Is BigBear.ai a Buy?

Key Points

BigBear.ai's revenue fell 20% in the third quarter, following a pattern of declines.

The company's margins are falling, and it has a negative free cash flow of $9.8 million.

To make matters worse, shares of the data analytics company are looking expensive.

- 10 stocks we like better than BigBear.ai ›

Artificial intelligence companies are the must-have stocks for many investors right now, and BigBear.ai (NYSE: BBAI) has been no exception. The AI data analytics company has seen its share price rise by more than 600% over the past three years, leading many to wonder if this AI stock is worth buying right now.

Unfortunately, I think investors have been caught up in a bit of a flurry of excitement for BigBear.ai that's not necessarily warranted, given the company's falling sales and tumbling margins. Here's why it's best to avoid BigBear.ai stock right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

BigBear.ai is a growth company, minus the growth

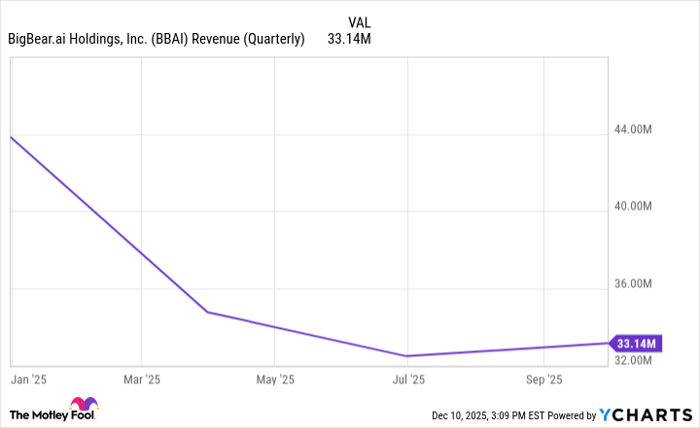

One of the most glaring issues with BigBear.ai is that the company's sales are declining. The company recently reported its third-quarter results, showing revenue falling by 20% to $33.1 million.

That's a significant decline and continues a pattern of the company failing to grow its sales. Here's a quick look at BigBear.ai's revenue trajectory over the past year:

BigBear.ai Revenue (Quarterly) data by YCharts.

Growth stocks are supposed to be, well, growing. With sales sliding and no end in sight to the decline, I think some investors may be overlooking this problem and are instead too focused on the idea that BigBear.ai is an AI company. Unfortunately, offering artificial intelligence services -- and even having the letters in the company name -- aren't enough. BigBear.ai needs to right this revenue decline ASAP before any investors should consider buying the stock.

Don't let the company's temporary positive earnings fool you

Some investors may have been optimistic about BigBear.ai reporting GAAP earnings per share of $0.01 in the third quarter, up from a loss of $0.06 in the year-ago quarter. But that positive news wasn't because of underlying financial improvements at the company. It was instead the result of a non-cash change in derivative liabilities of about $26 million, which accounted for temporary changes in net income.

BigBear.ai doesn't generate any consistent positive operating income from its core AI analytics business. The company's gross margins are actually declining, falling to 22.4% in the third quarter, compared to 25.9% in the year-ago quarter.

What's more, the company had negative free cash flow of $9.8 million in Q3, meaning it's burning cash from operations rather than generating it.

BigBear.ai's stock is too expensive

Finally, as if all of the above weren't enough to make you want to avoid BigBear.ai stock right now, its shares are overpriced. The stock currently has a price-to-sales (P/S) ratio of approximately 14, which is higher than the tech sector's average P/S ratio of 9.

This is made even worse by the fact that, as I mentioned earlier, the company's sales are falling. If sales were skyrocketing and BigBear.ai was generating lots of revenue that it could reinvest into the company, then a higher valuation would be more justified. However, with them falling, BigBear.ai's overpriced shares appear even more expensive.

Let BigBear.ai be a warning about some AI stocks

Not only does BigBear.ai appear to be a good stock to avoid right now, but I also think it's a good example of how some investors are getting too caught up in the artificial intelligence boom. There are numerous companies generating substantial revenue and earnings from AI. By all means, buy some of those AI stocks and hold for the long term.

However, be cautious of investing in AI companies that sound promising but lack the financial fundamentals to support their rapidly rising share prices.

Should you invest $1,000 in BigBear.ai right now?

Before you buy stock in BigBear.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and BigBear.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.