XRP price edges lower amid 44% slump in active addresses, shrinking funding rates

- XRP trades 17% below its record high, held down by risk-off sentiment and increased profit-taking.

- The number of Active Addresses on the XRL Ledger dropped 44% to 28,000, indicating fading speculative demand.

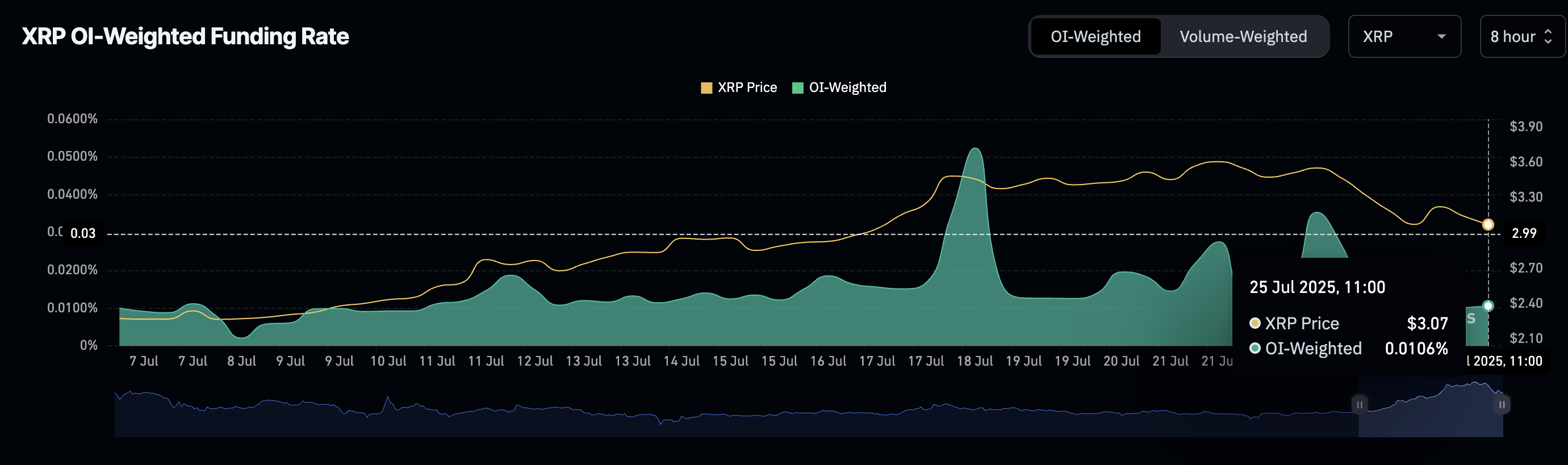

- The XRP derivatives market highlights a sharp drop in funding rates and futures Open Interest.

Ripple (XRP) price displays an upside-heavy outlook on Friday, following three consecutive days of declines. Investors appear to be inclined bearishly, indicating risk-off sentiment after XRP surged, hitting a new record high of $3.66 on July 18.

Key indicators suggest that the decline may extend into the weekend, particularly in funding rates and Open Interest (OI) in the derivatives market. XRP’s Active Addresses metric reflects the lack of conviction in the uptrend, which could keep prices suppressed in upcoming sessions.

XRP decline could extend as interest plunges

The level of user engagement on the XRP Ledger (XRPL) has fallen sharply from its recent peak. CryptoQuant’s Active Addresses metric indicates the number of addresses interacting with the protocol by sending or receiving XRP, averaging 28,000, representing a 44% decrease from 50,482, recorded on July 18.

If user engagement continues to drop, speculative demand for XRP would also decrease, depriving the token of the bullish momentum necessary to sustain the uptrend. This also highlights a lack of conviction among token holders as market sentiment turns bearish.

-1753455988336.png)

XRP Active Addresses metric | Source: CryptoQuant

The picture remains mundane in the derivatives market, particularly with the futures Open Interest falling to $9 billion after peaking at $10.94 billion on Tuesday. OI is a measure of the notional value of capital invested in XRP derivatives at any given time.

XRP Futures Open Interest | Source: CoinGlass

A persistent decline in OI indicates that trader confidence in the token is fading. Investors may be aligning with a risk-off sentiment and de-risking amid changing market dynamics.

The weighted funding rate chart below confirms the reduction in bullish momentum while signaling a steady increase in bearish sentiment. Key highlights derived from this fundamental indicator suggest that fewer traders are leveraging long positions, bearish sentiment is developing, and an opportunity to buy may arise if investors identify an entry point.

XRP Futures Weighted Funding Rate indicator | Source: CoinGlass

Technical outlook: XRP offers bearish signals

XRP bulls are battling to keep support at $3.00 intact, but key technical indicators suggest that supply could continue to outweigh demand in the short term. The previously overbought Relative Strength Index (RSI) remains downward-facing at 55, reinforcing bearish momentum amid fading buying pressure.

Traders are likely to maintain a risk-off stance, especially with the Moving Average Convergence Divergence (MACD) indicator confirming a sell signal on the daily chart. This call to reduce exposure occurred when the blue MACD line crossed below the red signal line on Friday. Red histogram bars expanding below the zero line, amid a surge in volume, would back the bearish grip.

XRP/USDT daily chart

Traders should monitor for price action below the $3.00 near-term support, which could expand the bearish scope 6% to the 50-day Exponential Moving Average (EMA) at $2.66 and 18% to the 100-day EMA at $2.48.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.