This Fintech Stock Had an Incredible 2025. Can Its Run Continue Into 2026?

Key Points

SoFi Technologies boasts prolific growth and over 12.6 million members.

The company has additional growth opportunities from cross-selling products and a recovering student loan segment.

But the stock's 2025 rally has lifted its valuation, leaving less room for stellar returns next year.

- 10 stocks we like better than SoFi Technologies ›

It took Wall Street a while to embrace SoFi Technologies (NASDAQ: SOFI).

Perhaps it was the fact that the digital bank and fintech company went public via a SPAC merger in 2021, at the height of a stock market bubble. Once the air let out, many SPAC stocks lost their shine as investors fled speculative names.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Despite the stock's slump, SoFi Technologies continued to grow. This year, investors have acknowledged the company's success. Shares have soared by 80% since January.

Can SoFi Technologies stock sustain its momentum into next year? Here is what you need to know.

Image source: Getty Images.

SoFi's strong business performance has fueled the stock's dramatic rise

There is no denying SoFi's popularity among U.S. consumers. The company's user base has rapidly expanded, growing from just over a million members in early 2020 to over 12.6 million as of the third quarter of this year. Considering users grew by 35% year over year in Q3, there is still clear ongoing momentum.

SoFi is a digital bank, meaning it has no physical branches. Instead, users bank on the company's website or smartphone app. SoFi has created a one-stop shop, an ecosystem where users can easily access other products and services. Roughly 40% of SoFi's product growth in Q3 came from existing members, making SoFi more profitable, as existing customers don't cost as much to acquire as new ones.

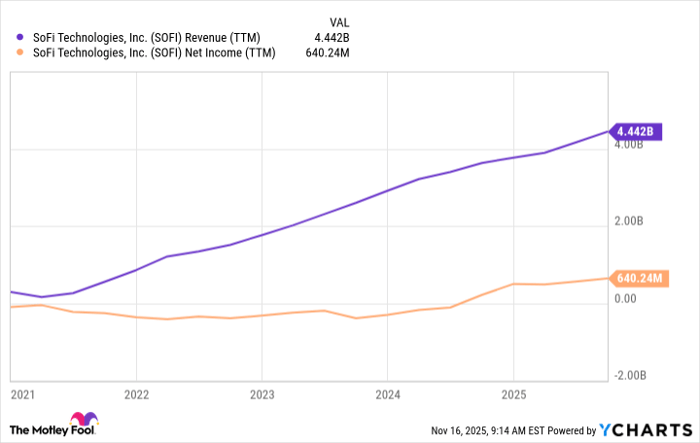

The company's revenue and profits have surged along with its user growth, making SoFi one of the world's fastest-growing fintech companies.

SOFI Revenue (TTM) data by YCharts

Room to grow for SoFi's student loan business

The most impressive part of SoFi's journey is that its success in recent years has come with little contribution from its student loan business, which was actually the most significant part of its business before the student loan freeze put in place during the COVID-19 pandemic. SoFi built its reputation in the student loan business.

That freeze lasted years, and though the Trump Administration has resumed interest accumulation on Federal student loans impacted by the Biden Administration's SAVE Plan, the entire student loan industry remains quite messy. Collectively, about 42.5 million Americans have $1.8 trillion in student loan debt.

SoFi had nearly $6.7 billion in student loan originations in 2019. It has originated $3.7 billion in student loans over the first three quarters of 2025, putting it on pace for far less than when SoFi was a much smaller business than it is now.

Barring a dramatic regulatory overhaul, such as mass loan forgiveness, which seems unlikely given how divisive the idea is, there's a good chance more borrowers will seek out SoFi and other private lenders as the government continues to push borrowers back into repayment schedules.

Student loan originations rose 58% year over year in the third quarter, and investors could see that growth continue for a while.

Why the stock may struggle to repeat its performance next year

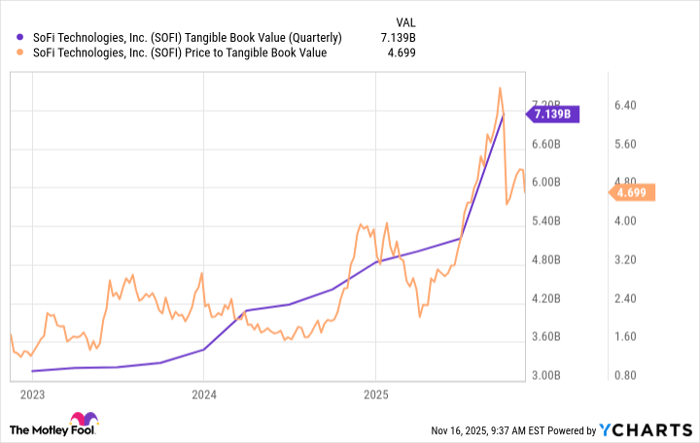

For a bank such as SoFi, investors want to see the company's tangible book value (TBV) increase over time. SoFi has done precisely that; its tangible book value has surged to over $7.1 billion, up significantly from just a year ago and more than double its TBV from two years prior.

SoFi now anticipates its tangible book value increasing by $2.5 billion in 2025, up from its prior guidance for $640 million. It's a notable and impressive change from just three months ago and pegs its year-end TBV at just under $7.2 billion, a 47% increase from last year.

SOFI Tangible Book Value (Quarterly) data by YCharts

That said, the stock has gotten more expensive over the past year because the share price is up more than SoFi's book value. It now trades at a price-to-TBV ratio of almost 4.7, a hefty premium to most banks, even if deservedly so given how fast SoFi is growing.

Thinking ahead to 2026, SoFi's investment upside likely depends on the company sustaining, or even improving, on that growth. Sure, a stock's valuation can keep rising, but SoFi is expensive enough now that it seems doubtful there's enough room for it to easily match its 2025 gains again next year without clearing what is now a pretty high bar.

That could be tough against a worsening economic backdrop. Remember, banks are susceptible to recessions, so any economic hardship will likely weigh on SoFi and other bank stocks.

SoFi has been growing fast and long enough to prove itself a rising superstar in the financial industry. That makes the stock a good buy-and-hold candidate. But after such a strong outing in 2025, investors may want to temper their expectations for 2026.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.