Prediction: XRP Will Be Worth More Than TRON in 2030

Key Points

XRP and Tron both have the ability to process higher transaction volumes at lower costs compared to legacy financial infrastructure solutions.

Tron is primarily used by retail customers and has reportedly been a platform riddled with financial shenanigans.

XRP targets large financial institutions, which lend a higher level of credibility than the Tron network enjoys.

- 10 stocks we like better than XRP ›

In discussions of leading blockchain platforms, two names that often emerge are XRP (CRYPTO: XRP) and Tron (CRYPTO: TRX).

XRP boasts a market capitalization of $133 billion. This is nearly five times Tron's market value of about $27 billion, handily making it the more valuable cryptocurrency.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Below, I'll explore the primary applications that Tron and XRP focus on in the world of decentralized finance (DeFi). From there, I'll make the case for why I believe XRP is well-positioned to remain a more valuable digital asset than its competitors.

Image source: Getty Images.

What is Tron, and what is it used for?

Similar to Ethereum, Tron's ecosystem supports smart contracts and users' ability to send cryptocurrency tokens to one another. And like XRP, Tron can process thousands of transactions per second at a fraction of a cent.

The combination of speed and cost-efficiency over legacy financial services infrastructure makes Tron a suitable option for peer-to-peer payments in the digital era.

Where I begin to see some risk with Tron is in the underlying details of its user activity. According to data from Elliptic, Tron's network has been heavily utilized by countries such as Russia and North Korea. Moreover, TRM Labs reported that of the $45 billion in suspicious or illicit crypto volume in 2024, nearly 60% occurred on Tron.

Against this backdrop, it appears that Tron has become a playground for fraud and scams -- serving as a mechanism to fuel activity, including money laundering schemes, and acting as a decentralized vessel for gambling payments and similar applications.

XRP has more brand recognition than Tron

Indeed, XRP does not exactly have a squeaky-clean reputation of its own. Ripple -- the company that issues XRP -- was at the center of a lawsuit with the Securities and Exchange Commission (SEC) for several years.

However, Ripple's recent legal victories over the SEC suggest the company and its underlying technology, including the XRP ledger, achieved some level of acceptance and cooperation in the regulatory environment.

With that in mind, I think Ripple's target customer demographic -- primarily large financial institutions -- may be more willing to adopt, or at the very least explore and test, the company's services.

Some of Ripple's more notable customers include American Express, Bank of America, Western Union, and the Saudi Central Bank.

Why XRP will remain more valuable than Tron

In my opinion, the primary difference between the two blockchains explored here is that Tron is a platform primarily used for stablecoin transfers among retail users. In other words, Tron's network continues to process high transaction volumes, but its user base lacks the same level of sophistication or mission-critical needs as those of a traditional bank or large corporation.

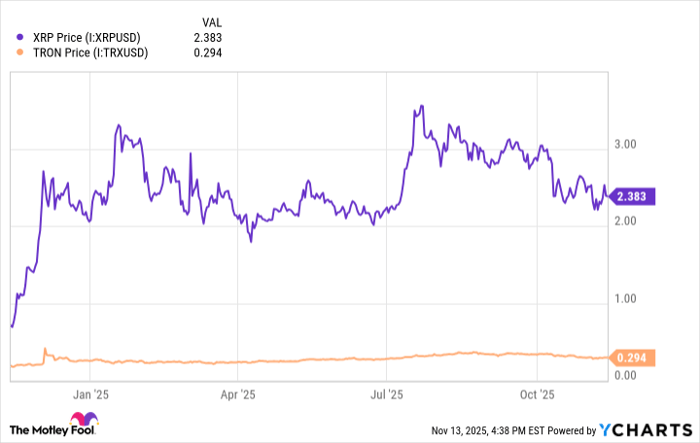

XRP Price data by YCharts

By contrast, XRP is purpose-built to facilitate cross-border transactions for complex global financial institutions at global scale.

Moreover, I think XRP's compliance with the SEC could go a long way toward improving its image and ultimately inspire accelerated adoption and integration among banks and large-scale payment processors down the road.

While XRP and Tron carry similar value propositions, I believe that Tron's affiliation in geographic jurisdictions where regulatory oversight and security protocols may be less developed, as well as its exposure to less transparent use cases, will put pressure on its ability to experience notable valuation appreciation in the future.

For this reason, I'm more bullish about XRP's future trajectory compared to its seemingly compromised peer. With these dynamics in mind, I believe XRP will remain a more valuable cryptocurrency than Tron for years to come.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

American Express is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Ethereum and XRP. The Motley Fool has a disclosure policy.