Bitcoin Buying Spree Ends On Coinbase: Temporary Pause Or Trend Shift?

Data shows the Bitcoin Coinbase Premium Gap recently broke its longest ever streak of positive values. Here’s what this could mean for the market.

Bitcoin Coinbase Premium Gap Turned Negative Recently

In a new post on X, CryptoQuant community analyst Maartunn has talked about the recent trend in the Bitcoin Coinbase Premium Gap. The “Coinbase Premium Gap” refers to an indicator that keeps track of the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The former cryptocurrency exchange is primarily used by US-based investors, especially large institutional entities. The latter, on the other hand, has a global userbase. As such, the Coinbase Premium Gap essentially tells us about how the buying or selling behaviors differ between the American and foreign whales.

When the value of the metric is positive, it means the cryptocurrency is listed for a higher price on Coinbase than Binance. Such a trend implies buying pressure is stronger (or selling pressure is weaker) on the former as compared to the latter.

On the other hand, the indicator having a negative value implies Binance is the platform observing a net higher accumulation as its users have pushed BTC to a higher value than on Coinbase.

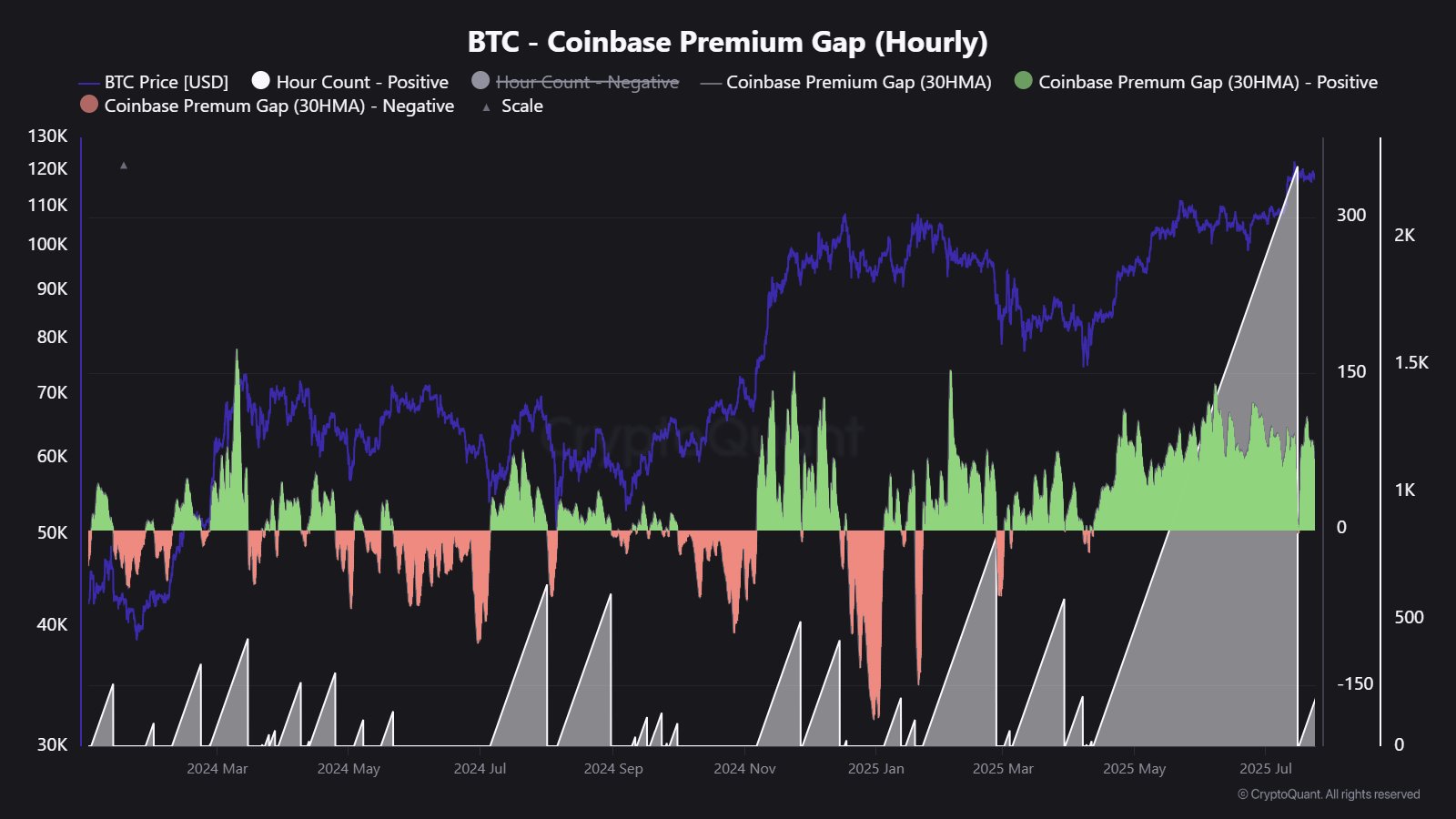

Now, here is a chart that shows the trend in the 30-hour moving average (MA) of the Bitcoin Coinbase Premium Gap over the past year and a half:

As displayed in the above graph, the 30-hour MA Bitcoin Coinbase Premium Gap has mostly held a positive value for a while now, indicating that Coinbase users have been buying.

