Prediction: Alphabet Could Reach This Valuation by 2028

Key Points

Relatively speaking, Alphabet isn't too far from a $5 trillion market cap.

The company is reasonably valued, which could allow it to perform well in the medium term.

Alphabet's strong business makes it a top stock to hold over the long term.

- 10 stocks we like better than Alphabet ›

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is part of the exclusive group of companies worth more than $1 trillion -- but there's only one member that has ever reached a $5 trillion market cap: Nvidia. However, in my view, there's a good chance that Alphabet will also be able to claim this achievement by the end of 2028.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

It's not that far off

Alphabet's current market cap is $3.8 trillion. So, the $5 trillion milestone doesn't seem out of reach at all. The stock would need to achieve a compound annual growth rate of about 9.6% through December 2028 to pull that off. That's in the neighborhood of the average returns for the broader U.S. equities market over the long run -- and Alphabet is no average company. True, we're talking about a three-year period, and a lot can happen in that time that would sink its stock price. However, there is yet another reason I believe Alphabet could get to $5 trillion.

The valuation looks reasonable

If we compare Alphabet's valuation to those of its fellow Magnificent Seven" giants, a clear picture seems to emerge: It is one of the more reasonably valued members. Its forward price-to-earnings ratio is the second lowest in the group.

GOOG PE Ratio (Forward) data by YCharts.

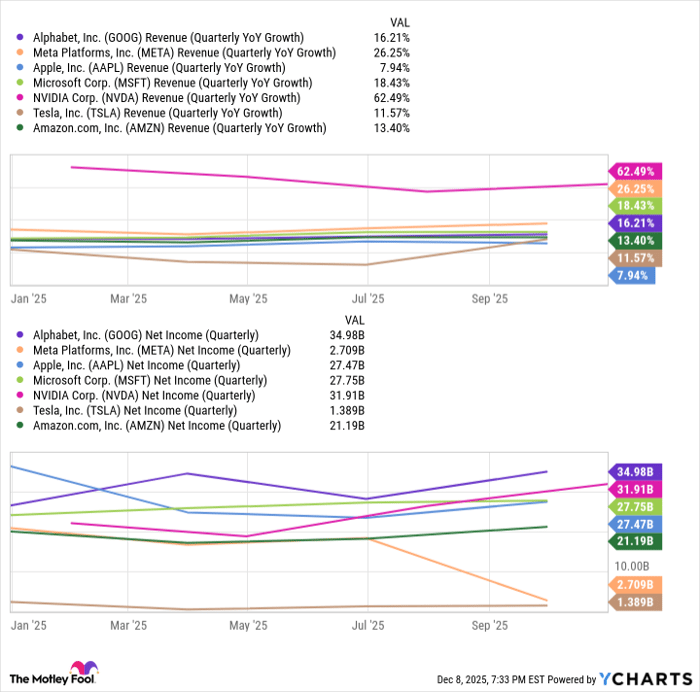

Even looking at these megacaps' price/earnings-to-growth (PEG) ratios, Alphabet still appears to be one of the most attractive among them. Meanwhile, its revenue growth rate was in the middle of the pack as of the last quarter. It now generates the highest quarterly net income and also boasts competitive profit margins compared to its Magnificent Seven peers.

GOOG Revenue (Quarterly YoY Growth) data by YCharts.

Alphabet's apparently more reasonable valuation today could position it for better share price returns over the next few years.

A significant tailwind

Alphabet's financial results should also remain strong through 2028. The company remains the leader in the online search space thanks to Google, which generates substantial ad revenue. However, over the past two years, Alphabet has improved its operations thanks to artificial intelligence (AI). Adding AI Mode and AI Overviews to its search engine helped Alphabet fend off the threat to search volume posed by AI chatbots.

It also started offering a suite of AI services through its cloud business (its fastest-growing segment) and is using AI-powered algorithms to increase engagement on YouTube, which helps boost ad sales. AI is proving to be a significant growth driver for Alphabet, and this trend should continue through 2028 and beyond, considering we are still arguably in the early stages of the AI revolution. This is a key reason that investors should consider holding Alphabet's stock even beyond the next three years.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Prosper Junior Bakiny has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.