Litecoin Price Forecast: LTC reclaims $100 as NASDAQ-listed MEI Pharma unveils $100 million treasury

- Litecoin surges 28% in July, reclaiming $100 amid rising institutional adoption and retail demand.

- NASDAQ-listed MEI Pharma announces a dedicated $100 million Litecoin treasury.

- LTC offers signs of extending the bullish leg reinforced by a robust technical structure and a MACD buy signal.

Litecoin (LTC) price extends its recovery, trading at around $104 on Friday, after breaking above $100 for the first time in nearly two months. Institutional demand for LTC is increasing, reflected by the NASDAQ-listed MEI Pharma (MEIP) launching a dedicated strategic treasury.

MEI Pharma launches $100 million Litecoin treasury

The Litecoin Foundation has announced the unveiling of MEI Pharma's $100 million LTC treasury strategy, in collaboration with Titan Partners Group and the crypto investment firm GSR.

Additionally, Charlie Lee, the creator of Litecoin, will be joining the Board of Directors of MEI Pharma. The Litecoin Foundation also stated that it had invested in MEI Pharma, aligning the two companies' missions to drive global adoption of the crypto network.

"For 14 years, Litecoin has consistently delivered a stable, low-cost, and accessible network for millions and over a decade," Lee said, adding, "this partnership with GSR and MEI Pharma brings that utility and mission into an institutional setting for the first time."

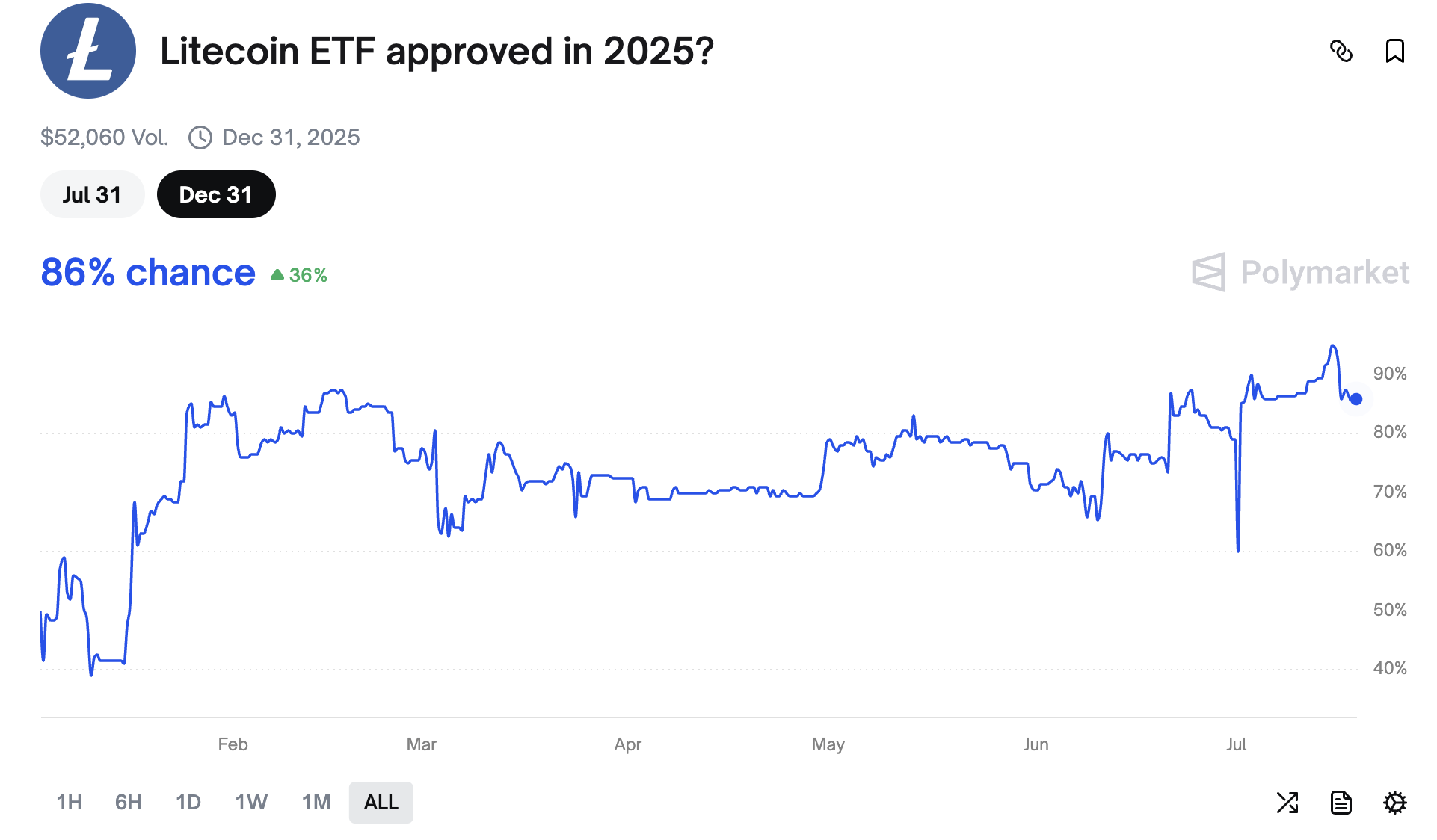

Interest in Litecoin is growing steadily, with both institutional and retail investors championing it. Polymarket users believe that there is an 87% chance that the United States (US) Securities and Exchange Commission (SEC) will approve the Litecoin spot Exchange Traded Fund (ETF) before the end of 2025.

If approved, institutional investors who prefer regulated exposure to crypto assets via stock exchanges could increase their exposure to Litecoin. The approval of Bitcoin (BTC) and Ethereum (ETH) spot ETFs in the US has sparked a surge in interest from Wall Street players, catalyzing steady price increases.

Litecoin ETF approved in 2025 | Source: Polymarket

Technical outlook: Litecoin eyes support above $100

Litecoin price is currently trading at $104, up almost 2% on the day at the time of writing. The token with an opt-in privacy feature is holding above key moving averages, including the 50-day Exponential Moving Average (EMA), the 100-day EMA, and the 200-day EMA, all of which lie between $90 and $ 92.

With the 50-day EMA and the 100-day EMA's likelihood of confirming a Golden Cross pattern in upcoming sessions, Litecoin could extend the uptrend amid high investor conviction.

At the same time, a buy signal, validated by the Moving Average Convergence Divergence (MACD) indicator on June 28, supports Litecoin's bullish case. The blue MACD line crossing above the red signal line signaled this call for traders to buy LTC.

The green histogram bars above the zero line, along with the surge in volume to $1.47 million, indicate steady buying pressure, which increases the probability of extending the uptrend to $112, tested on Friday, and $140, which was previously tagged as resistance in February.

LTC/USD daily chart

Still, the bullish outlook could be at risk now that the Relative Strength Index (RSI) has entered overbought territory, holding at 74. Should the RSI continue to rise, the risk of a correction or consolidation would increase as the market overheats, encouraging profit-taking.

Extremely high RSI readings are often a precursor to trend reversals; hence, there's a need to prepare for a potential retreat below $100 toward the cluster of moving averages currently between $90 and $90.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.