2 Bank Stocks That Can Diversify a Tech-Heavy Portfolio

Key Points

While tech and artificial intelligence stocks can continue to move higher, there's increased scrutiny on the sector.

After years of underperformance, the banking sector appears to have some tailwinds.

The sector is now under a friendlier regulatory regime, and there could be a wave of mergers and acquisitions.

- 10 stocks we like better than Citigroup ›

Tech and artificial intelligence stocks have delivered outperformance for investors in recent years. While the party may very well continue this year, the bar for tech and AI is certainly rising, as valuations increase and investors assess the returns likely to be generated from all this AI infrastructure spending.

No one knows the future, which is why investors may want to diversify their portfolios to mitigate risk. The banking sector is a good place to look for this diversification. Banks face a much easier regulatory regime under President Donald Trump's administration, and I would expect mergers and acquisitions (M&A) to accelerate over the next few years. Banking regulators may also lower regulatory capital requirements, allowing financial institutions to increase capital distributions to shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Finally, there's a chance that the yield curve will continue to steepen, in which the rates on shorter-duration Treasury bonds stay at current levels or decline, while the yields on longer-duration bonds rise. Banks tend to benefit from this environment because they typically borrow money at the short end of the yield curve and lend it out at the long end.

Here are two bank stocks to diversify a tech-heavy portfolio.

Look at valuations and play the M&A wave

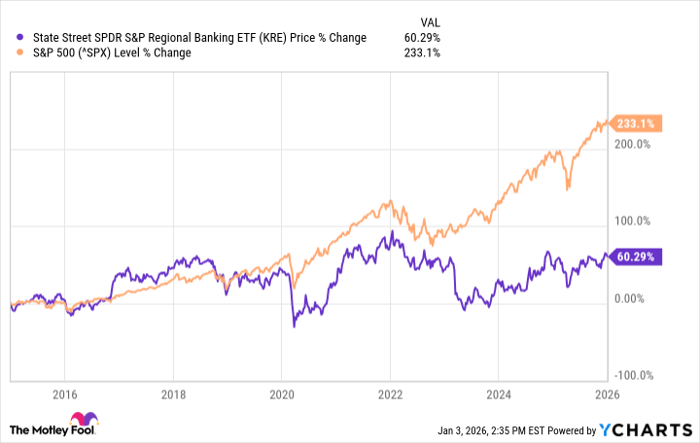

Banks have widely underperformed the broader benchmark S&P 500 index over the past decade, presenting numerous opportunities within the sector. One bank that has long traded at a significant discount to peers is Citigroup (NYSE: C). CEO Jane Fraser, who took over at the bank in 2021, has made significant strides in recent years, divesting less profitable divisions of the bank that lack sufficient scale to compete.

KRE data by YCharts

Fraser and her team have also invested further in the bank's most valuable businesses and fixed regulatory issues, leading to higher returns. The work has led to a rerating of the stock, which has increased by over 67% in the past year. However, there should still be room to run, as the bank is still trading at a significant discount to its large bank peers.

Another way to play the banking sector is by taking advantage of the incoming mergers and acquisitions wave and purchasing bank stocks that are likely to be acquired at a nice premium to their current stock price. This also reduces some of the broader market risk because the investment is based on an idiosyncratic factor; however, the flip side to this is that the bank may never be acquired.

One potential seller is Florida-based BankUnited (NYSE: BKU). BankUnited has one of the lowest five-year returns on equity among all large banks, according to MarketWatch. Furthermore, BankUnited still trades at a fairly modest valuation of 114% of its tangible book value (TBV), or net worth. This could make it easy for a buyer with a higher stock currency to make a potential acquisition immediately accretive to TBV, which investors look favorably upon.

Should you buy stock in Citigroup right now?

Before you buy stock in Citigroup, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Citigroup wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $490,703!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,157,689!*

Now, it’s worth noting Stock Advisor’s total average return is 966% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2026.

Citigroup is an advertising partner of Motley Fool Money. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.