Tron Price Forecast: SRM Entertainment stakes 365 million TRX tokens as part of its TRON treasury plan

- Tron price hovers around $0.279 on Tuesday after rallying 5% the previous week.

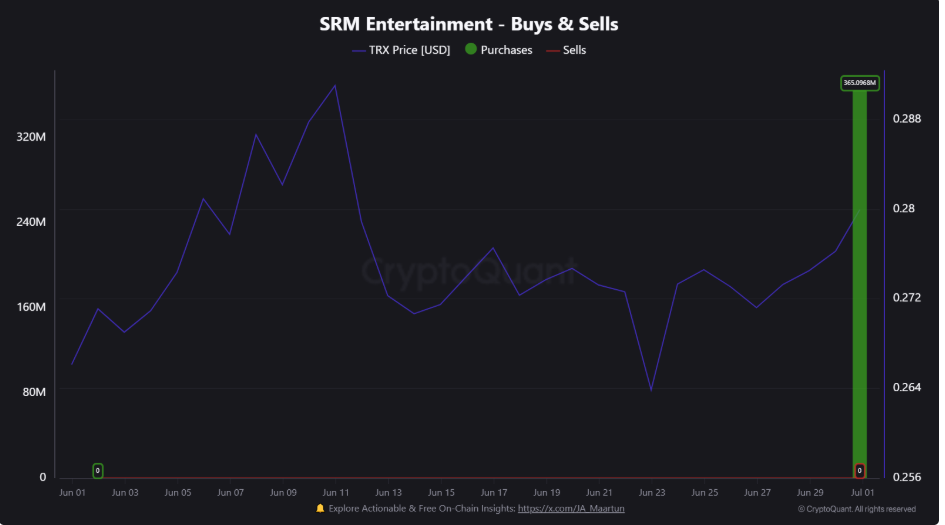

- SRM Entertainment completes its $100 million TRON treasury launch, staking 365 million TRX tokens.

- The technical outlook suggests a potential rally ahead, with stablecoin market capitalization surpassing $81 billion.

Tron (TRX) steadies at around $0.279 at the time of writing on Tuesday after posting a 5% gain the previous week. SRM Entertainment completed its $100 million TRON treasury launch by staking 365 million TRX tokens on Monday, signaling a long-term commitment to the network. The stablecoin market capitalization is climbing above $81 billion, reflecting rapid growth and adoption. The technical indicators suggest TRX could be poised for further upside.

SRM completes $100 million TRON treasury launch

SRM Entertainment (SRM) announced on Monday that it has successfully staked its treasury holdings of 365,096,845 TRX tokens through JustLend. Combining standard staking rewards and energy renting enhances TRX staking yield to up to 10% per annum. This news had a mild impact on the TRX price, which rose by 1% on that day.

This move follows its closing of a $100 million investment earlier this month to launch a TRON treasury strategy. After multiple companies have established Bitcoin and Ethereum Treasury reserves, TRX is the next coin on the list to have a treasury reserve, with an investment from SRM Entertainment.

SRM recently appointed Weike Sun as Chairman of its Board of Directors and agreed to have Justin Sun, founder of TRON Blockchain, join its strategic advisory board.

“The TRON treasury strategy continues to unlock new value for our shareholders. We expect SRM to benefit as Blockchain technology gains wider adoption globally,” said Rich Miller, Chief Executive Officer of SRM.

Apart from the treasury reserve, DefiLlama data show that the stablecoin market capitalization on TRON’s blockchain has been steadily rising and reached a milestone of $81.05 billion on Monday, marking a new all-time high. Such stablecoin activity and value increase on the TRX project indicate a bullish outlook, as it boosts network usage and can attract more users to the ecosystem, driven by Decentralized Finance (DeFi), meme coins, and payment use cases.

TRX stablecoin market capitalization chart. Source: DefiLlama

Tron Price Forecast: TRX bulls are aiming for the $0.296 mark

Tron price rebounded after retesting its daily support level around $0.259 on June 22 and rallied by 5% last week. This week, on Monday, it traded slightly up by 1.05%, and when writing on Tuesday, it stabilizes at around $0.279.

If TRX continues its upward trend, it could extend the rally toward the next daily resistance at $0.296.

The Relative Strength Index (RSI) reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart also displayed a bullish crossover on Sunday, providing a buy signal and indicating an upward trend.

TRX/USDT daily chart

However, if TRX faces a pullback, it could extend the decline to find support around its 50-day Exponential Moving Average (EMA) at $0.270.