Meet The Newest Artificial Intelligence (AI) Stock That Billionaire Stanley Druckenmiller Just Bought in His Duquesne Family Office

Key Points

Amazon stock was one of Druckenmiller's largest purchases last quarter.

The company is now benefiting from accelerating AWS growth.

Wall Street may underappreciate its recent profit-margin expansion.

- 10 stocks we like better than Amazon ›

One of the largest investments that hedge fund manager Stanley Druckenmiller made in his family office last quarter was a repurchase of Amazon (NASDAQ: AMZN) stock. Druckenmiller had been a shareholder for many years but decided to take over 2% of his portfolio and buy the "Magnificent 7" stock at some point in the third quarter, according to SEC filings.

So, what does the veteran investor see in the cloud computing and e-commerce company? Most likely, he sees an underappreciated artificial intelligence (AI) story and accelerating revenue growth. Below, I'll review the state of Amazon after reporting its third-quarter earnings, and why the stock might be a buy for investors today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Amazon's cloud momentum

Compared to competitors Microsoft Azure and Alphabet's Google Cloud, Amazon has been considered a laggard in AI with Amazon Web Services (AWS), its cloud computing division. AWS is larger than these competitors but growing slightly slower, which has put out a narrative of fear around the leader in cloud infrastructure losing market share because it's falling behind in AI capabilities.

Last quarter, AWS showed some momentum with reaccelerating cloud revenue growth. Its revenue grew 20% year over year in the period to $33 billion, driven by its relationship with AI upstart Anthropic, which utilizes AWS for its intensive cloud computing needs.

The AWS client is growing revenue at an insane pace, with its $1 billion in annual recurring revenue (ARR) at the start of this year projected to reach $9 billion soon and $70 billion by 2028. Even so, Amazon is losing money today because of infrastructure spending in areas like AWS.

The company's 20% revenue growth is an acceleration from 17.5% revenue growth in the prior quarter and likely a welcome sigh of relief for Amazon investors. Expect strong AWS revenue growth to continue as long as Anthropic and other AI start-ups keep posting huge revenue growth.

Image source: Getty Images.

Investors keep underplaying e-commerce momentum

Even though investors are focused on AI above all else right now, Amazon still has a rock-solid e-commerce business that keeps producing steady revenue growth year after year. Last quarter, Amazon's North America revenue grew 11% year over year to $106 billion, with international up 10% in constant currency to $40 billion.

The company keeps pushing the limit on fast and convenient delivery, with new initiatives, such as rapid grocery delivery, robotic warehouses, and generative AI tools for both shoppers and merchants selling on Amazon.

There are also projects entirely outside of e-commerce, such as autonomous driving division Zoox, Alexa smart computing devices, and Project Kuiper for satellite internet. All three of these projects are likely burning cash and generating insignificant revenue today but have a lot of long-term potential for patient shareholders.

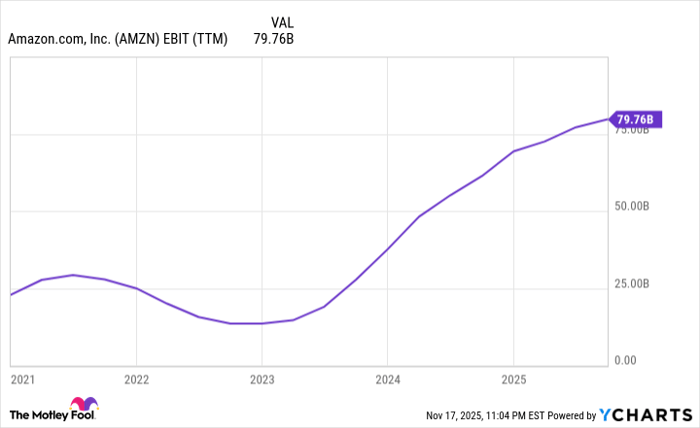

AMZN Earnings Before Interest and Taxes (EBIT) (TTM) data by YCharts.

Why Amazon stock is a buy today

Amazon is poised to keep generating steady revenue growth unless a huge macroeconomic headwind arrives for consumer spending. It will benefit from AI and has lots of innovative projects being worked on today that will bear fruit in the decade ahead. So, why is the stock cheap?

Above all else, it's because of Amazon's margin-expansion story. The company admittedly hired too many people in 2020 through 2022, which led to profit-margin compression as it over extrapolated growth from the pandemic e-commerce and cloud computing boom. Now, it's beginning to thin its ranks with consistent layoffs, leading to a more efficient business that's ready to experience huge levels of operating leverage.

Last quarter, Amazon's stated operating margin was under 10%, which was actually down from the third quarter a year ago. However, this was due to one-time charges of fines and layoffs. Excluding these expenses, Amazon's third-quarter profit margin was a record 12%.

This margin expansion should continue as layoff costs roll off the income statement and the company keeps growing its revenue in both cloud computing and retail. Over the last 12 months, Amazon generated EBIT of just under $80 billion. More margin expansion and steady revenue growth should help EBIT grow significantly over the next few years, making Amazon stock an easy buy for an investor's portfolio today.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,342!*

Now, it’s worth noting Stock Advisor’s total average return is 1,013% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.