The Master's Playbook: How Institutional Investors View the U.S. Tech Giants and Market Outlook at Present

TradingKey - This week, with tech giant Nvidia Corp. releasing its Q3 2025 earnings, the reporting season for the US stock market's 'Magnificent Seven' has officially concluded. Simultaneously, global markets are intensely debating whether US AI technology is over-invested, with investors presenting increasing evidence analyzing the current high valuations of US stocks and the phenomenon of tech giants forming alliances and creating an investment closed-loop around AI.

However, from a sentiment perspective, compared to the dot-com bubble of 2000 or the 'Nifty Fifty' era, the current market appears more "rational." One explanation suggests that investors have become more cautious and astute due to painful lessons learned from the past. Yet, as Hegel once famously remarked, "The only thing we learn from history is that we learn nothing from history."

This implies that we are still some distance from a true AI bubble burst and a US stock market collapse.When a crisis genuinely looms, most investors tend to become even more optimistic. Conveniently, Nvidia, a crucial component in the AI investment closed-loop, just reported earnings that seem to once again affirm "all is well." Its Q3 revenue and gross margin once again surpassed expectations, coupled with optimistic guidance for the next quarter, allowing the market to breathe a collective sigh of relief.

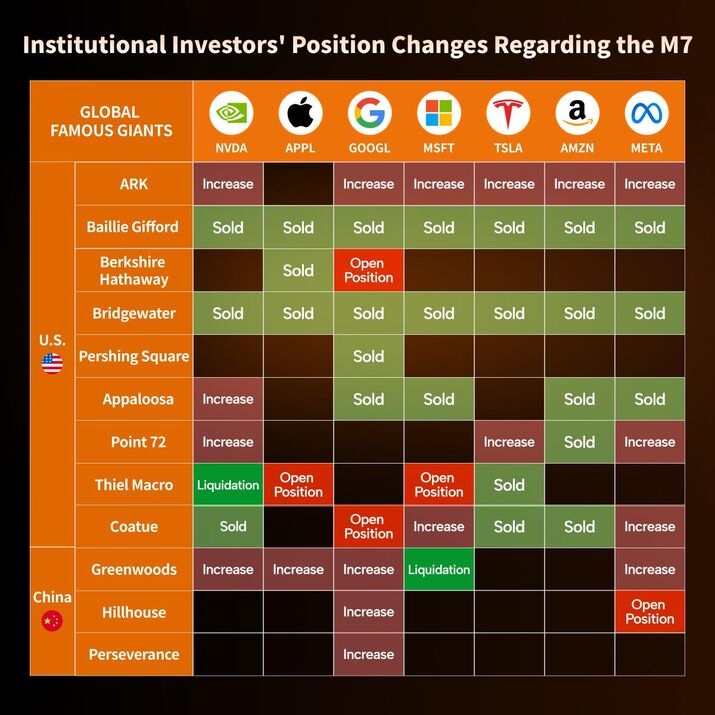

So, beyond retail investors, how do the world's top investment institutions truly view the current US tech Magnificent Seven? Portfolio allocations reflect conviction; therefore, we have analyzed the latest quarterly 13F filings to help demystify the situation and understand the underlying truths.

Perspectives on Divergence Among Star Investors

Data Sources: Reuters, TradingKey As of: November 20, 2025

Evidently, unlike the similar trend changes observed in Q2, global professional investors this quarter displayed significant contention and divergence regarding AI investments, specifically within the Magnificent Seven. Firstly, among foreign investors, Cathie Wood's ARK Invest, a prominent tech enthusiast, increased its holdings in six of the seven tech companies (excluding Apple) to varying degrees.

Conversely, Peter Thiel and Coatue, also leading tech stock investors, adjusted and reallocated their positions within the Magnificent Seven. Thiel initiated new long positions in Apple and Microsoft, while completely liquidating his Nvidia stake. Coatue, meanwhile, opened a new position in Google, simultaneously reducing exposure to Amazon, Tesla, and Nvidia. Point72, the rapidly growing hedge fund, also made significant portfolio shifts, increasing positions in Nvidia, Microsoft, and Meta (Facebook), while trimming its Amazon holdings.

