2 Top Growth Stocks to Buy and Hold for the Next 10 Years

Key Points

Netflix has a resilient business with an excellent outlook and a new acquisition that may boost its prospects.

Shopify is riding the e-commerce tailwind while inching closer than ever to consistent profitability.

- 10 stocks we like better than Netflix ›

If you had invested in either Netflix (NASDAQ: NFLX) or Shopify (NASDAQ: SHOP) a decade ago and held on, you would have earned outstanding returns. Both companies have significantly outperformed broader equities since 2015.

And here's the best news about these market leaders: They still have significant room to grow in their respective industries and boast outstanding moats that will help them, once again, deliver superior returns through 2035.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's take a closer look.

Image source: Getty Images.

1. Netflix

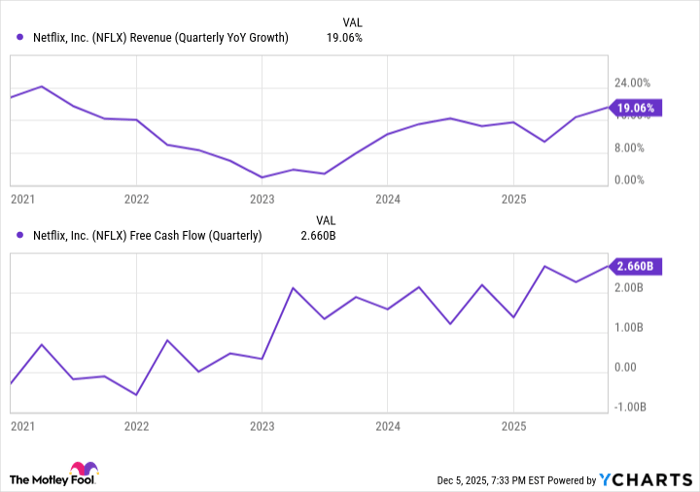

Netflix is the undisputed leader in streaming, although other companies have tried to steal its market share. In fact, due to increased competition and other factors, Netflix's revenue growth dipped significantly and was in the low single digits at some point a couple of years ago.

However, the company has bounced back from that thanks to important changes it made to its business. And amid all that, Netflix's free cash flow continued to move in the right direction.

NFLX Revenue (Quarterly YoY Growth) data by YCharts

It proved through this ordeal that it can thrive even in a highly competitive landscape. And now, Netflix has plenty of growth fuel that should still allow it to deliver superior returns through the next decade.

The company's revenue growth is still fueled partly by an increasing number of paid subscribers, a deeper ecosystem that also grants it access to even more data to pick the right content to license or create, thereby attracting even more customers -- a wonderful example of the network effect.

Netflix is also branching out into new areas, including sports. It's a niche of the streaming market currently dominated by other successful media giants. Disney-owned ESPN comes to mind. However, Netflix is slowly making moves in this space, including plans to bid on global rights to host the UEFA Champions League. If it were to win this bidding war, Netflix might be able to make significant progress in regions outside the U.S.

That's because, although the UEFA Champions League isn't nearly as popular as, say, the NFL in the U.S., it is one of the most-watched sports competitions in the world. Between this move and Netflix's decision to show Christmas Day NFL Games, the company is clearly looking to gain market share in an area where it currently lags, efforts that, over the next 10 years, could significantly boost paid subscribers, engagement, and, of course, revenue, including from ads.

This highlights an important point: Netflix has barely scratched the surface of its addressable market, which it estimated to be more than $650 billion. This dwarfs its trailing-12-month revenue of $43.3 billion. The company's recently announced acquisition of Warner Bros. Discovery for $72 billion in equity value (or a total of $82.7 billion in enterprise value) could grant Netflix even more opportunities. Netflix has plenty of growth fuel that could allow it to beat the market through 2035.

2. Shopify

Shopify has been an innovator since its early days. The e-commerce specialist now stands as one of the leaders in its niche, helping merchants set up online storefronts. Shopify makes the process easy. It offers basic, highly customizable templates that don't require any coding knowledge. And that's just the beginning.

Shopify offers a comprehensive suite of services that simplify the operations of its clients once they have established their online stores, including shipping solutions, inventory management, analytical tools, payment processing, marketing, and the ability to sell products across social media channels, among others. The interconnected nature of these offerings, along with the time, money, and effort required to set up all of them, makes it difficult for Shopify's clients to leave the platform, resulting in high switching costs.

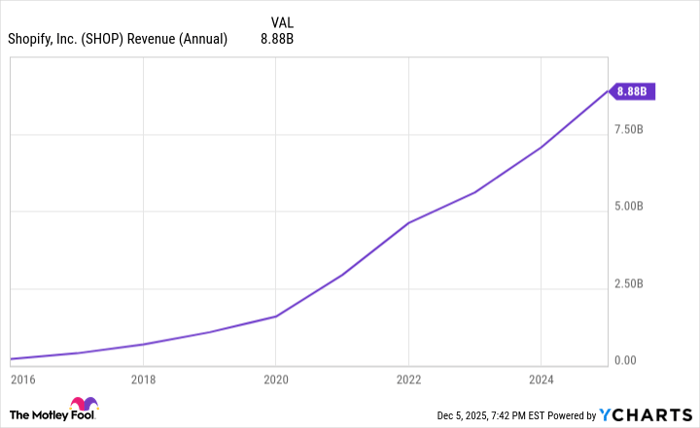

Shopify has found tremendous success. Revenue has grown -- and continues to grow -- rapidly.

SHOP Revenue (Annual) data by YCharts

The company isn't yet consistently profitable, but it has also made significant progress in that area. It got rid of its low-margin logistics business a couple of years ago and has since recorded stronger profits, margins, and free cash flow. Shopify is on a roll, and over the next 10 years, the company should ride the massive e-commerce tailwind. Online transactions still account for less than 20% of total retail transactions in the U.S.

Meanwhile, Shopify is still making moves, including an agreement with OpenAI that will enable its merchants to sell products directly on ChatGPT, potentially boosting its gross merchandise volume and revenue. In short, Shopify has excellent prospects. Those who hold on to its shares through the next decade likely will be happy they did so.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Prosper Junior Bakiny has positions in Shopify. The Motley Fool has positions in and recommends Netflix, Shopify, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.