The Best Energy Stock to Hold in Uncertain Times

Key Points

Diamondback Energy is a low-cost U.S. oil producer with limited geopolitical risk.

The company offers a stable dividend and strong free cash flow potential.

The downside risk appears to be limited unless oil prices drop significantly.

- 10 stocks we like better than Diamondback Energy ›

Oil prices have always been unpredictable, so anyone investing in oil and gas stocks must consider the associated risks. Much of the world's oil comes from politically unstable regions, which adds to the uncertainty.

Given these factors, Diamondback Energy (NASDAQ: FANG) stands out as a strong investment option. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

A dividend-paying energy stock to buy

Diamondback Energy has less downside risk than many other oil companies, and there's a real chance its stock price could increase with a higher oil price. The main reason is that Diamondback produces oil at a lower cost in the U.S., mainly in the Permian Basin. This means it avoids the geopolitical risks that affect many other producers. In fact, if global oil supplies are threatened, oil prices could rise, which would help Diamondback.

Management states that the company's base dividend and break-even oil price are both $37 per barrel. This break-even price is what's needed to maintain steady oil production year over year and pay the $4 annual dividend per share, which currently yields 2.7%.

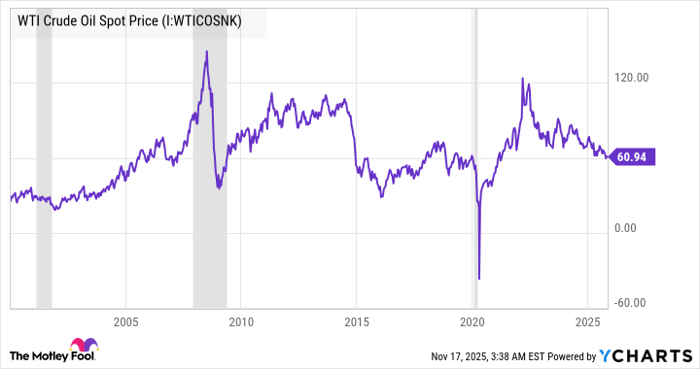

Unless there's another major event like the COVID-19 pandemic, it would probably take a severe recession for oil prices to fall back to $37 a barrel. Additionally, rising costs have increased the break-even price for oil producers worldwide.

WTI Crude Oil Spot Price data by YCharts

Diamondback's relatively low cost of production and reinvestment rate means management believes it can generate 12.9% of its current market capitalization in free cash flow (FCF) at a $50-per-barrel oil price in 2025. With the current price just shy of $60 per barrel and management committed to returning 50% of FCF to stockholders, there's a range of scenarios from $37 per barrel to $50 per barrel on the downside, and plenty of upside potential should oil start rising again.

Should you invest $1,000 in Diamondback Energy right now?

Before you buy stock in Diamondback Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Diamondback Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,786!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,832!*

Now, it’s worth noting Stock Advisor’s total average return is 1,021% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.