Fed's Cook: Bond markets were 'orderly' in April, but seeing rising stress in households

Federal Reserve (Fed) Board of Governors member Dr. Lisa Cook noted on Friday during a hosted event at New York University that while US economic factors were strong during the first quarter, Fed policymakers are beginning to see signs of stress in key industries, namely housing and commercial real estate.

Dr. Cook also highlighted that Treasury markets were orderly and functional during April's trade-related volatility, but stopped short of saying that bond market functionality may begin to suffer at the hands of inconsistent policy management from the White House.

Key Cook highlights

According to Dr. Cook, a "sufficiently large income shock could push up defaults, lead to losses for lenders." Fed BoG member Dr. Cook avoided outright stating what a large income shock might look like, but lately, Fedspeak has been notably tilted toward inflationary and downside employment pressures from lopsided trade policies from the Trump administration.

Dr. Cook admitted that she is "watching commercial real estate closely," and acknowledged that she is also beginning to see signs of balance sheet stress among low-to-moderate income households.

Market reaction

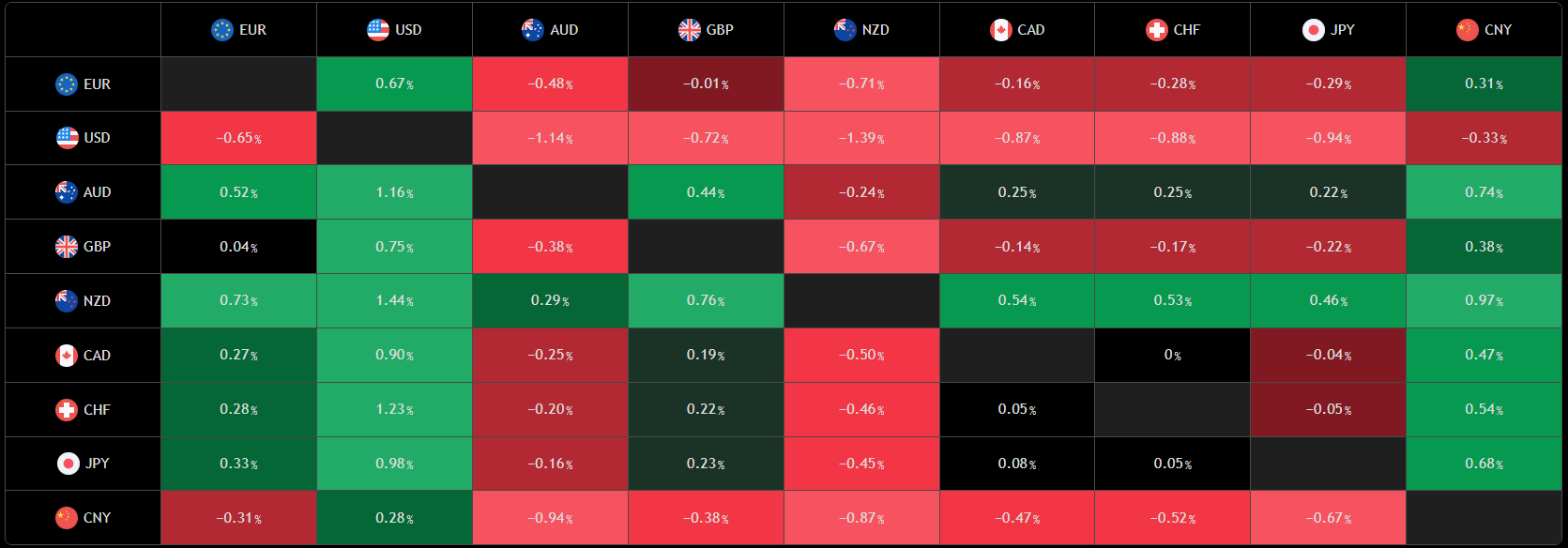

The Fed's Dr. Cook didn't reveal much that wasn't already known to investors, and market-wide positioning remains largely unchanged on the day as US investors gear up for a long weekend. The US Dollar Index (DXY) is sharply lower on Friday, down near 99.20 as of writing. The Greenback is down across the board heading into the weekend, floundering against the Euro (EUR), the Pound Sterling (GBP), and the Canadian Dollar(CAD), with steep losses stacked up in the Antipodeans, the Australian Dollar (AUD) and the New Zealand Kiwi (NZD).

(TradingView forex heatmap, 1D timeframe)