Is Nokia a Must-Own Stock for 2026?

Key Points

The former mobile phone leader struggled in 2024, with revenue down 9% year over year.

But the stock bounced back in 2025 thanks to a new CEO and a partnership with Nvidia.

Nokia saw sales jump 12% year over year in Q3, and its new strategy bears watching.

- 10 stocks we like better than Nokia ›

Tech titan Nokia (NYSE: NOK) has lived many lives. It began 160 years ago as a pulp mill, eventually moving into technology and becoming the global leader in mobile phones in 1998.

Nokia was dethroned after the arrival of the Apple iPhone, and the Finnish company sold its handset business. Today, it focuses on networking infrastructure for data centers, along with its wireless network solutions.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Now, Nokia stock is surging in the era of artificial intelligence (AI). Shares in the company are up more than 40% in 2025 through the week ended Dec. 12, as Nokia positions itself to be a key player in the AI era.

Let's dive deeper into the tech giant to see if its stock is a buy for the new year.

Image source: Getty Images.

Nokia's key partnership with Nvidia

Nokia had a rough 2024, with revenue dropping 9% year over year to 19.2 billion euros. While the company struggled last year, 2025 is proving transformative for the company.

In the first quarter, it brought on a new CEO, Justin Hotard, as it transitions to greater AI emphasis. In October, the company announced a partnership with Nvidia to construct a wireless network that can support artificial intelligence's use on the edge.

Together, Nokia and Nvidia are building a 6G wireless system designed to support AI radio access network (AI-RAN) technology. AI-RAN differs from today's 5G network in that artificial intelligence transforms it from a passive data pipe into one where AI intelligently manages traffic for better speed, coverage, and capacity.

Nokia will adopt Nvidia's accelerated computing platform, which helps telecommunications companies seamlessly transition from 5G to 6G through software upgrades. In addition, Nvidia will make a $1 billion equity investment by purchasing Nokia stock at $6.01 per share.

Hotard summarized the significance of this deal, stating, "Our partnership with Nvidia... will accelerate AI-RAN innovation to put an AI data center into everyone's pocket." AI-RAN deployment is happening quickly. T-Mobile US is set to begin testing Nokia's AI-RAN in 2026.

Nokia's return to sales growth

AI-RAN technology is needed, since AI usage is expected to send wireless traffic soaring in the years ahead. Already, about half of ChatGPT's 800 million weekly active users access the service through mobile devices, according to Nokia.

Demand for AI delivered wirelessly is growing with the rise of AI-controlled self-driving cars, drones, robots, and agentic AI. In fact, Nokia sees ongoing network traffic expansion over the next decade. This makes its AI-native 6G network an important growth driver for the company.

The deal with Nvidia isn't the only bright spot. After Nokia's 2024 revenue dropped 9% year over year, sales reversed course and are up this year. In the third quarter, revenue reached 4.8 billion euros, a strong 12% year-over-year increase. The company's February acquisition of Infinera, a provider of optical networking solutions, contributed to the sales growth.

However, Nokia's Q3 operating profit fell 14% year over year to 239 million euros as costs increased. This contributed to a 67% year-over-year decline in Q3 diluted earnings per share (EPS) to 0.01 euros.

The company is working to reduce expenses. At the end of Q3, Nokia had achieved cost savings of 0.8 billion euros, and is striving to reach total savings of 1.2 billion euros by the end of 2026. If it continues to reduce expenses while increasing revenue through its AI efforts, it could see EPS grow.

To buy or not to buy Nokia stock?

The progress made in 2025 bodes well for Nokia's future. It's poised to benefit from the tailwind delivered by the AI market's expansion. The industry is forecast to reach $4.8 trillion by 2033, a jaw-dropping 25x increase in a decade from 2023's $189 billion.

Nokia's focus on AI-RAN technology looks like a winning strategy, and having Nvidia in its corner is advantageous. But its success isn't assured, as it competes against the likes of Ericsson and Cisco Systems.

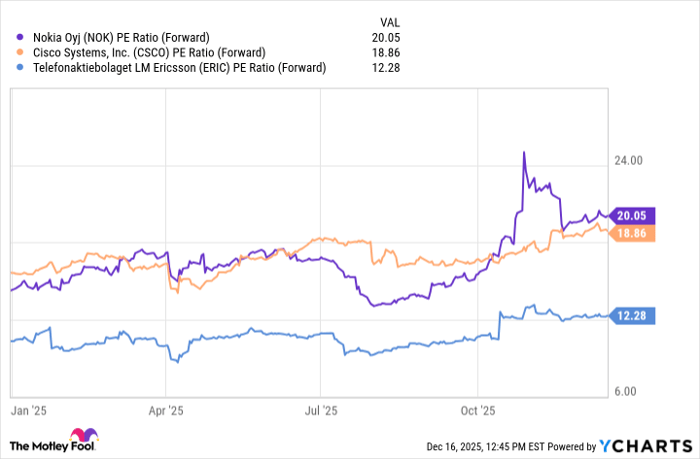

That said, if you believe it can succeed, now isn't a bad time to buy the stock based on its share price valuation. Here's a comparison of its forward price-to-earnings (P/E) ratio, which tells you how much investors are paying for a dollar's worth of earnings, based on estimates for the next 12 months, against competitors.

Data by YCharts.

The chart shows Nokia's forward P/E multiple hovers around Cisco's after it came down from the boost it got with the Nvidia deal announcement. However, Ericsson has been the better value all year, and remains so.

Nokia still has to prove its strategy can deliver long-term financial upside, so its stock isn't a must-buy at this point. But the company looks like it's headed toward better days ahead.

Should you buy stock in Nokia right now?

Before you buy stock in Nokia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nokia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $506,935!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,514!*

Now, it’s worth noting Stock Advisor’s total average return is 958% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 19, 2025.

Robert Izquierdo has positions in Apple, Cisco Systems, Nvidia, and T-Mobile US. The Motley Fool has positions in and recommends Apple, Cisco Systems, and Nvidia. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.