[IN-DEPTH ANALYSIS] Snowflake: Making AI Real and Unlocking New Data Cloud Growth

Key Takeaways

- AI Leadership: Snowflake’s Cortex AI drives rapid AI adoption, with 5200 customers using it weekly.

- Competitive Edge: Snowflake stands out with a platform that works across all major clouds, ensures data privacy, and offers tailored AI solutions for specific industries.

- Strong Financials: Solid growth, high customer loyalty, and a $211–$225 target share price reflect Snowflake’s AI momentum.

If you’re looking for a company that’s not just talking about AI but actually making it real, Snowflake stands out. It’s helping businesses turn AI from a buzzword into practical solutions, acting as the engine room powering the AI revolution. Snowflake’s AI progress is impressive, and the latest results back that up. This is a company delivering real impact, not just hype. Snowflake’s share price has increased by 30% since I last covered it in March. If you’re curious about Snowflake’s full backstory, check out my previous article.

Source: TradingKey

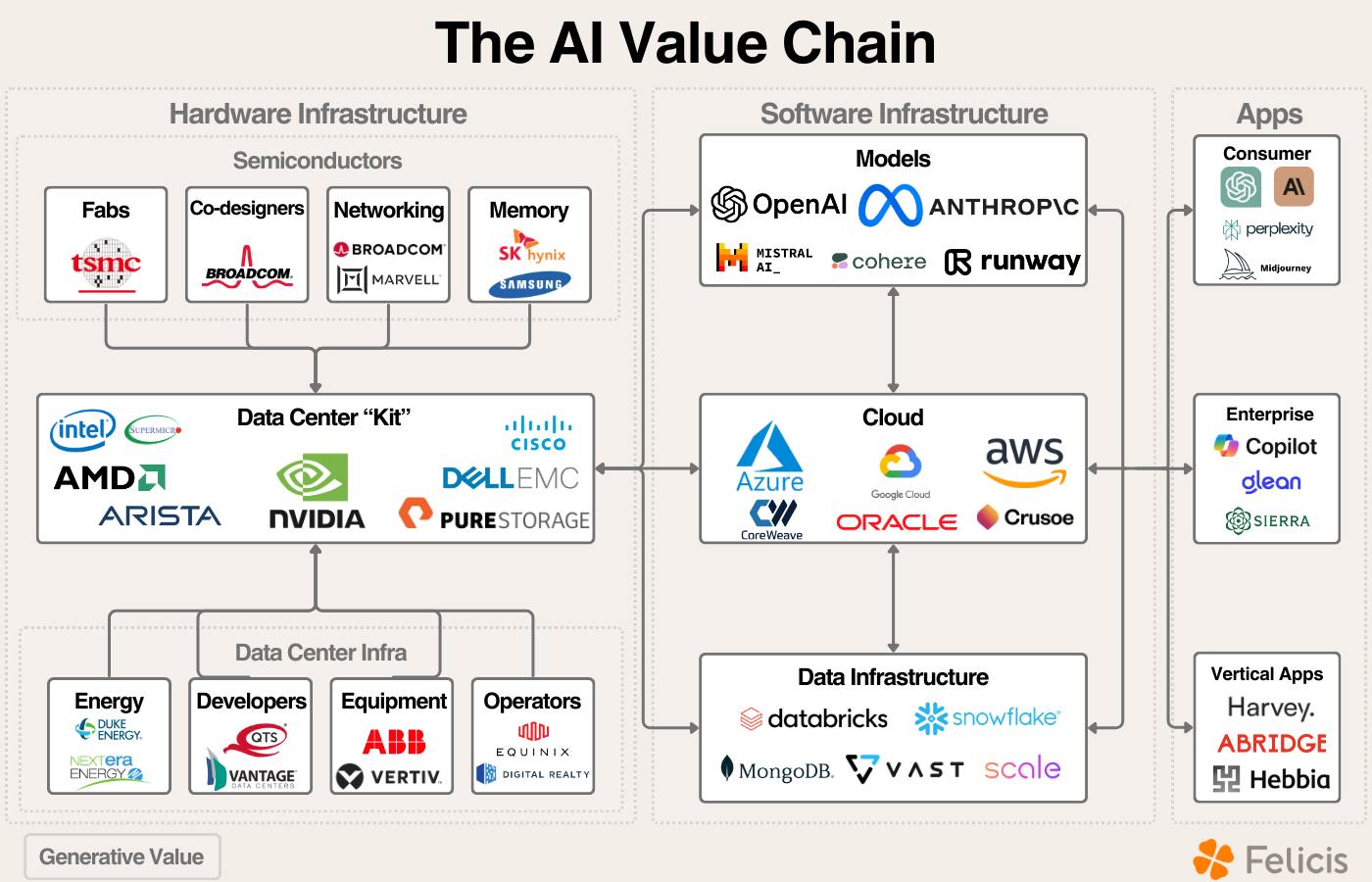

Snowflake’s position in AI value chain is shown in the following chart:

