Should You Forget High-Yield AGNC Investment and Buy W.P. Carey Instead?

Key Points

AGNC Investment has a huge 13.7% dividend yield.

W.P. Carey's yield is a much lower 5.5%.

Although both have dividend cuts in their histories, one is a more reliable income stock.

- 10 stocks we like better than AGNC Investment Corp. ›

Dividend investors love high-yield stocks and can often get so enamored of a yield that they overlook important facts about an investment. AGNC Investment (NASDAQ: AGNC) is a good example of this: Its huge 13.7% yield is so enticing that many investors overlook the fact that it is an unreliable dividend payer.

Meanwhile, a dividend cut at W.P. Carey (NYSE: WPC) in 2023 will often leave it on the sidelines despite an attractive 5.5% yield. Here's why most long-term income investors will be better off with W.P. Carey than AGNC Investment.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What are you looking for?

If you are like most dividend investors, your goal is to use the income generated by your portfolio to help support you during retirement. What you are likely trying to find are stocks that have attractive yields backed by dividends that have an opportunity to grow over time. This approach to investing has proved attractive and successful for generations.

Image source: Getty Images.

However, there are two pieces to the equation that you must balance. How much dividend yield do you need, and how much risk are you willing to take on? The biggest risk is a dividend cut, particularly if you are using the income you generate to cover essential living expenses. This is where AGNC Investment should fall off most dividend investors' radar screens.

AGNC Investment is a mortgage real estate investment trust (mREIT). It is a fairly complex niche within the REIT sector, known for offering extremely high yields. AGNC's yield, as noted above, is a huge 13.7%.

What's backing that yield is a portfolio of mortgages that have been pooled together into bond-like securities. There are numerous moving parts involved, including housing market dynamics, mortgage repayment rates, and interest rates, among others. In some ways, AGNC is essentially managing a portfolio of mortgage-backed securities.

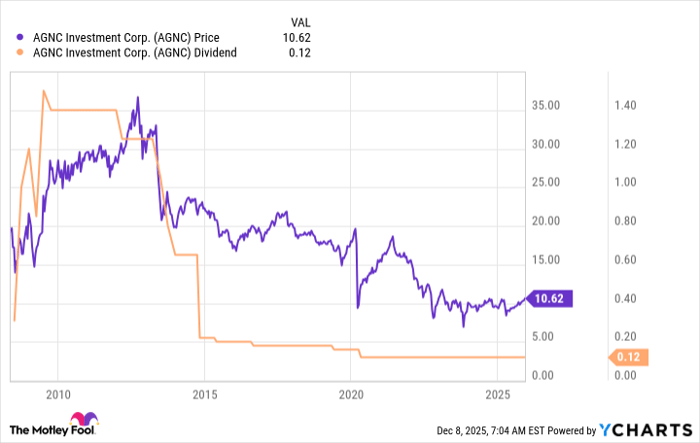

AGNC data by YCharts.

Although the yield is huge, dividend investors shouldn't get too excited. As the chart above highlights, the payout has been highly volatile over time, though in recent years it's been in one direction -- down. It isn't a bad company, per se; it just isn't a particularly reliable dividend stock if your goal is to generate a reliable income stream.

Not all dividend cuts are the same

The thing is, it is fairly normal for mortgage REITs like AGNC to cut their dividends. They also raise them at times. However, fluctuating dividends make budgeting impossible if you rely on them to cover your living expenses.

But don't overlook all REITs that have cut their dividends, with property-owning REIT W.P. Carey being a prime example of a dividend cutter you might want to buy today.

In 2023, W.P. Carey trimmed its dividend. It was just one year shy of reaching 25 years of consecutive annual dividend increases. Something terrible must have happened, right?

Not really. Management and the board of directors made a tough decision to sell a number of properties and exit the troubled office sector in a single swift move. It was a large enough change that the dividend had to be reset lower.

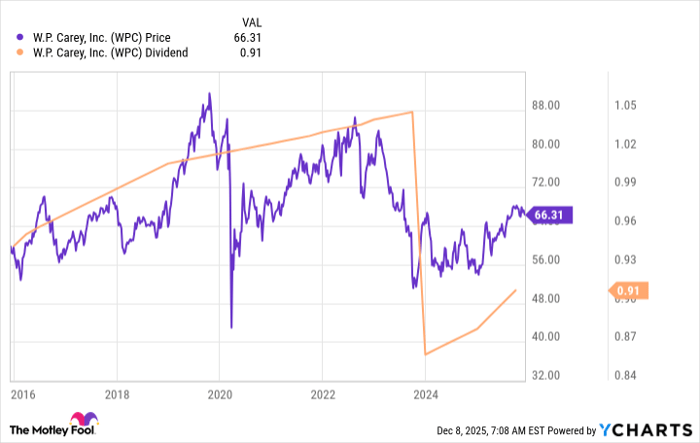

WPC data by YCharts.

This decision was made from a position of strength, as the company began to raise the dividend in the very next quarter. It has been increased every quarter since, which was the same cadence that existed before the cut.

Moreover, W.P. Carey used the proceeds from the office sale to invest in new industrial, warehouse, and retail properties. The property owning REIT's growth has actually picked up steam, as shown by management raising its full-year forecast when it announced third-quarter 2025 earnings.

Given the long history of dividend increases before the office exit and the swift return to dividend growth, W.P. Carey and its healthy 5.5% yield are actually quite attractive. Yes, you have to get over the dividend cut. But if you do, you will likely find you like what you see.

High yields are bad, and dividend cuts are good?

Don't read too far into the point being made here. Not all high-yield stocks are risky dividend investments. Nonetheless, AGNC remains an unreliable income generator that most dividend investors will likely want to avoid, given its history of dividend cuts.

However, don't just ignore an attractive business because of a dividend cut. W.P. Carey is a testament to this, with its return to dividend growth indicating that the cut was strategic, and it appears to have positioned the company well for the future.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Reuben Gregg Brewer has positions in W.P. Carey. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.