Prediction: Amazon Stock Will Have a Monster 2026

Key Points

Amazon's third quarter showed impressive growth across the board.

The success of 2026 hinges on two business units.

The stock isn't trading at historically cheap levels.

- 10 stocks we like better than Amazon ›

Amazon (NASDAQ: AMZN) has had a fairly disappointing 2025 so far. The stock has risen a mere 6% for the year, lagging the S&P 500 (SNPINDEX: ^GSPC), which is up about 16% for the year. That level of underperformance is disappointing for shareholders, but it sets the stage for an exciting 2026.

I think that Amazon will come roaring back in 2026, mainly on the back of its strong cloud computing business and advertising services. If its commerce divisions can play a part too, that will make Amazon's stock perform even better in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Amazon.

Commerce isn't Amazon's only business

The first thing people think of when they hear "Amazon" is its e-commerce site. While this division accounts for the majority of Amazon's revenue, it isn't the fastest-growing one. During the third quarter, Amazon's online store sales grew 10% year over year. It's the third-slowest-growing segment in Amazon, in front of physical stores and "other."

However, it was Amazon's largest by revenue, with its $67.4 billion total making up about a third of Amazon's $180.2 billion total. Amazon's overall revenue rose 13% during Q3, which points to other business units being much stronger than online sales.

The most prominent of those units is Amazon Web Services (AWS), its cloud computing division. Cloud computing is a thriving business model, as it's benefiting from two primary tailwinds. First, many companies are shifting their on-premise computing and website hosting workloads to the cloud. This is a multi-year trend that has nothing to do with artificial intelligence and will continue for several years.

The second trend is emerging AI workloads, which need a lot of computing power to function. Many companies launching their AI products do not have access to the funds necessary to build a data center dedicated to AI training. Renting the computing capacity from a provider like AWS instead of building it allows the client to stay asset-light and easily scale their usage up or down as necessary.

AWS had its best quarter in recent memory during Q3, with revenue rising 20% year over year. The reacceleration of growth is a big deal, as its growth was lagging behind its cloud computing competition. While AWS only made up 18% of Amazon's total during Q3, it accounted for 66% of its operating income. That's a critical part of the Amazon investment thesis, as AWS delivers much higher profit margins than other segments, making it more important to the bottom line. If AWS continues to excel as it did during Q3, I'd expect Amazon's stock to deliver market-beating returns in 2026.

Another exciting segment is Amazon's advertising services. Amazon has critical advertising information that it can sell, as people come to its platform when they're looking to buy something. This is about as good an information pipeline as advertisers can hope for, which is why advertising has been Amazon's fastest-growing segment in recent quarters. In Q3, ad revenue increased by 24%. That marks a reacceleration from the beginning of this year, and bodes well heading into 2026.

The success of AWS and advertising services will drive Amazon's stock in 2026. If the results from Q3 continue into the new year, I think Amazon will be an excellent stock pick. However, there is one factor that could limit upside.

Amazon's stock isn't cheap

When a company is reasonably valued, its growth translates directly into stock performance. However, if the stock is overvalued, some of that growth can go to decreasing the stock premium versus increasing the stock price. That's a risk for Amazon's stock, as it isn't cheap.

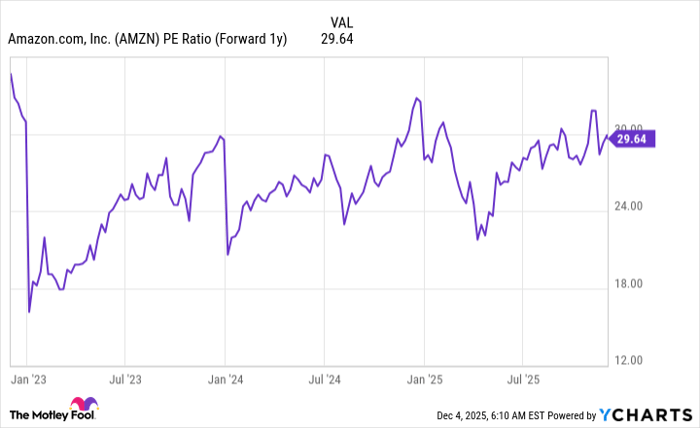

AMZN PE Ratio (Forward 1y) data by YCharts. PE = price-to-earnings.

At slightly less than 30 times next year's earnings, Amazon's stock recently was trading at a premium to its historical valuation of this metric. Still, it's not far off from the valuations of other big tech companies, like Apple and Alphabet.

If Amazon's stock underperforms again in 2026, this will be the likely culprit. However, if Amazon continues to post strong results as it did during Q3, I think it has a strong chance to slightly outperform the market in 2026, making it a stock to consider buying now.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Apple. The Motley Fool has a disclosure policy.