Source: Felicis

Snowflake’s AI Game: From Vision to Victory

Snowflake is a cloud-based data platform that helps companies store, organize, and analyze massive amounts of data. This includes both the neat stuff, like spreadsheets (called structured data), and the chaotic bits, like emails or videos (called unstructured data). AI needs high-quality data, and Snowflake’s AI Data Cloud acts like an intelligent data factory, transforming messy unstructured data into the high-quality inputs AI models require, enabling enterprises to quickly build and deploy advanced artificial intelligence solutions.

This quarter, Snowflake’s progress in AI adoption is undeniable, and it’s all about making AI practical for businesses.

- Cortex AI Is Exploding: Snowflake’s Cortex AI is a suite of tools that lets companies build AI-powered features directly on their data. In Q1 FY2026, over 5,200 accounts, nearly 45% of Snowflake’s total 11,578 customers used Cortex weekly, up from nearly zero a year ago. That’s a massive leap, showing businesses are jumping on Snowflake’s AI ship. For example, Kraft Heinz built an AI assistant called Lighthouse using Cortex, helping employees make faster decisions. This is part of agentic AI, where AI doesn’t just answer questions but takes actions, like automating workflows or analyzing data on the fly. What this means is that Snowflake is capitalizing on a powerful trend: AI is evolving from a simple tool into an active collaborator that helps businesses get things done, which in turn boosts the demand for Snowflake’s platform.

- Privacy-First AI: In a world obsessed with data privacy, Snowflake’s Data Clean Room technology lets companies like Samsung Ads share data securely for personalized advertising without breaking privacy rules. This is huge for industries like retail and media, where AI-driven personalization is a goldmine. Snowflake’s ability to balance innovation with trust makes it a go-to for businesses scaling AI.

- Industry-Specific AI Push: Snowflake is doubling down on sectors like automotive, for example, CarMax and Nissan using AI for supply chain analytics, and the public sector. At the same time, it just got approval to work with the U.S. Department of Defense. These markets need AI to solve complex problems, and Snowflake’s tailored solutions are winning big contracts. This diversification means Snowflake isn’t just a tech play, it’s a bet on AI transforming every industry.

Standing Out in a Crowded Field

Snowflake isn’t the only player in the data platform space. It competes with major players like Databricks, which focuses heavily on AI and machine learning, as well as cloud-native services such as AWS Redshift, Google BigQuery, and Microsoft Azure Synapse. Databricks’ recent acquisition of Neon, a serverless database designed for real-time data updates like payment processing, directly targets Snowflake’s Unistore capability.

However, Snowflake’s key differentiator is its cloud-agnostic architecture. It seamlessly operates across AWS, Azure, and Google Cloud, unlike many competitors tied to a single cloud provider. Moreover, strategic partnerships, such as hosting OpenAI models on Azure, position Snowflake as a collaborator rather than a competitor to the major cloud giants.

Microsoft’s Fabric platform is emerging as a notable challenger, aiming to unify data and AI much like Snowflake. Yet, Snowflake’s user-friendly interface, support for open data formats like Apache Iceberg, which standardizes data table organization, and its AI-ready toolset provide it with a competitive edge.

Snowflake’s flexibility and strong partnerships help mitigate the risk of losing market share to rivals.

What Makes Snowflake Standout in AI Era?

Snowflake is positioning itself as the leading platform for agentic AI, AI systems that go beyond data analysis to act as intelligent assistants, making decisions and automating workflows. For example, Cortex Agent helps Luminate Data extract actionable entertainment insights, while Siemens integrates IT and operational data to optimize manufacturing processes. These applications represent more than just analytics; they are AI-driven workflows that enable businesses to operate smarter and faster.

