XRP Daily New Addresses Plunge 80% In 2025 — Bearish On-Chain Metrics Raise Alarm

Crypto education and media platform Coin Bureau has shared some puzzling developments on the XRP market that may hint at a prolonged bearish future. Notably, the altcoin has been a major headliner amidst a general crypto market correction in the past one month. During this period, XRP prices have dipped by over 10% with current market prices around $2.13. While crypto enthusiasts remain hopeful of market resurgence, Coin Bureau’s recent revelations shows that on-chain data suggests otherwise.

XRP $3 Target Impossible Amid Declining Network Activity – Analyst

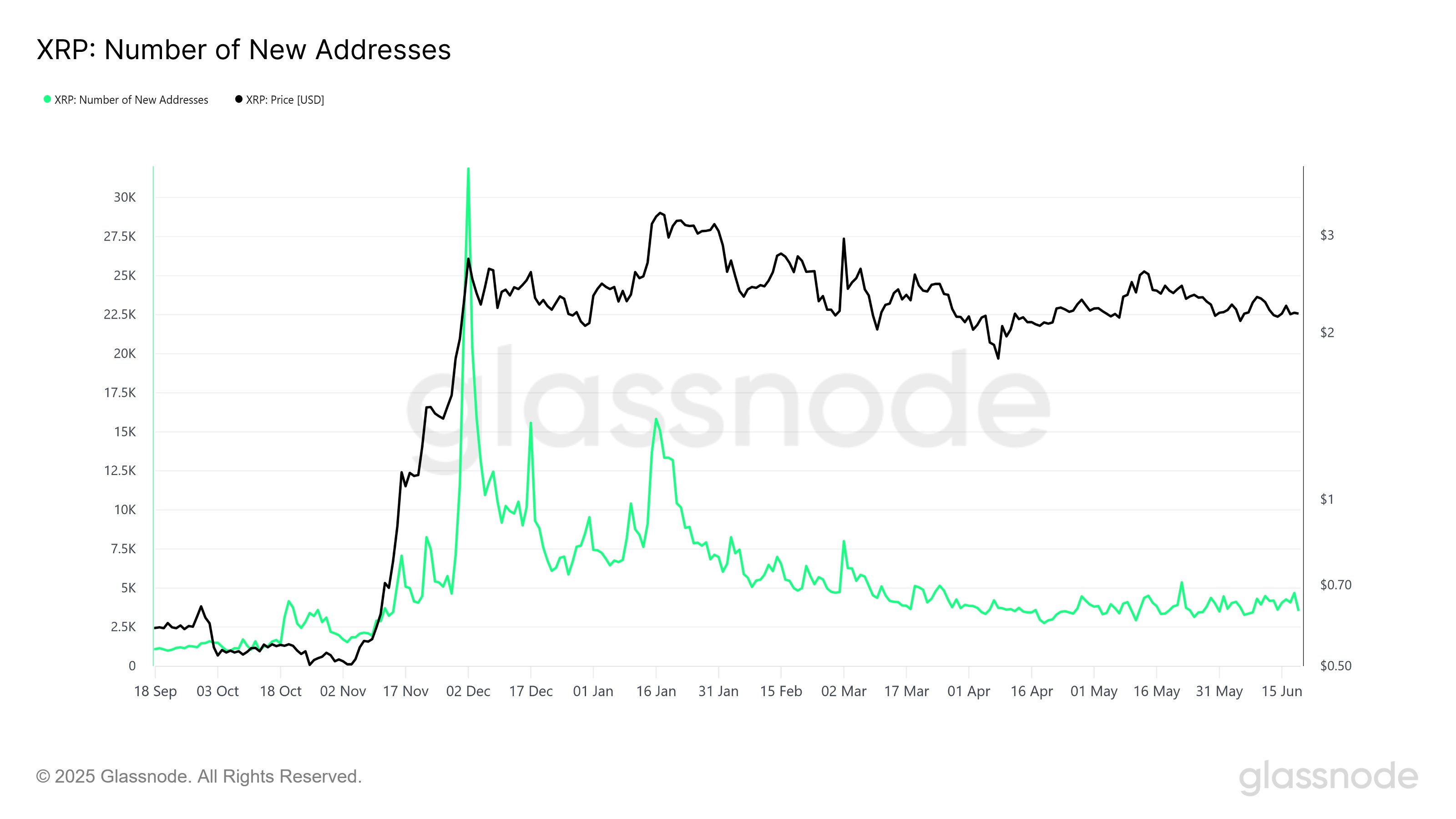

According to an X post by Coin Bureau on June 20, XRP is facing an uphill task in regaining its bullish form due to network engagement crises. Notably, data from Glassnode shows that new wallets on the XRP Ledger have crashed from above 30,000 new addresses daily in January to presently below 5,000 new addresses daily. Interestingly, the chart by Glassnode presents a strong correlation between price action and network growth. The surge in wallet creation during late Q4 2024 was accompanied by a parabolic move in price that brought XRP to trade as high as $2.71. However, as the rate of new users entering the network began to decline, XRP’s price action also entered a consolidation and gradual downward trend.

Amidst other developments, Coin Bureau also highlights XRP’s daily active addresses has experienced a staggering drop from 557,000 to 34,000 to further suggest a lack of retail investor interest in the XRP ecosystem. According to the market analyst, the glaring fall in network engagement indicates XRP may lack sufficient market demand to support a bullish climb towards the $3 price region which is a crucial resistance zone. However, other analysts have presented an alternative theory. In particular, a market expert with X pseudonym MoonLambo explains the previous highs in network activity seen in Q4 2024 and January coincided with a period of widespread market greed following the US general elections. The analyst claims the decline is normal alongside social trends rather and is overemphasized by Coin Bureau.

XRP Price Outlook

At the time of writing, XRP continues to trade at $2.13 reflecting a 1.33% decline in the past day. Meanwhile, the asset’s daily trading volume is up by 22.29% and valued at $2.25 billion. According to data from prediction site CoinCodex, XRP Investors still remain largely bearish but the Fear & Greed Index stands neutral at 54.

CoinCodex analysts are predicting XRP to remain in consolidation for the short term with predictions of $2.12 in one month. However, they forecast a steady long-term bullish revival with projections of $2.45 in three months and $3.03 in six months.