Bridgewater Associates, following Ray Dalio's stepping down, and Baillie Gifford explicitly expressed concerns about the high valuations of tech stocks. They have collectively begun to retreat from the tech stock frenzy, not just from Nvidia, but by broadly reducing their holdings across the entire US tech Magnificent Seven. Furthermore, David Tepper, renowned as Wall Street's "king of bottom-fishing," also ceased his opportunistic buying and instead began to partially take profits. His firm, Appaloosa, reduced its exposure to four tech stocks, while increasing its Nvidia position.

Finally, it's worth noting that Warren Buffett's Berkshire Hathaway, which just announced his retirement, continued to pare down its Apple holdings but, for the first time in its history, acquired Google shares. This move is reasonably speculated to be an initiative by the newly appointed head of the firm.

On the Chinese institutional side, Greenwoods Asset Management (景林) and Gaoling Fund (高领) appeared relatively optimistic. The former increased holdings in four tech stocks but exited Microsoft, while the latter initiated a new position in Meta and added to its Google stake.

In summary, the conviction among global investment masters regarding US tech giants is beginning to diverge. The tech rivalry between the US and China is set to continue, but the competition for capital among American tech giants has intensified, even as they increasingly form alliances and seek to strengthen their interconnectedness through various collaboration models. This presents a double-edged sword: tighter business ties may help weaker players weather challenges before a crisis, yet once a crisis hits, a stampede could ensue, escalating casualties exponentially.

An online chart vividly illustrates this situation, showing how most global stock markets have consistently reached new highs in recent years. Prominent performers like Japan and South Korea have directly benefited from the influence of US tech stocks, particularly Nvidia. Fortunately, Nvidia delivered a satisfactory report this quarter, alleviating short-term market concerns.

Data Sources: Reuters, TradingKey As of: November 20, 2025

Two Scenarios for U.S. Stocks

Finally, I would like to share my thoughts on the future trajectory of the overall U.S. stock market. The recent adjustments in U.S. stocks appear to stem from investors reflecting on the excessive short-term investments in AI and engaging in profit-taking actions. However, underlying this is a growing concern over liquidity, spurred by government shutdown possibilities and the anticipated pause in rate cuts in December. The Federal Reserve currently faces two potential scenarios:

Scenario 1: If the Fed refrains from cutting interest rates to maintain its policy independence, this would indicate a willingness to sacrifice near-term performance in the stock market to support the dollar and U.S. treasury bonds.

Scenario 2: Should the Fed signal a willingness to accommodate an interest rate cut in December, it would suggest that Powell favors sacrificing the dollar and treasury bonds while continuing to inflate the stock market, likely leading the U.S. economy into a state of stagflation with widening wealth disparity.

Short-term market feedback seems to favor Scenario One. The U.S. dollar index has reversed its previous downturn and is currently strengthening, poised to break through established resistance levels. However, I believe that the U.S. will likely opt for Scenario Two. The rationale is as follows:

- American household wealth is deeply intertwined with US stock prices, particularly those of tech giants. If the bubble is allowed to burst in an uncontrolled manner, the economy will inevitably enter a recession, with consequences that are difficult to manage.

- The Federal Reserve currently retains ample policy tools, and the US economy remains relatively healthy. Furthermore, the upcoming change in Fed leadership and the impact of next year's mid-term elections will likely strengthen expectations for the administration to maintain an accommodative environment and pressure the Fed to cut rates.

- After the recent meeting between U.S. and Chinese leaders, both nations have entered a deeper phase of technological and economic competition, with technology and AI at the core. Deliberately puncturing the stock market bubble would essentially signify an admission of premature surrender.

Therefore, I personally believe that Scenario Two is the more likely outcome, foreseeing continued horizontal fluctuations in U.S. stocks at elevated levels. However, as mentioned, the market will experience pronounced fragmentation, especially among tech giants.

On one hand, these companies will accelerate their collaborations, but on the other, heightened competition will arise due to the homogeneity of many services they offer, such as cloud services, large models, and advertising revenues. The market's capital will no longer tolerate faltering companies or tech enterprises that incur massive capital expenditures without profitability (as evidenced by a surge in short-selling and selling pressure on underperforming tech stocks). Instead, capital will increasingly gravitate towards industry leaders with more optimistic fundamentals and profitability outlooks. Ultimately, I expect a significant decline in the earning potential of U.S. stocks over the next year, while volatility will sharply increase.

Data Sources: Reuters, TradingKey As of: November 20, 2025