Snowflake’s strength lies in its ability to manage both structured and unstructured data, combined with tools like Cortex Analyst, which allows users to ask questions in plain English and receive answers without complex coding. For instance, a retailer can leverage Snowflake to analyze customer reviews, identify emerging trends, and automatically adjust marketing campaigns in real time.

Snowflake isn’t merely enabling AI; it’s embedding it seamlessly into everyday business operations.

Although, there are risks. Tariffs or a slowdown could make customers cut back on spending, especially smaller ones. The data and AI space is a battlefield. If Snowflake stumbles on rolling out new AI features, rivals like Databricks or Microsoft could gain ground.

The Numbers: Proof Snowflake’s AI Bet Is Paying Off

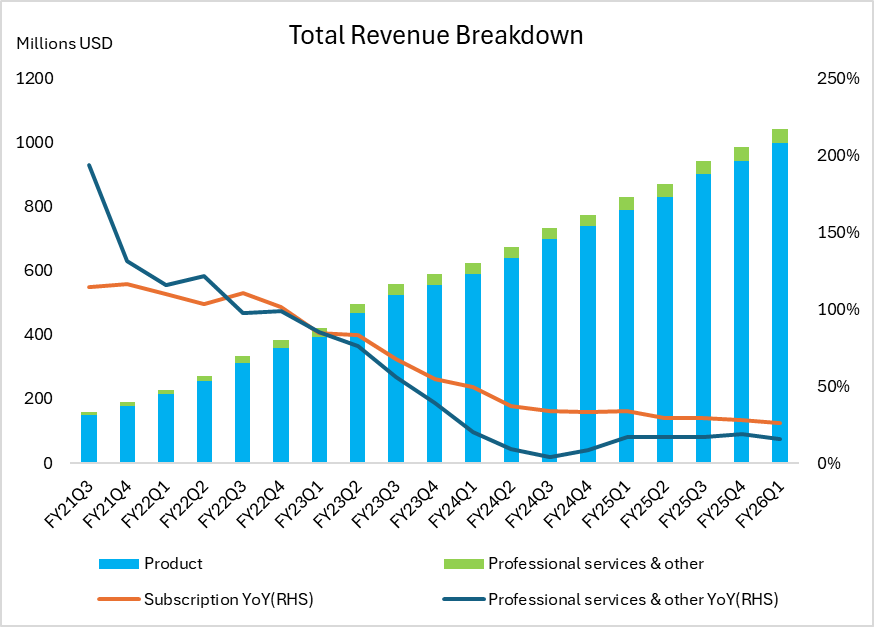

Snowflake’s Q1 FY2026 financials support the growing AI momentum. Product revenue reached $997 million, up 26% year-over-year. While this growth rate is slightly lower than in previous quarters, it reflects a more cautious macroeconomic environment. Even so, AI adoption remains a significant driver of customer investment in Snowflake’s platform.

