Is NuScale Power Stock a Buy Now?

Key Points

NuScale Power is attempting to build a business around small-scale modular nuclear reactors.

The company's first potential customer has yet to make a final investment decision.

Investors are clearly concerned that NuScale's prospects aren't as promising as hoped.

- 10 stocks we like better than NuScale Power ›

The last 52 weeks have been very exciting for NuScale Power (NYSE: SMR) shareholders, despite the stock's relatively stagnant performance over the year. The roller-coaster ride isn't shocking, however, given that NuScale is an upstart business that has yet to finalize its first sale. Is this nuclear power stock worth the risk?

A year in the life of NuScale Power

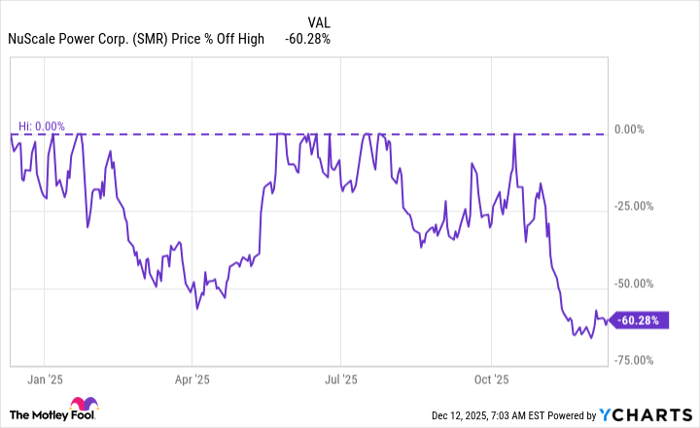

Roller coaster is an understatement when you consider the price performance of NuScale Power's stock over the past 52 weeks. If you only look at the starting and ending points, the stock is down around 5% over the year. However, it was up by more than 130% in between. All of that, and then some, has been lost.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

SMR data by YCharts.

That snapshot doesn't even tell the whole story. The 52-week period included a 50% price decline that was fully recovered as the stock went on to new highs. Then, there was a roughly 30% drawdown, which was fully recovered as the stock rebounded to its previous high. Now, the stock is down 60% from that high, mired in the middle of another sell-off.

This type of volatility isn't that unusual for a start-up business. However, if you can't handle material price swings like this, you shouldn't even consider buying NuScale Power, as more volatility is highly likely.

Image source: Getty Images.

NuScale Power has big plans

The truth is, the story behind NuScale Power is pretty exciting. The company aims to develop small-scale, modular nuclear reactors and has obtained key regulatory approvals. It has a customer lined up to purchase its first reactor.

There's just one problem. The Romanian power company, which could be the first customer, has yet to make a final investment decision. That decision isn't expected to be made until late 2026 or early 2027 and is dependent on the utility's ability to get financing.

In other words, NuScale Power's first sale remains uncertain. There are other possibilities, including the company's work with ENTRA1, which just inked a deal to build a modular nuclear reactor plant in the United States. The problem is that this nuclear power plant is still a future project, too, not a concrete sale.

NuScale Power really needs a concrete sale so it can start to manufacture its small-scale modular nuclear reactors. At that point, investors will know if the business has a long-term future. Until a reactor is built and deployed, there's no way to know if the technology is as attractive as it sounds.

Factory-built nuclear small modular reactors could be lower in cost, safer, and easier to place where they're needed (such as next to a data center, for example). However, until one is built and installed, few utilities or industrial customers are probably going to jump at the proposition of buying one. The first sale is likely to be a key turning point for NuScale Power.

The goal post keeps moving

Nuclear power is experiencing a renaissance right now, thanks to increased power demand from technologies such as artificial intelligence and electric vehicles. However attractive NuScale Power's story is, the big step -- a finalized sale -- has yet to materialize. The date for what was expected to be the first sale, meanwhile, has now been pushed out by as much as a year.

Only the most aggressive investors should consider purchasing NuScale Power at this time. Even then, you'll need to be prepared for more, possibly material, swings in the stock price. The story here is engaging, but you may need to wait for a while before it fully unfolds. Most investors will probably want to see a few more milestones achieved before buying NuScale Power's stock.

Should you buy stock in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.