Prediction: SoundHound AI Stock Could Hit $20 by 2030

Key Points

SoundHound AI's voice AI offerings can help improve productivity and enhance the operational efficiency of its customers.

The company is growing at a faster pace than the overall voice AI market.

SoundHound's growth potential suggests that it could deliver healthy gains through 2030.

- 10 stocks we like better than SoundHound AI ›

SoundHound AI (NASDAQ: SOUN) went public after merging with a special purpose acquisition company (SPAC) in April 2022, which means that it started trading on the stock market just before the artificial intelligence (AI) boom began with the arrival of ChatGPT later that year.

Importantly, SoundHound AI has capitalized on the growing demand for AI applications over the past three years. The company's voice AI solutions are gaining popularity among customers, which explains why its revenue is growing at an incredible pace. However, SoundHound stock has seen a lot of volatility since it went public.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The stock price is up just 48% since going public, following a roller-coaster ride on the market. SoundHound reported a stellar 2024 before pulling back substantially this year, driven by valuation concerns and Nvidia's decision to sell its stake in the company earlier this year. However, a closer look at SoundHound AI tells us that the company is likely to get much bigger over the next five years and deliver healthy gains to investors. Let's look at the reasons why.

Image source: Getty Images.

SoundHound AI's voice AI tools are boosting customers' productivity

Productivity improvements and efficiency gains are key reasons why major companies have been investing in AI. Market research firm IDC estimates that AI will contribute $22.3 trillion to the global economy through 2030, accounting for 3.7% of the world's gross domestic product (GDP) by the end of the year. The firm also adds that each new dollar spent on AI solutions is expected to generate $4.90 in value.

This is precisely the reason why SoundHound AI's voice AI solutions are in healthy demand. It offers various kinds of voice AI products, such as AI agents, automotive-focused chatbots, smart answering systems, voice-based e-commerce solutions, smart ordering systems for restaurants, and custom AI applications.

Voice AI automation can deliver efficiency gains of 30% to 40%, according to a report. Employees can save around five to 10 hours every week, handle more customer queries, and reduce errors thanks to AI. Not surprisingly, SoundHound AI's business has been growing at a nice clip in recent years, driven by the company's fast-growing customer base.

It reported $21 million in revenue in 2021. It is on track to finish 2025 with $172.5 million in revenue, as per the midpoint of its guidance range. That translates into an impressive compound annual growth rate (CAGR) of 69%. The good part is that SoundHound's growth is accelerating even though its revenue base is getting bigger with each passing year.

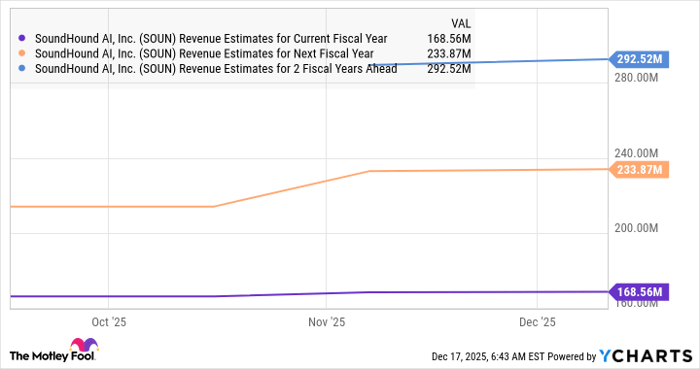

Analysts, somehow, believe that SoundHound's growth rate will drop sharply from 2026, following an estimated jump of 104% this year.

Data by YCharts.

However, that's unlikely to be the case, as the voice AI infrastructure market is forecast to generate a whopping $133 billion in revenue in 2034 as compared to just $5 billion last year. SoundHound is growing at a much faster pace than the 38% annual growth that this market is projected to clock over the next decade.

Moreover, it was sitting on a potential revenue backlog of $1.2 billion at the end of 2024 for the next seven years. This should allow SoundHound to easily cruise past Wall Street's growth expectations in the future, especially considering that the demand for voice AI solutions should take off thanks to the productivity gains that this technology is delivering.

Here's what the stock could be worth in 2030

We have already seen that SoundHound AI has ample room for growth on account of the huge addressable opportunity in the voice AI market. Even if the company grows its revenue at an annual rate of 40% (almost in line with the pace of the voice AI infrastructure market) over the next five years, its top line could hit $928 million (using its 2025 revenue estimate of $172.5 million as the base).

If the stock is trading at 8.7 times sales at that time, in line with the U.S. technology sector's average sales multiple, its market cap could jump to $8 billion. That points toward potential upside of 74% for the next five years, indicating that the stock could be trading at almost $20 in 2030.

SoundHound, however, could do better than that as it is capable of growing at a much faster pace than the voice AI market, which could lead the market to reward it with a higher sales multiple and result in even bigger gains over the next five years.

Should you buy stock in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $506,935!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,514!*

Now, it’s worth noting Stock Advisor’s total average return is 958% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 19, 2025.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends SoundHound AI. The Motley Fool has a disclosure policy.