Source: Company Financials, TradingKey

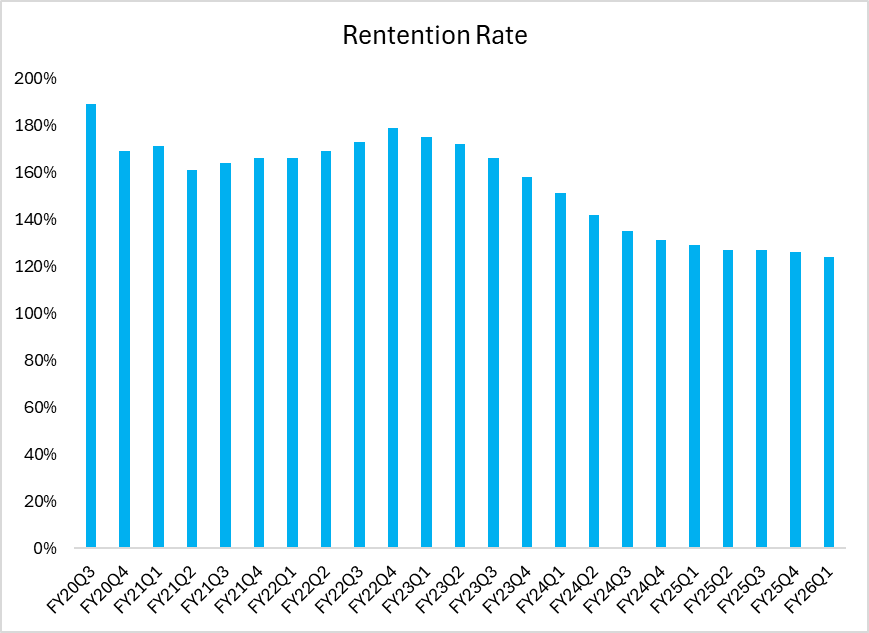

The net revenue retention rate (NRR) was 124% in Q1 FY2026, down slightly from 126% in the previous quarter, but still indicating robust customer loyalty and expansion. Existing customers continue to increase their usage and spending, highlighting the ongoing adoption of Snowflake’s AI and data solutions.

Source: Company Financials, TradingKey

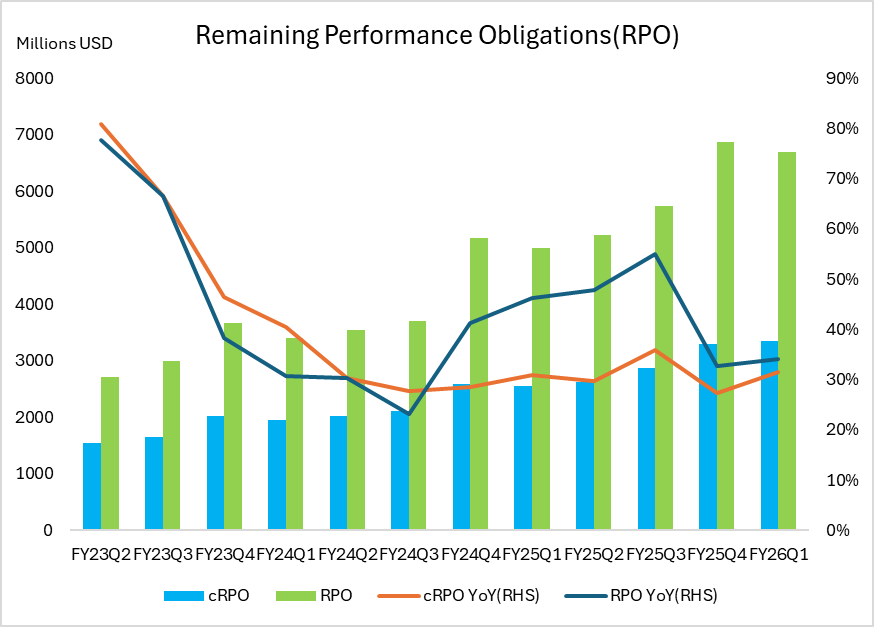

Remaining performance obligations (RPO), representing contracted future revenue, jumped 34% to $6.7 billion, driven in part by two major $100 million-plus deals in financial services. These large contracts underscore the strong confidence that banks and insurers place in Snowflake’s platform, particularly for AI-powered use cases such as fraud detection and customer personalization. This robust RPO growth provides solid visibility into Snowflake’s future revenue streams.

