Worried About a Recession or Bear Market in 2026? This ETF Is One of the Best You Can Own Right Now.

Key Points

Many investors are growing increasingly concerned about future market volatility.

While nobody knows for certain what's coming, it's smart to begin preparing now.

Broad market funds can help limit risk while still building long-term wealth.

- 10 stocks we like better than Vanguard Total Stock Market ETF ›

As we head into 2026, many Americans are feeling conflicted about the future.

A recent survey from financial association MDRT found that around 80% of U.S. adults are at least slightly concerned about a recession. However, just over 44% of investors still feel optimistic about the stock market's next six months, according to the most recent weekly survey from the American Association of Individual Investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

So what should investors do right now, when the future is uncertain? Rather than simply waiting it out -- and risking missing out on valuable time to build wealth -- it's often wiser to invest in solid stocks with a high chance of surviving any potential volatility.

While there are countless investments out there that can fit that bill, there's one exchange-traded fund (ETF) that's among the safest you can own right now: the Vanguard Total Stock Market ETF (NYSEMKT: VTI).

Image source: Getty Images.

Why invest in a broad market ETF?

ETFs come in all shapes and sizes. Some of them are highly targeted, focusing on niche subsectors of the market -- like artificial intelligence (AI) or semiconductors, for example. Others may only contain growth stocks or companies of a particular size.

A broad market fund, on the other hand, covers nearly every corner of the market. The Vanguard Total Stock Market aims to follow the performance of the market as a whole, and it contains 3,531 stocks from all industries -- from small-cap to mega-cap and everything in between.

There are a few advantages of investing in a total stock market ETF, especially during periods of volatility:

- Ultimate diversification: You'd be hard-pressed to find an investment more diversified than a total stock market ETF. Generally, greater diversification can help mitigate risk. When you're not putting all your eggs in one basket, so to speak, it's less likely your portfolio will be hit hard if a few stocks -- or even an entire industry -- takes a tumble.

- Flawless track record: The stock market itself has decades of experience surviving recessions, crashes, bear markets, and corrections. While it's impossible to know what lies ahead, chances are good it will recover from any future turbulence as well.

- Less short-term volatility: The Vanguard Total Stock Market ETF contains many small stocks, growth stocks, tech stocks, and others that may be more prone to significant fluctuations. However, it also includes a diverse mix of established companies from recession-proof industries. No investment is immune to volatility, but because of its wide variety of holdings, this ETF will likely experience fewer price swings than many other funds.

There are never any guarantees in the stock market, and every investment will have its rough patches. But a broad-market fund like this one is incredibly likely to rebound after a downturn, going on to experience long-term growth.

In fact, since its inception in 2001, the Vanguard Total Stock Market ETF has earned an average rate of return of 9.25% per year. If you'd invested $5,000 in this fund back then, you'd have close to $30,000 by today -- and that's despite the numerous recessions and bear markets we've survived in that time.

One downside to consider

No investment is perfect, and even relatively safe ETFs will have drawbacks. Perhaps the biggest downside to this fund is that it may earn lower returns than more growth-focused ETFs.

Risk and reward can often be trade-offs when investing in the stock market, and that's a compromise investors must decide for themselves. For some investors, the safety of a total stock market ETF is worth the lower returns. Others, though, may opt for an ETF with higher growth potential, even if it comes with increased chances of volatility.

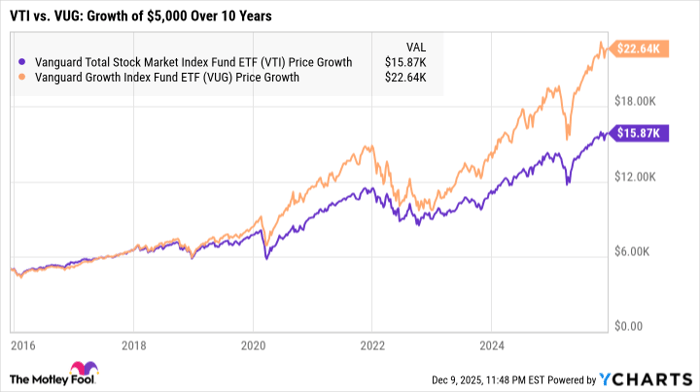

It's unclear how any investment will perform over time, but sometimes the earnings difference can be substantial. For example, while the Vanguard Total Stock Market ETF has earned an average return of around 14% per year over the last decade, the growth-focused Vanguard Growth ETF has earned returns of more than 17% in that time. Over years, that difference can add up to thousands of dollars.

VTI data by YCharts

There's no one-size-fits-all answer here, so where you choose to invest will come down to your risk tolerance and goals. Those looking for stability above all else may be best suited for a broad market fund like the Vanguard Total Stock Market ETF, while investors seeking greater returns might opt for a growth ETF instead.

Nobody knows whether a recession or bear market is looming in 2026. However, being proactive with your investment strategy can maximize your earning potential, regardless of what happens. By investing in the right places now, you'll be better prepared heading into the new year.

Should you invest $1,000 in Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Katie Brockman has positions in Vanguard Index Funds-Vanguard Growth ETF and Vanguard Total Stock Market ETF. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF and Vanguard Total Stock Market ETF. The Motley Fool has a disclosure policy.