Prediction: This Artificial Intelligence (AI) Stock Could Beat Palantir in 2026. Now Is a Great Time to Buy It Hand Over Fist

Key Points

Palantir's stunning returns over the past several years have left the stock expensive.

Snowflake is experiencing healthy growth and trades at a significantly lower valuation.

- 10 stocks we like better than Snowflake ›

Palantir Technologies is among the leaders in the artificial intelligence (AI) software market, and has experienced terrific revenue and earnings growth over the past couple of years. As a result, its stock has been flying higher. But the problem is that its shares are now trading at expensive levels. There's a large amount of hoped-for future growth baked into the stock price.

That's why investors seeking strong returns in that AI niche may be looking for alternative plays. Snowflake (NYSE: SNOW) appears to be one that could outperform Palantir in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image Source: Snowflake.

Snowflake's data platform is getting an AI-powered boost

Snowflake operates a cloud-based data warehouse platform. Its clients can not only store their proprietary data on its systems, but also use that data to build apps, gain insights, and run analytics. The company also provides a marketplace for third-party data sets, allowing customers to share and exchange data, thereby monetizing it.

Its infusion of AI tools into its offerings is helping the company attract new customers while gaining more business from existing ones. Snowflake now offers a broad range of AI services, including serverless graphics processing units (GPUs), which customers can rent to access large language models (LLMs). And its Cortex platform allows customers to build and deploy AI apps using their own data.

The productivity gains these options can produce for clients explain why demand for Snowflake's AI solutions is increasing. On its latest earnings call, management said that more than 7,300 customers were using its AI features every week in the third quarter of its fiscal 2026 (which ended on Oct. 31), and 1,200 of them were building AI agents on its platform.

The company finished the quarter with just over 12,600 customers, an increase of 20% from the year-ago period. So there are still numerous customers to which it can cross-sell its AI offerings.

More importantly, the cross-selling opportunities are helping it extract more business from existing customers, as shown by its net revenue retention rate of 125% last quarter. This metric compares the product revenue coming from the customer cohort it had in the prior-year period to the revenues booked from that same cohort in the latest one. So a retention rate of more than 100% means that established customers as a group are spending more on its offerings.

Given that Snowflake won't need to incur high marketing costs to pitch its AI tools to its established customers, its earnings are growing at an impressive pace. It reported a 29% increase in product revenue to $1.16 billion in its fiscal third quarter, while its adjusted earnings shot up by 75% year over year to $0.35 per share. The company's bottom line increased by 79% in the first nine months of the fiscal year.

It could replicate such a performance in the current quarter as well, especially considering that it has increased its guidance. It now expects to finish fiscal 2026 with a 28% increase in product revenue to $4.45 billion, up from its earlier guidance of $4.39 billion. Also, Snowflake reported remaining performance obligations (RPO) of $7.9 billion last quarter, up by 37% year over year. The fact that this metric grew by more than its top line shows that the company is getting contracts at a faster rate than it can fulfill them.

So an acceleration in its growth in 2026 could pave the way for more upside in the stock beyond the 44% gain it has registered so far this year.

A strong 2026 could be in the cards for the stock

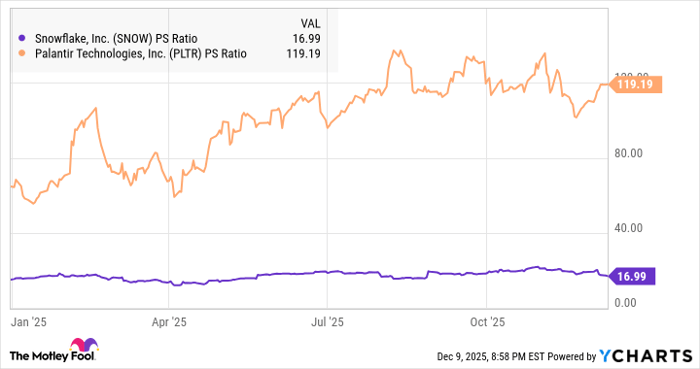

Snowflake's share price rise this year is well below Palantir's 140% jump, but the latter's lofty valuation may prove a drag on the shares in 2026. Snowflake trades at a significantly cheaper sales multiple.

SNOW PS Ratio data by YCharts; PS = price-to-sales.

Comparing the potential growth that both companies are likely to register next year, it's easy to understand why Snowflake has the potential to outpace Palantir. Analysts are projecting a 40% increase in Palantir's top line in 2026 to $6.2 billion, down from this year's estimated growth of 54%. Snowflake's top line, meanwhile, is expected to jump by 24% next year to $5.7 billion.

Both businesses could exceed those consensus estimates thanks to their rapidly improving backlogs. However, Snowflake's valuation is significantly cheaper, and therefore more sustainable.

Assuming Snowflake hits $5.7 billion in revenue next year as expected and trades at 20 times sales (a premium that it could justify by outpacing consensus estimates in 2026), its market cap could jump by about 50% from current levels to $114 billion. Palantir's 12-month median price target of $200, meanwhile, suggests upside of just 7% or so from current levels.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and Snowflake. The Motley Fool has a disclosure policy.