Source: Company Financials, TradingKey

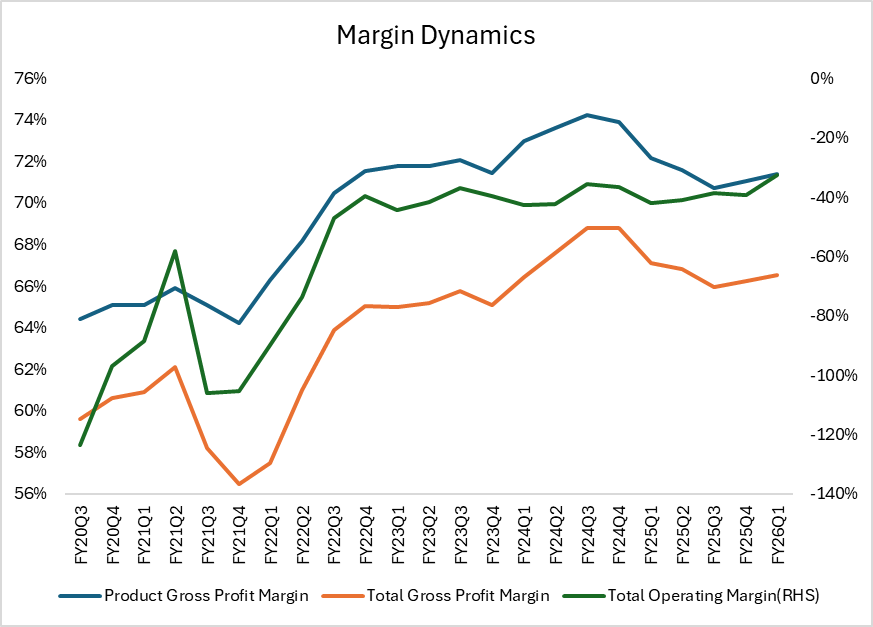

Snowflake is also improving its profitability metrics. In Q1 FY2026, product gross margin slightly improved to approximately 71%. The overall gross margin also saw a positive increase. While operating margin remained negative, the trend indicates progress toward improved profitability. With a strong cash position of approximately $4 billion in cash and investments, Snowflake has significant financial flexibility to continue investing in innovation, including AI technologies, and strategically pursue acquisitions.

Source: Company Financials, TradingKey

Looking ahead, Snowflake's guidance for Q2 FY 2026 ($1.035 billion to $1.04 billion, up 25%) and FY 2026 ($4.325 billion, up 25%) is solid but cautious. If AI adoption continues to soar, Snowflake could exceed these numbers.

Why consider Snowflake?

AI adoption is accelerating, and Snowflake is at the center of this shift. With Cortex AI, seamless data integrations, and industry-specific solutions, Snowflake is helping companies for analytics, making AI practical and impactful. For those interested in the AI sector, Snowflake stands out as a fast-growing company with strong cash management and strategic partnerships.

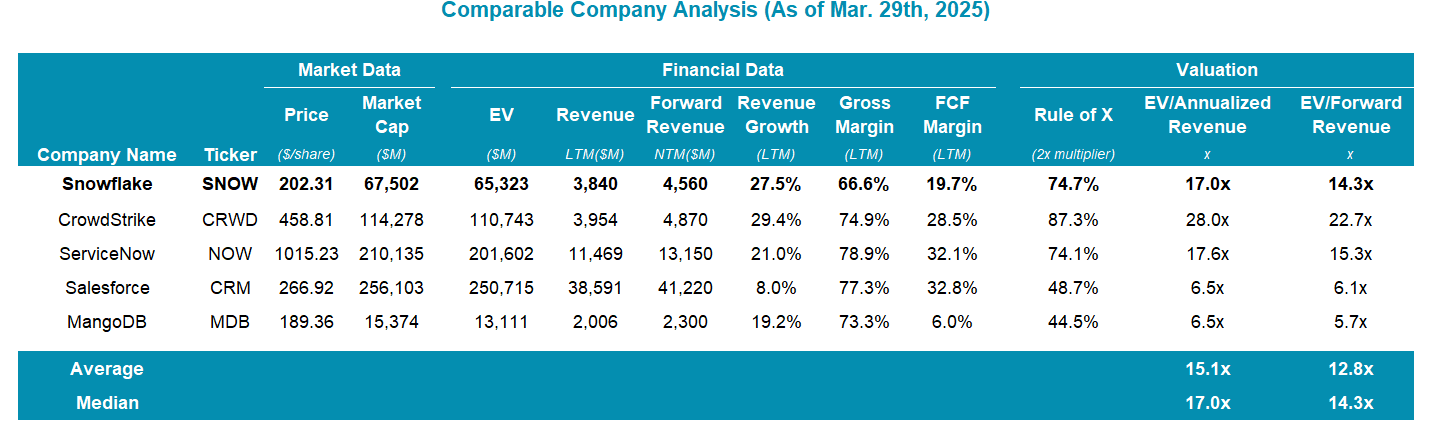

We value Snowflake using the EV/Forward Revenue multiple, a forward-looking metric well-suited for high-growth SaaS companies. Assign a target EV/Forward Revenue range of 15.0x–16.0x, which exceeds the industry average, a premium driven by Snowflake’s unparalleled leadership in AI-powered data cloud platforms, but remains below the peer group’s upper bound to reflect macro risks, Using $4,560M forward revenue, the target EV ranges from $68,400M (15.0x) to $72,960M (16.0x). Assuming net cash of $2,179M (current TTM net cash), the implied equity value ranges from $70,579M to $75,139M. The target price ranges from $211–$225 per share.

Source: StockAnalysis, TradingKey