If You'd Invested $10,000 in Palantir Stock 5 Years Ago, Here's How Much You'd Have Today

Key Points

Palantir's share price has been under pressure of late, but the market seems to be ignoring the company's rapidly improving prospects.

The company delivered a triple-digit percentage jump in earnings last quarter, and it could sustain that impressive momentum.

Palantir stock is trading at a rich valuation.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) has been one of the hottest stocks on the market over the past five years. The software specialist, which initially made its name by selling software and analytics solutions to U.S. intelligence agencies and the military, is now experiencing a remarkable upturn in its fortunes, thanks to the booming demand for artificial intelligence (AI) software.

An investment of $10,000 in shares of Palantir five years ago would now be worth just over $93,000, with an average annual return rate of 56.4%. However, the stock has experienced its share of volatility during that time, enduring a period of slowing growth in 2022 and 2023 before stepping on the gas once again in 2024.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The good part is that Palantir's AI-driven growth continues to accelerate. However, will the drivers of the business be sufficient to enable the stock to replicate its remarkable performance over the next five years?

Image source: Getty Images

On course to become a much bigger company

In 2020, Palantir's revenue rose 47% to $1.1 billion. For 2025, its revenue forecast stands at almost $4.4 billion, which would be a jump of nearly 54% over last year. So, Palantir's revenue has grown by almost four times in just five years, for a compound annual growth rate of almost 32%.

However, as the company's 2025 revenue guidance indicates, it is now growing at a significantly faster pace than previously. That's a result of the fast-growing adoption of its Artificial Intelligence Platform (AIP), which it launched in April 2023. This platform has turned out to be a major success for the company, as it allows customers to integrate generative AI into their operations.

Palantir customers can utilize AIP for building, customizing, and managing AI applications tailored to their specific business needs. The good part is that its customers are witnessing improvements in productivity, reductions in redundancy, and higher efficiency by integrating generative AI. As a result, customers who initially adopt AIP usually go on to deploy this platform to more areas of their operations. This enterprise-wide adoption of AIP is helping Palantir score bigger and longer contracts.

So, it was not surprising to see Palantir land $2.8 billion worth of contracts in the third quarter, a jump of 151% from the prior-year quarter. This was higher than its 63% year-over-year increase in revenue to $1.18 billion. Palantir, clearly, is now adding more business to its backlog than it is able to immediately fulfill. This is the reason why the company's revenue pipeline now stands at a whopping $8.6 billion, almost double what it was a year ago.

For comparison, Palantir's remaining performance obligations (RPO) stood at $597 million at the end of 2020, which was lower than the annual revenue generated by the company that year. The size of Palantir's revenue pipeline as of the end of Q3 was well above the revenue that analysts expect it to generate in 2026.

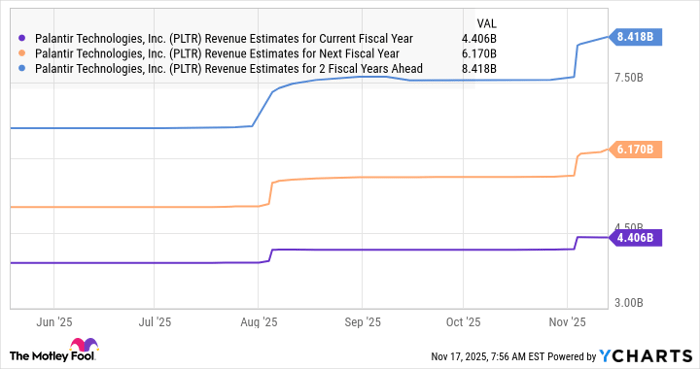

PLTR Revenue Estimates for Current Fiscal Year data by YCharts.

The chart above also indicates that analysts have become increasingly bullish about Palantir's growth prospects. However, the more important thing to note here is that Palantir's earnings are growing at a much faster pace than its revenue. The company's non-GAAP earnings per share increased to $0.21 per share in Q3 from $0.10 per share a year earlier.

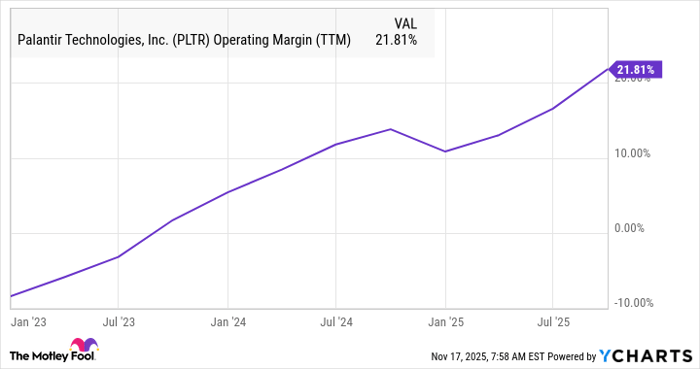

This triple-digit percentage earnings growth last quarter is the result of massive improvements in Palantir's margins.

PLTR Operating Margin (TTM) data by YCharts.

The chart above also tells us that Palantir's operating margin has improved significantly since the end of 2023, after the launch of AIP. This can be attributed to the increased adoption of Palantir's AIP by customers who are signing bigger contracts with the company. Additionally, the new customers that Palantir is attracting should pave the way for improvements in its earnings power, as they, too, could purchase more of its offerings, thereby leading to further margin improvements.

As a result, Palantir's earnings could grow at a faster rate than analysts are expecting.

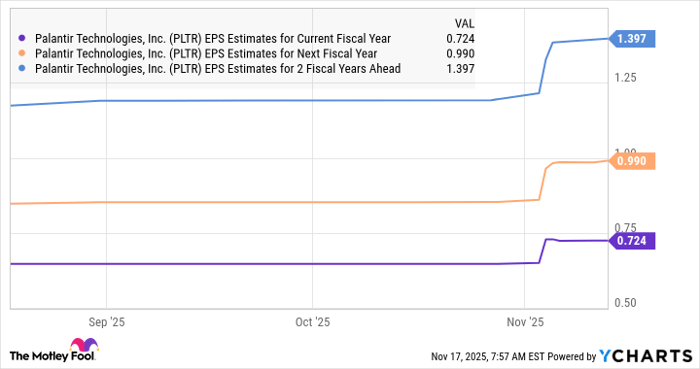

PLTR EPS Estimates for Current Fiscal Year data by YCharts.

The upside outlook

Palantir's earnings are expected to increase by 76% in 2025. Even though analysts are forecasting a slight slowdown from there, it is still expected to clock healthy levels of bottom-line growth. But then, don't be surprised to see Palantir's earnings growth come in much hotter than Wall Street's expectations.

That's because the AI software platforms market is expected to grow fivefold over the next five years, to over $94 billion. That would translate into an annual growth rate of almost 39%. Palantir is growing at a much faster pace than that, indicating that it is on track to capture a sizable chunk of its addressable opportunity.

As a result, there is a good chance of the company sustaining robust earnings growth over the next five years. Assuming it can grow its earnings at an annualized pace of 50% through 2030, its bottom line could jump to $5.47 per share (using 2025's estimated earnings of $0.72 per share as the base). Palantir is trading at a very expensive 172 times forward earnings right now. The U.S. technology sector's average price-to-earnings ratio is just 48.5.

Assuming Palantir trades in line with the broader index over the next five years, its stock price, based on the assumptions above, would then be about $265. That would be a gain of 58%. So, this AI stock has the potential to deliver more gains, although investors who purchase it now will have to pay a significant premium.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,786!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,832!*

Now, it’s worth noting Stock Advisor’s total average return is 1,021% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.