Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

- Bitcoin price stabilizes above $94,000 on Monday, following a 10% rally the previous week.

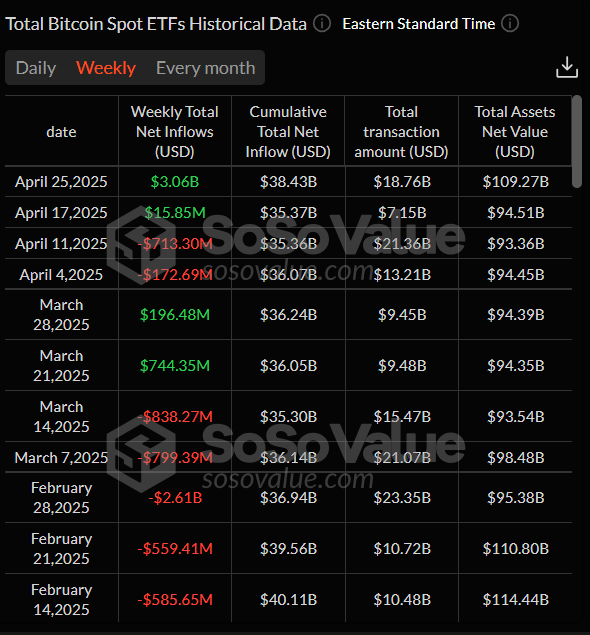

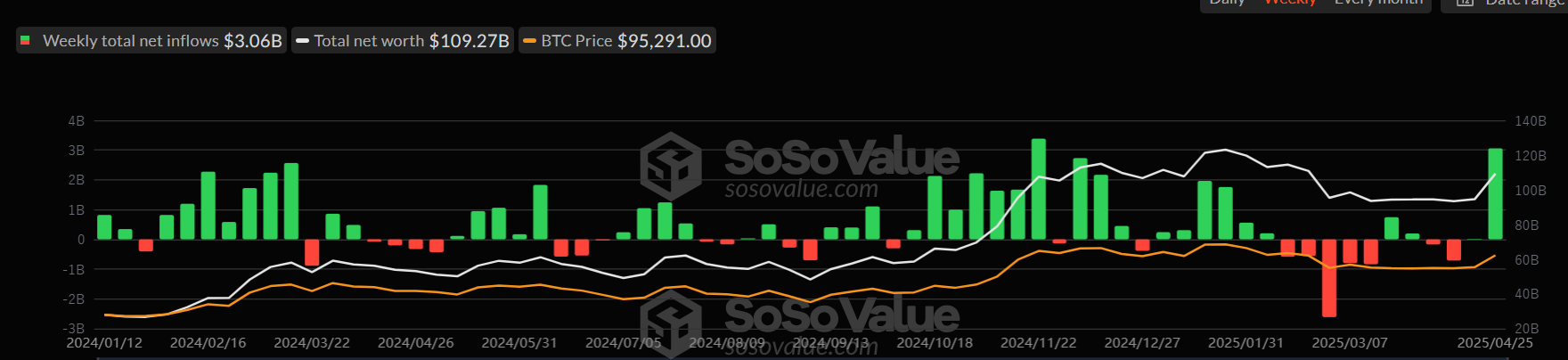

- US Bitcoin spot ETFs recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

- The technical outlook suggests a successful breakout above $95,000 could rally toward $97,000.

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November. The technical outlook suggests that a successful breakout above $95,000 could lead to a rally toward $97,000.

Bitcoin inflows have reached levels since the US Presidential election

Institutional demand strengthened last week. According to the SoSoValue data, the US spot Bitcoin ETFs recorded a net inflow of $3.06 million last week after an inflow of $15.85 million the previous one. Last week’s inflow record reached levels seen during the US Presidential election in November, where BTC price soared above $100,000 for the first time. If the demand from institutional investors continues and intensifies, Bitcoin could see a similar price rally.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

QCP Capital’s report on Monday highlights that BTC’s rally appears to be fundamentally healthier compared to previous cycles.

The report explains that, rather than speculative leverage, this recovery is being driven by increased adoption of Traditional Finance (TradFi). Perpetual funding rates have remained flat to slightly negative, while spot BTC ETFs have recorded six consecutive days of net inflows.

Arizona could be the first state to hold BTC as reserve

According to Bitcoin Laws posts on X, Arizona’s two Bitcoin Reserve Bills are now scheduled for Monday for a third reading and a potential final vote. The two bills are SB1373 and SB1025, which aim to make the state the first in the US to hold Bitcoin in its treasury. SB1373 focuses on a digital assets strategic reserve fund, while SB1025 addresses public monies and virtual currency investment.

The outcome of Monday’s House debate will be a critical next step in determining whether Arizona will become the first US state to hold Bitcoin as a reserve asset, which could set a precedent for other states, such as New Hampshire and Texas, also listed in the State Reserve Race.

Bitcoin Price Forecast: BTC bulls could target $97,000 if it closes above the $95,000 resistance

Bitcoin price broke above its 200-day Exponential Moving Average (EMA) at $85,000 early last week, rallying 11.14% until Friday. However, BTC failed to close above its March high of $95,000 and declined slightly over the weekend. At the time of writing on Monday, BTC approaches its key resistance level at $95,000.

If BTC breaks and closes above $95,000 on a daily basis, it could extend the rally to retest its next daily resistance at $97,000.

The Relative Strength Index (RSI) on the daily chart holds at 67 after being rejected around its overbought level of 70 on Saturday, indicating fading bullish momentum. However, given the current market sentiment and increasing institutional demand, this may be a pause or consolidation before the next leg higher.

BTC/USDT daily chart

However, if BTC fails to close above the $95,000 resistance level and faces a pullback, it could extend the decline to find support around the $90,000 psychological importance level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.