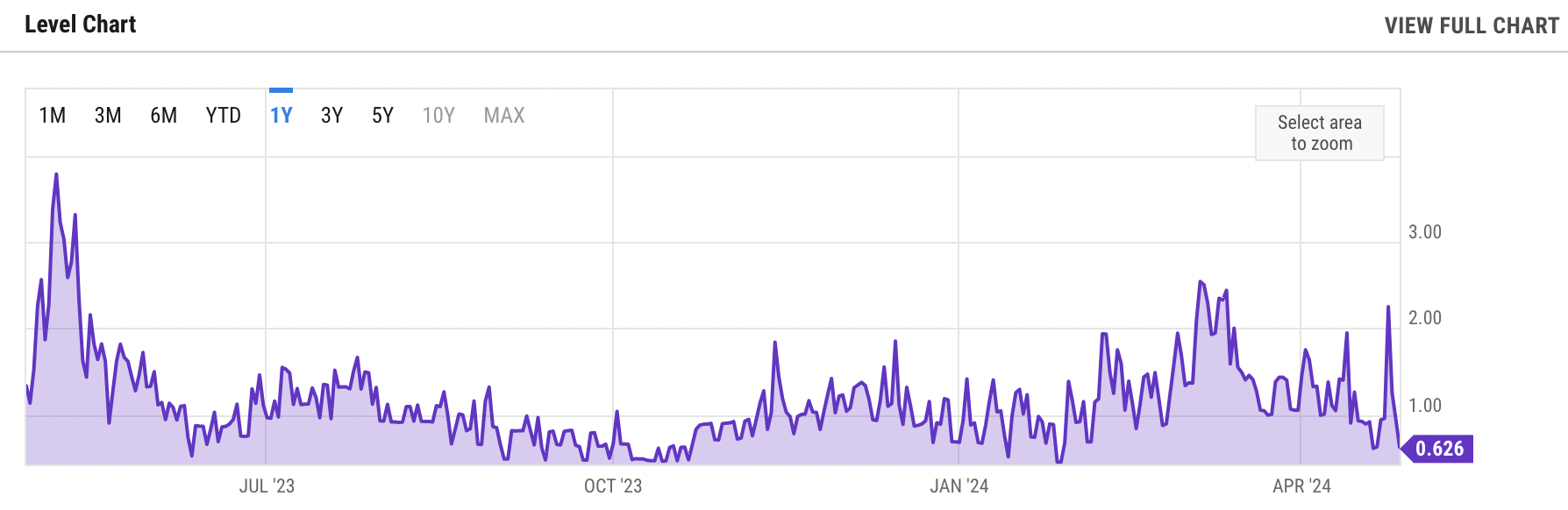

■Average fee has nosedived to $1.12 per transaction, lowest since October.

■Ether sustained above $3,200 on Sunday, up 4% in the past seven days.

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

The issue seems to have de-escalated with Ethereum’s average fee level dipping to $1.12 per network transaction. This is one of the lowest levels noted since October 18.

Ethereum transaction fee declines

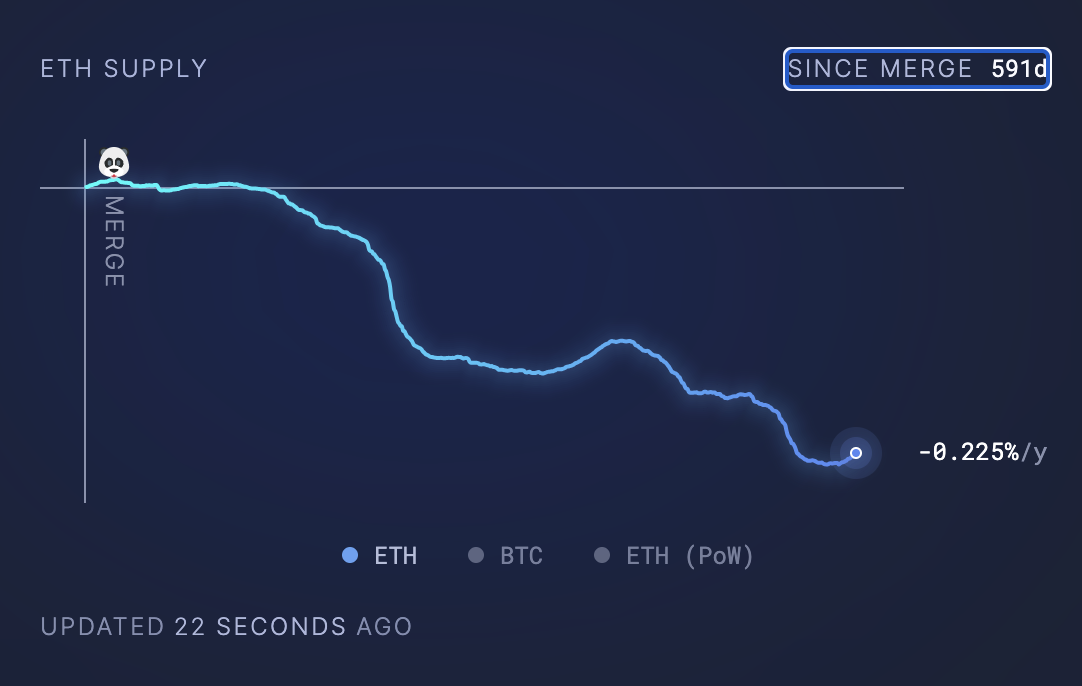

Data from Ultrasound Money shows that Ether’s circulating supply has surged, climbing to the highest level witnessed since March. A little over 120 million Ether is in circulation now and the sharp increase in supply can be attributed to the consistent decline in burn rate, in the past two weeks.

Gas fees is currently 7.19 Gwei, up from a low value of 4.48 Gwei, as seen on Ultrasound.money. Gas fees is currently $0.62, as seen in YCharts, down from the May 2023 peak of $3.788.

Ethereum gas fees

The Ethereum supply chart shows inflation, and the recent increase sprung on ETH holders as a surprise, after five months of steady deflation. The ETH supply chart below shows the sudden increase in supply.

ETH supply

These catalysts have failed to have a significant impact on Ether price. The altcoin has sustained above $3,200 on Sunday, after relatively less significant moves since the Bitcoin halving. ETH holders are awaiting the Securities and Exchange Commission’s (SEC) decision on Spot Ether ETF and this is likely to emerge as the most significant catalyst for Ethereum.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.