Is This Ultra-High-Yield Dividend Stock a No-Brainer Heading Into 2026?

Key Points

Cigarette maker Altria has increased its annual dividend for 56 consecutive years.

It has used its pricing power to offset declining volume due to fewer adult smokers.

With a forward P/E ratio of around 10.7, Altria is trading at a bargain by most standards.

- 10 stocks we like better than Altria Group ›

Dividends are an effective way to generate value from your stocks without relying solely on their stock price performance. A dividend plus stock price growth is obviously ideal, but it's nice knowing you have guaranteed dividend income in the works regardless of how a stock performs.

One dividend stock that has been a staple on the market for decades is tobacco giant Altria Group (NYSE: MO). With 56 consecutive years of dividend increases (and 60 total in that span), Altria is a dividend king and one of the highest-yielding stocks on the market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

With a 7% dividend yield (as of Dec. 8), Altria's stock could be appealing to investors seeking income. However, does that alone make it a no-brainer heading into 2026? Let's take a look.

Image source: Getty Images.

Using its pricing power to its advantage

Altria owns well-known tobacco brands such as Marlboro, Black & Mild, Copenhagen, Skoal, Virginia Slims, and others. These companies span from traditional cigarettes to cigars to smokeless tobacco to e-vapor, and in many cases, Altria holds a strong position in these categories.

One knock on Altria's business in recent years has been the declining smoking rate of American adults, which, in turn, has translated to declining volume for Altria. Smoking rates among adults have fallen from around 42% in 1965 to just over 11% in 2022.

Luckily, Altria has been able to offset declining volume with its pricing power. Tobacco consumers, for better or worse, don't typically stop using tobacco whenever prices are increased. In some instances, they'll switch to a cheaper brand, but in a lot of cases, they'll just deal with the increase and buy their preferred brand. This is how Altria's financials have remained stable even while its volume has declined.

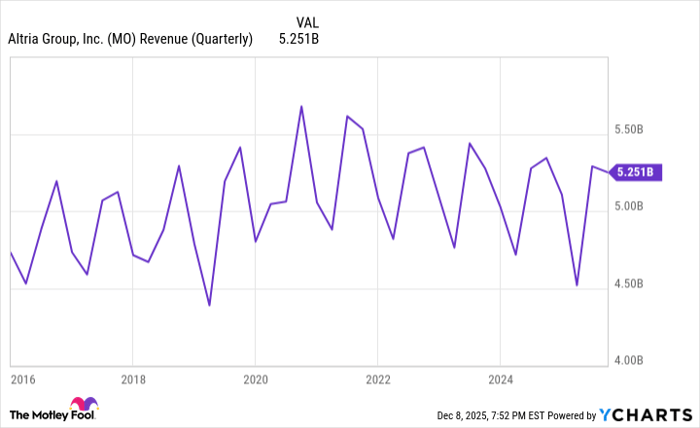

Altria isn't a company that's going to experience high revenue growth, but its revenue has remained fairly stable over the years. Simply raising prices isn't a productive long-term strategy, but it has bought, and will continue to buy, Altria time while it gets a viable non-tobacco option.

MO Revenue (Quarterly) data by YCharts.

How safe is Altria's dividend?

There's no doubt that Altria's selling point is its dividend. However, if the company continues to lose volume and can't fully offset it with its pricing power, there are rightly questions about the dividend's stability. The good news is that the dividend doesn't seem to be in jeopardy.

Altria aims for a payout ratio of around 80% of its adjusted earnings per share (EPS). The adjusted EPS excludes one-time expenses and better reflects its day-to-day earnings from operations. Below are Altria's past four payout ratios compared to its adjusted EPS:

| Quarter | Dividend | Adjusted EPS | Payout Ratio |

|---|---|---|---|

| Q3 2025 | $1.06 | $1.45 | 73.1% |

| Q2 2025 | $1.02 | $1.44 | 70.8% |

| Q1 2025 | $1.02 | $1.23 | 82.9% |

| Q4 2024 | $1.02 | $1.29 | 79.1% |

Source: Altria quarterly reports.

As with the stock price itself, past performance doesn't guarantee future performance, but I don't see a situation where Altria's dividend will be in legitimate jeopardy in the foreseeable future. Knowing that the dividend is what attracts investors, I'd imagine the company would cut expenses elsewhere before it ever slashed its dividend.

Altria's stock is trading at a bargain right now

I wouldn't call Altria's stock a no-brainer for long-term investors, because there are legitimate concerns about the traditional cigarette business. However, at its current valuation, Altria seems a bargain for investors willing to bet on its ability to overcome the declining smoking "problem."

Altria shares are trading around 10.7 times its projected earnings for the next 12 months, which is cheap by most standards. That doesn't guarantee the stock price will perform well, but it does give the stock more upside than if it were priced at more of a premium.

If you're looking for a stock that will beat the market year in and year out or produce double-digit percentage revenue growth, Altria isn't the stock for you. However, if you're looking for above-average dividend income from a company that has so far stood the test of time, Altria is a good go-to.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.