The Best Dividend ETF to Invest $1,000 in Right Now

Key Points

Schwab U.S. Dividend Equity ETF has lagged the market over the past year or so.

The ETF has a fairly complex stock selection process that serves its investors well.

If you like dividends, Schwab U.S. Dividend Equity ETF's approach is very attractive.

- 10 stocks we like better than Schwab U.S. Dividend Equity ETF ›

Wall Street has a tendency to prioritize performance over process. However, from a long-term perspective, the way you invest is usually more important than the performance of that investment approach in any given period. If the process is good, the long term will take care of itself even if near-term performance is weak.

This is the big story behind Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) right now. It is also a compelling reason to buy it, as the market continues to be driven by a small number of large technology stocks. Here's why Schwab U.S. Dividend Equity ETF could be the best way to invest $1,000 today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What does Schwab U.S. Dividend Equity ETF do?

The Schwab U.S. Dividend Equity ETF is an index-tracking exchange-traded fund (ETF), which essentially does nothing more than buy the securities included in the Dow Jones U.S. Dividend 100 index. That index owns 100 dividend stocks, but it has a fairly complicated selection methodology.

Image source: Getty Images.

The first step in the screening process is to identify all companies that have increased their dividends for at least 10 consecutive years. Real estate investment trusts are eliminated from consideration. After this point, a composite score is created for each of the surviving companies. That score includes cash flow to total debt, return on equity, dividend yield, and a company's five-year dividend growth rate.

The 100 companies with the highest composite scores get included in the index and the ETF using a market cap weighting. Without going into each piece of the composite score, the goal is to buy financially strong and well-run companies that have high yields and fast-growing dividends. That is, essentially, what most dividend investors aim to do with their own portfolios.

If you like dividends and want to outsource the work of managing your portfolio to someone else, Schwab U.S. Dividend Equity ETF is a solid choice. One of the most attractive features here is the expense ratio, which is surprisingly low at 0.06%. That is a very low price for the amount of screening being done here.

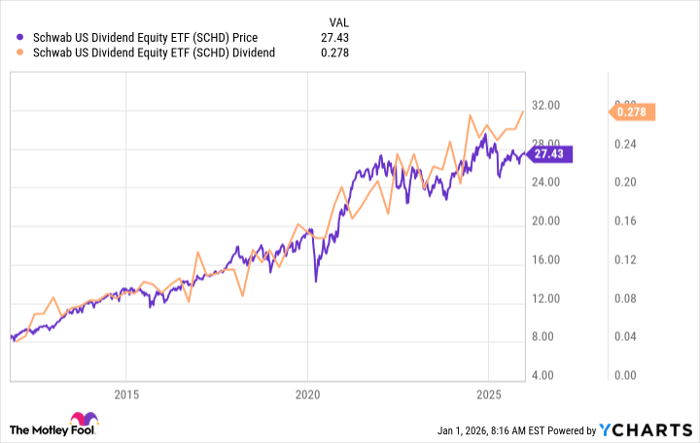

The performance results, meanwhile, have been pretty good. The price of the ETF and the dividend have both grown fairly regularly over time. Still, no investment approach works 100% of the time, and Schwab U.S. Dividend Equity ETF has been a performance laggard relative to the broader market. In 2025, the ETF was up 0.6% while the S&P 500 index rose 16%.

Don't count Schwab U.S. Dividend Equity ETF out. In fact, now may actually be the best time for a dividend investor to buy the ETF.

SCHD data by YCharts

The big problem that might not be a problem

One of the primary reasons why Schwab U.S. Dividend Equity ETF is currently trailing the S&P 500 index is an underweighting in technology stocks. The S&P's tech weighting is shockingly high at nearly 35%. That's been great for the index's performance, since a small number of large tech stocks have been leading the market. However, what happens if -- or more likely when -- those tech stocks reverse course? The answer is that the S&P 500 is going to feel a great deal of pain.

Meanwhile, the Schwab U.S. Dividend Equity ETF's technology exposure is approximately 8%. It won't be hit nearly as hard as the S&P 500 when tech stocks eventually turn south. With the fund's heavy exposure to energy, consumer staples, and healthcare stocks, at a combined 54% of the portfolio, a rotation out of technology could help turn the Schwab ETF's performance around.

While you wait for a market rotation into stocks other than the seven or so top technology companies, you can collect an attractive 3.7% dividend yield from Schwab U.S. Dividend Equity ETF. The S&P 500 index's yield, for comparison, is a tiny 1.1%. Schwab U.S. Dividend Equity ETF's yield isn't bad compensation for those who are willing to focus on the process of investing over just the near-term results of an investment approach.

One of the best buys in the market

An attractive yield, strong historical performance, and well-structured investment approach make Schwab U.S. Dividend Equity ETF one of the best investment choices on Wall Street today. A $1,000 investment will get you around 36 shares of the ETF. That's an investment that's likely to serve a patient dividend investor well over the long term.

Should you buy stock in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $490,703!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,157,689!*

Now, it’s worth noting Stock Advisor’s total average return is 966% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 5, 2026.

Reuben Gregg Brewer has positions in Schwab U.S. Dividend Equity ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.