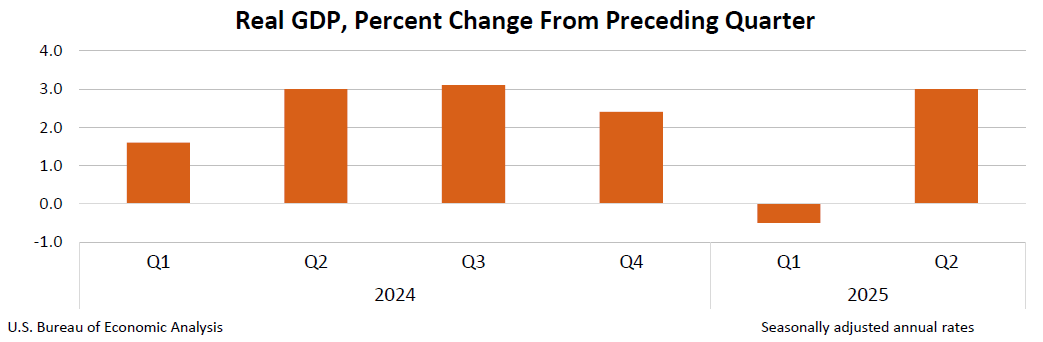

U.S. economy posts 3% bounce in annualized Q2 GDP growth

The U.S. economy grew at a 3.0% annualized rate from April to June 2025, according to the Bureau of Economic Analysis.

That follows a 0.5% drop in GDP in Q1, putting a hard stop to the previous quarter’s contraction, as lower imports and stronger consumer spending pulled the real GDP back into positive territory.

The rebound wasn’t across the board, though. While Americans spent more at home and bought fewer foreign goods, which both helped GDP rise, the economy also saw drops in investment and exports during the same quarter. But those losses weren’t enough to drag the whole figure down.

In simple terms, people spent more, bought less from overseas, and that combo pushed the headline number back into the green.

U.S. imports fall, consumer spending climbs, but investment dips

Compared to Q1, the biggest swing came from the decline in imports, which are counted as a negative in GDP math. That drop, paired with faster consumer spending, delivered the turnaround. Meanwhile, investment spending fell, meaning businesses didn’t pour as much money into buildings, machinery, or other long-term plans as they had in the past. Exports also slowed down.

Another piece of the puzzle is real final sales to private domestic purchasers, which is a cleaner look at demand from American households and companies. That number rose 1.2% in Q2, down from 1.9% in Q1, showing the growth came more from shifts in trade than from a big surge in private demand.

Prices cooled off too. The price index for gross domestic purchases rose 1.9%, well below the 3.4% increase in Q1. The personal consumption expenditures (PCE) price index, used by the Fed to track inflation, went up 2.1%, a drop from 3.7% the previous quarter. Taking out food and energy, the core PCE rose 2.5%, compared to 3.5% before.

Private hiring rebounds in July as ADP beats forecasts

While GDP rebounded in Q2, the job market gave its own update in July. A report from ADP showed private payrolls rose by 104,000 during the month. That beat expectations from economists surveyed by Dow Jones, who had predicted 64,000 new jobs. June’s numbers, initially reported as a 33,000 job loss, were revised to a 23,000 decline.

Nela Richardson, chief economist at ADP, said, “Our hiring and pay data are broadly indicative of a healthy economy. Employers have grown more optimistic that consumers, the backbone of the economy, will remain resilient.” That optimism showed up strongest in the leisure and hospitality sector, which added 46,000 jobs in July.

Financial activities gained 28,000 positions, while trade, transportation and utilities added 18,000, and construction picked up 15,000. Mid-sized and large firms each brought in 46,000 jobs, but small businesses, those with fewer than 50 employees, only added 12,000.

Not every sector was hiring. Education and health services saw a net loss of 38,000 jobs, making it the only major category to pull job growth down.

Wages also rose, growing at an annual pace of 4.4%, which lines up with the trend seen in recent months.

The ADP report is released just before the Bureau of Labor Statistics publishes the official nonfarm payrolls figures. While the two don’t always match, June’s BLS numbers showed 74,000 new private sector jobs, and 147,000 jobs in total when counting government positions.

Looking ahead, economists polled by Dow Jones expect that July saw 100,000 jobs added, and they’re projecting the unemployment rate to rise slightly to 4.2%. That number will give a clearer picture when the BLS report drops later this week.

KEY Difference Wire helps crypto brands break through and dominate headlines fast