This accumulation was so consistent earlier that it managed to reach a streak of 94 days, but recently, a dip into the negative territory finally broke it. “This was the longest streak in history,” notes the analyst.

Since the start of 2024, US institutional investors have generally played a driving role in the market, with the price often showing correlation to the Coinbase Premium Gap. Given this pattern, a pivot to selling from this group can naturally be a bearish sign for Bitcoin.

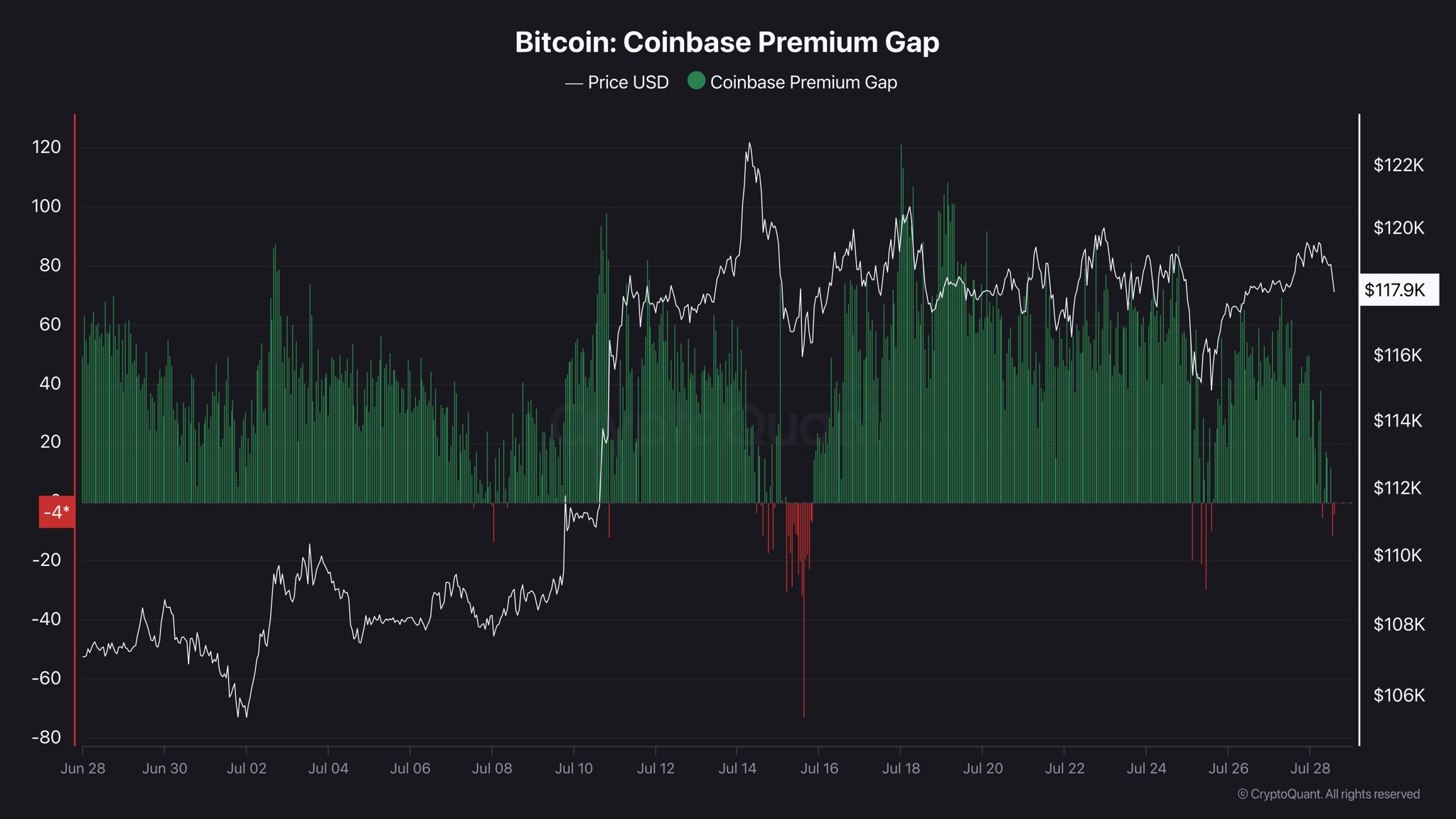

The chart shared by Maartunn shows more of a long-term view of the indicator. So, here is another graph, this one from CryptoQuant author IT Tech, that shows how the metric’s fluctuations have looked on a higher resolution over the past month:

From the chart, it’s apparent that the metric has seen multiple drops into the negative zone recently, with the latest one coming during the past day. “The demand in the US Market is weakening,” says the analyst. “Caution is necessary.”

BTC Price

Bitcoin has been unable to find a direction as its price is still floating around $117,700.