Riding the U.S. IPO Wave, Figma Brings Back the “Auction-Like IPO” to Wall Street — What’s Behind the Confidence?

TradingKey - As Figma, the cloud-based design software company, moves forward with its IPO process, the SaaS firm — widely seen as a potential catalyst to revive a long-dormant software IPO market — is taking a dual approach:

- Pricing its shares at a “discounted” valuation of $14.5–16.5 billion

- Adopting an auction-style IPO pricing mechanism to capitalize on the current surge in investor appetite for tech listings

According to Bloomberg, citing people familiar with the matter, Figma is asking potential investors to submit limit orders — specifying both the number of shares they want and the price they’re willing to pay — rather than the traditional market orders used in most IPOs.

How Auction-Style IPOs Work

In a standard IPO, investors typically submit market orders, which are filled at the best available price. But for high-demand stocks, this can lead to distorted demand signals, as investors flood the book with unlimited bids to secure larger allocations — inflating perceived demand and complicating pricing.

In contrast, the auction-like model allows companies to gather granular price and volume data, enabling a more accurate assessment of true market demand and fair value.

This method was used successfully by high-profile tech firms like DoorDash and Airbnb in their IPOs during the Covid era. But as IPO activity cooled, the approach fell out of favor.

Now, Figma’s revival of this model signals both strong confidence in its offering and a broader resurgence in U.S. IPO market momentum — exemplified by Circle’s fivefold stock surge within a month of listing.

Some analysts believe Figma could surpass CoreWeave, the AI cloud platform that debuted earlier this year, to become the breakout tech IPO of 2025.

David Erickson, Adjunct Professor at Columbia Business School said, “Figma wants to show that it is a hot deal and encourage the right investors to pay up for it, and right now they are the only game in town.”

What Makes Figma Stand Out?

According to Appeconomyinsights, Figma’s core innovation lies in redefining how design software works:

- Web-first : Runs entirely in the browser — no downloads required

- Multiplayer by default: Real-time collaboration, like Google Docs for design

- Community-driven: Open sharing, templates, and plugins foster ecosystem growth

This combination has allowed Figma to outcompete legacy players like Adobe, especially among tech and product teams.

Despite industry skepticism about monetizing collaboration tools, Figma has emerged as a profitable, high-growth model for AI-era productivity software.

Key Highlights:

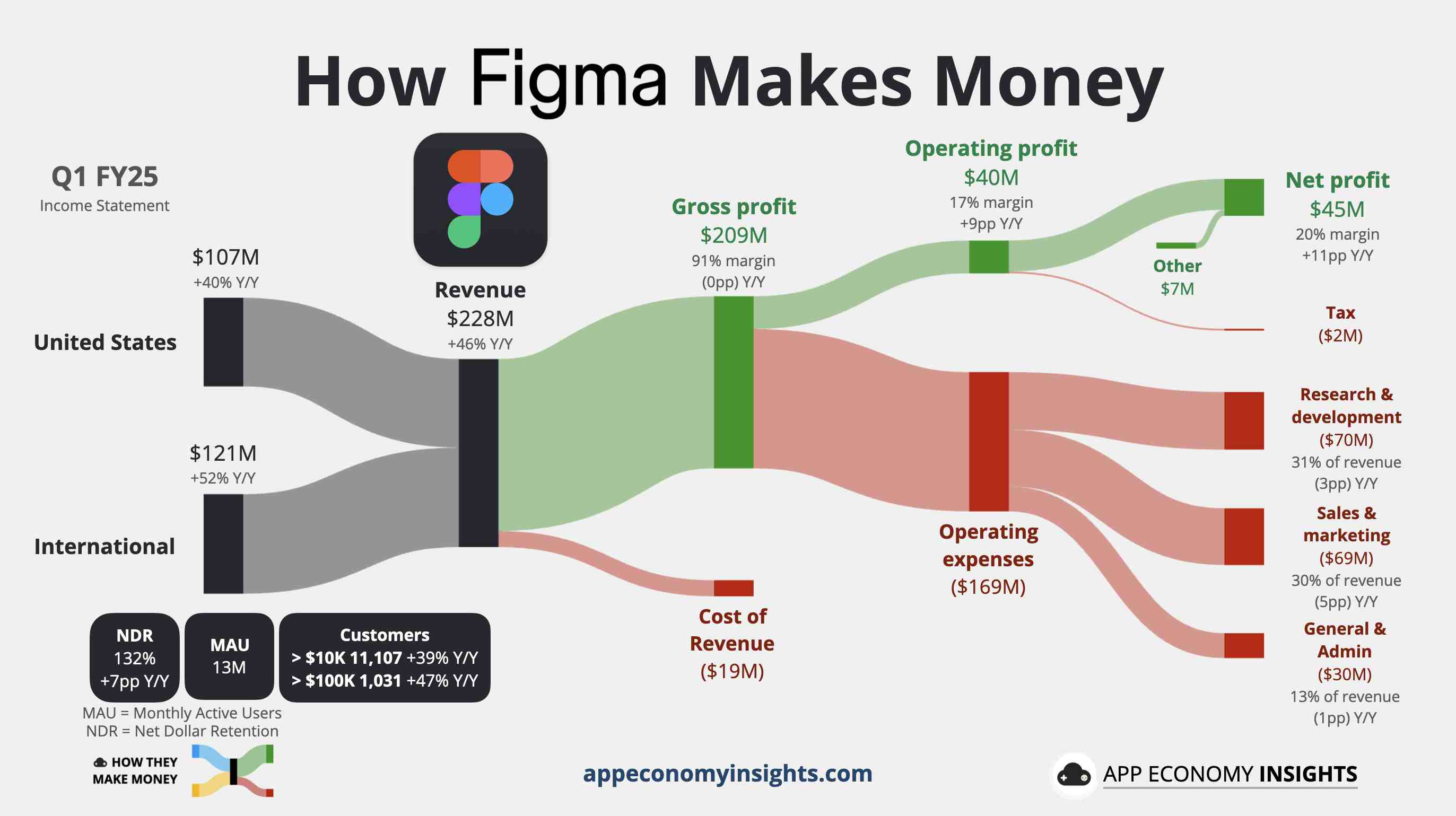

- Revenue: $749 million in FY2024, up 48% YoY

- Over 13 million monthly active users, including companies like Microsoft, Slack, and GitHub

- 95% of Fortune 500 companies as customers

- Over 1,000 clients paying more than $100,000 annually

Figma Q1 FY2025 Financial Breakdown, Source: Appeconomyinsights.com

Figma’s tools are embedded across the digital world — from Google Maps navigation and Netflix video interfaces to Duolingo language lessons, Airbnb booking flows, and LinkedIn networking features.