Here's My Top "Magnificent Seven" Stock to Buy for 2026

Key Points

Neither Tesla nor Apple has delivered great growth recently.

Alphabet, Microsoft, and Amazon are spending heavily on their cloud computing divisions.

Meta Platforms and Nvidia are the best bargains in the group based on the forward price-to-earnings metric.

- 10 stocks we like better than Nvidia ›

The "Magnificent Seven" is a popular grouping of the largest and most important tech stocks in the market. Its constituents are:

- Nvidia (NASDAQ: NVDA)

- Apple (NASDAQ: AAPL)

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Microsoft (NASDAQ: MSFT)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

These companies are listed in descending order of market cap, and the top five are the five largest companies in the world. Meta Platforms and Tesla are in the top 10, making this a definitive list of some of the most important tech companies in the world -- though the importance of Broadcom and Taiwan Semiconductor, which aren't on it, should not be overlooked.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

All have been winners for investors over the long term. But which one looks likely to be the best performer in 2026?

Image source: Getty Images.

Many of the Magnificent Seven stocks look like strong buys

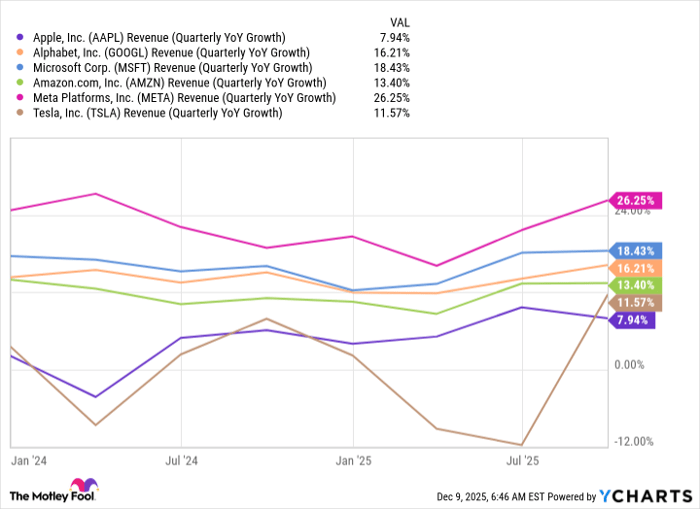

First, let's look at the stocks I'm avoiding in 2026: Apple and Tesla. Of all the stocks on this list, they have consistently had the lowest growth rates over the past few years. (Note: I left Nvidia off of this chart because its growth rates were so high that they made the rest of the graph tough to read.)

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Tesla appears to be trending up, so I'd rank it in front of Apple, but neither of these stocks excites me for 2026.

The remaining five Magnificent Seven stocks have serious potential in 2026. Microsoft, Amazon, and Alphabet all have strong base businesses alongside thriving cloud computing segments that are providing the infrastructure to power artificial intelligence (AI) systems. Most companies don't have the ability to put up their own data centers, so they rent the computing power they need, often from one of these giants. That trend will continue into 2026. Meanwhile, each of these companies' other core businesses are looking solid.

I like Microsoft, Amazon, and Alphabet for 2026, but none of them qualify as my top pick.

That leaves Meta Platforms and Nvidia -- the two fastest-growing companies in the bunch.

Better buy: Meta Platforms or Nvidia?

Meta Platforms' stock declined sharply after it delivered its third-quarter earnings report in late October because the market is growing worried about its massive AI spending. While the stock recently rebounded a bit on news that Meta intends to cut spending in its metaverse-focused Reality Labs division, the stock is still down by around 18% from its 2025 high.

Nvidia is in a similar boat: It's down by around 13% from its peak. However, considering how much money companies like Meta, Alphabet, Amazon, and Microsoft are planning on spending on AI computing power in 2026, its growth rate should continue to be incredible. During its most recent quarter, Nvidia's revenue rose 62% year over year. Management also reaffirmed its long-term forecast that global data center capital expenditures will rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030.

If that occurs, Nvidia will keep benefiting from the massive AI-related capital expenditures of companies such as Tesla, Meta, Alphabet, Amazon, and Microsoft. (Apple isn't really spending a lot on AI, and it shows.)

I think Nvidia's impressive growth outlook makes it the top Magnificent Seven stock pick for 2026. Wall Street analysts project that its revenue will rise by 48% in its fiscal 2027 (which ends in January 2027) after a 63% growth rate in the fiscal year that will close next month. That's a promising outlook, and it actually makes Nvidia stock look like a relative bargain.

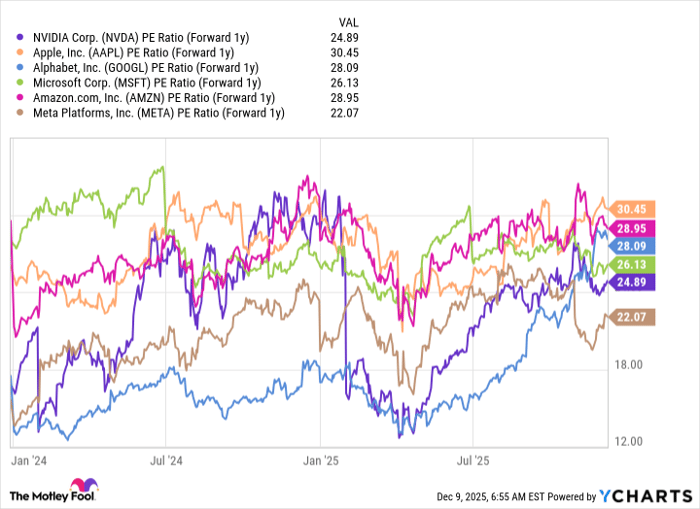

Trading at 25 times next year's expected earnings, Nvidia is the second-cheapest stock in the cohort by that valuation metric.

NVDA PE Ratio (Forward 1y) data by YCharts.

(Note: Tesla was not included in the chart above because its extremely high 195 ratio compresses the rest of the data lines, making them too hard to read.)

With Nvidia growing the fastest and priced nearly the cheapest, it's a no-brainer stock to buy right now. While there are other great options to invest within the Magnificent Seven group, Nvidia is still the best.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Keithen Drury has positions in Alphabet, Amazon, Broadcom, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.