Should You Really Invest in the Stock Market in 2026? Here's What History Says.

Key Points

More investors are becoming concerned that a recession or bear market is on the horizon.

It can be tempting to avoid investing right now, but history suggests the opposite.

With the right strategy, you can not only survive a downturn, but thrive.

- 10 stocks we like better than S&P 500 Index ›

As we head into the new year, it's time to start thinking about how your investing strategy might change in 2026.

Some investors are concerned that a recession or bear market may be looming, with close to one-third of investors admitting they feel "bearish" about the market's next six months, according to a December survey from the American Association of Individual Investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The future of the stock market will always be uncertain to a degree, but is it really safe to continue investing in 2026? History has promising news for investors.

Image source: Getty Images.

Should you invest now or wait?

If a downturn is around the corner, it may seem safer to wait to buy until prices drop. After all, with many stocks at record highs, right now is a pricey time to invest.

However, the unpredictability factor can make it nearly impossible to accurately time the market. If you hold off on investing now and stocks continue to surge, you'll miss out on those gains. The longer you wait, the more earnings you could potentially forego.

But what if the market does take a turn for the worse in the coming months? The good news is that as long as you keep a long-term outlook, it doesn't necessarily matter whether you buy at the ideal moment.

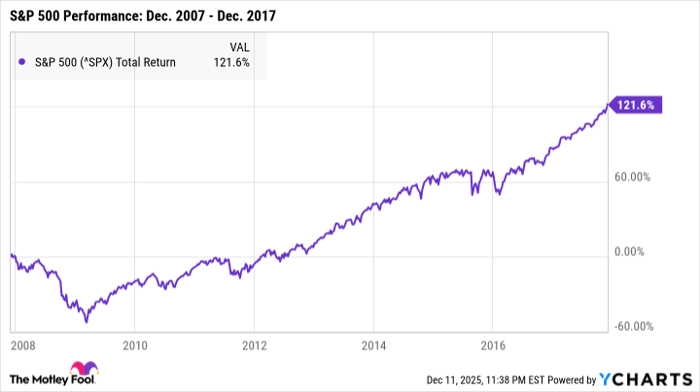

For example, back in December 2007, the S&P 500 (SNPINDEX: ^GSPC) was on the verge of plunging into the Great Recession. The index lost more than half of its value by 2009, and it took until 2012 for it to begin reaching new highs again.

Those years were rough for investors, and if you'd invested in December 2007, it may have seemed like the worst possible moment to buy. After 10 years, though, the S&P 500 had earned total returns of more than 121%. By today, its total returns have surged to nearly 560%.

^SPX data by YCharts

In other words, if you'd invested $5,000 in an S&P 500 index fund in December 2007, you'd have around $33,000 by today -- despite experiencing one of the longest and most severe recessions in U.S. history in that time.

This isn't to say that we're on track to see another Great Recession-level downturn in 2026. Nobody -- even the experts -- can say for certain where the market is headed in the short term. But over the long haul, it's incredibly likely stocks will thrive. History shows that even if you invest at a less-than-ideal time, staying in the market for at least a decade or so is one of the best ways to protect your portfolio.

The secret to thriving during periods of volatility

The investments you choose will make or break your portfolio, and that's especially true when the market is shaky.

Weak stocks can still perform well during periods of prosperity, but many of them will crumble during a recession or bear market. If you're investing heavily in these types of stocks, your portfolio will have a hard time recovering from the next downturn.

Strong companies, however, are more likely to bounce back. Some industries fare better than others during recessions, but even healthy companies in more volatile sectors can still thrive over time. They may be hit hard in the short term, but given a few years to recover, strong companies are more likely to see positive long-term returns.

So what makes a strong stock? There are many factors to consider when researching stocks, but a few of the most important include solid financial metrics, a capable management team, and a competitive advantage in the industry. The stronger a company's fundamentals, the better its chances of surviving even severe recessions or bear markets.

No matter where you choose to invest, a long-term outlook is key. The market may or may not take a turn in 2026, but downturns are an inevitable part of the market's cycle. Whatever happens, investing in strong companies and holding them for at least a few years can better protect your finances.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.