What to Watch With PepsiCo (PEP) Stock in 2026

Key Points

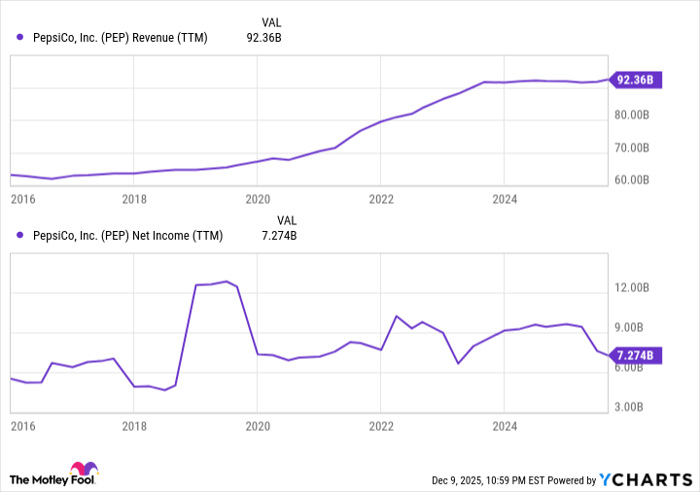

PepsiCo’s stock has struggled since 2023, in sync with its overall business.

Several strategic changes to its product lines have been made this year.

It’s positioned for rekindled growth, but there’s no room for error.

- 10 stocks we like better than PepsiCo ›

It's going to be another forgettable year for beverage giant PepsiCo (NASDAQ: PEP) shareholders. The stock's trading down (albeit slightly) since the end of 2024, marking the third year in a row it's lost ground. Almost needless to say, investors have become more than a little frustrated.

The good news is that this frustration is finally affecting real change. The even better news is that it will be pretty easy to know if this change is working. It shouldn't take too long to see it, either.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

A much-needed turnaround is in the works

As a reminder, PepsiCo isn't just its namesake cola. The company also owns Mountain Dew, Gatorade, and Tropicana juices, as well as Frito-Lay snacks and chips, which include Doritos and Cheetos. It even owns Quaker Oats.

It's this food arm that's been the big stumbling block of late. While inflation and health consciousness have certainly created challenges for its beverage business, snacking and commodity-based foods have proven particularly vulnerable to the current economic and consumer environment. Last year, Frito-Lay's revenue and volume fell slightly, while Quaker's revenue and volume both tumbled to the tune of 14%. It's a weakness that lingered into this year.

Data by YCharts.

Real change is finally taking shape, though. For instance, after acquiring the portion of hummus brand Sabra it didn't already own late last year, PepsiCo has been promoting it more aggressively as a healthy snack. Then, in July, PepsiCo's Frito-Lay unveiled dye-free versions of its Cheetos and Doritos chips.

It's not just its food arms that are undergoing a sweeping overhaul, either. Although the drinks segment is far from being in the same dire straits Frito-Lay and Quaker have been, building on March's acquisition of prebiotic soda brand Poppi, PepsiCo unveiled the world's first-ever prebiotic cola in July. The consumer goods company also recently announced plans to cut some of its beverage unit's operating costs -- including a 20% reduction in its total number of products -- to free up more funding for advertising and marketing.

So what will investors need to watch in the year ahead? The simplest and most obvious answer is the right one. After a disappointing couple of years, PepsiCo should begin seeing consistent sales and volume growth for its food and beverage businesses in the U.S. and abroad. There's no ambiguity or gray area with any of these fiscal metrics, either.

Even modest progress will do

Just keep things in perspective. Most consumer goods companies only grow or shrink at a pace in the low single digits. If PepsiCo's revenue makes the 3.4% year-over-year improvement that analysts are calling for in 2026, that would actually be a pretty significant victory for this slow-moving company in an even slower-moving industry. The same goes for earnings, which are expected to improve from a projected $8.11 per share this year to $8.58 next year.

Nevertheless, after two tough years of stagnant revenue and waning profitability, anything less than measurable progress toward a turnaround could cause a major loss of faith in PepsiCo's future. Tread lightly.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.