Ripple Price Forecast: XRP's bullish structure holds up as Ripple turns to Japan for Web3 and DeFi advancement

- XRP bulls eye fourth consecutive day of gains after rebounding from the $2.05 support level tested last week.

- Ripple has partnered with Japan's Web3 Salon project, supported by JETRO, focusing on DeFi, tokenization and payments.

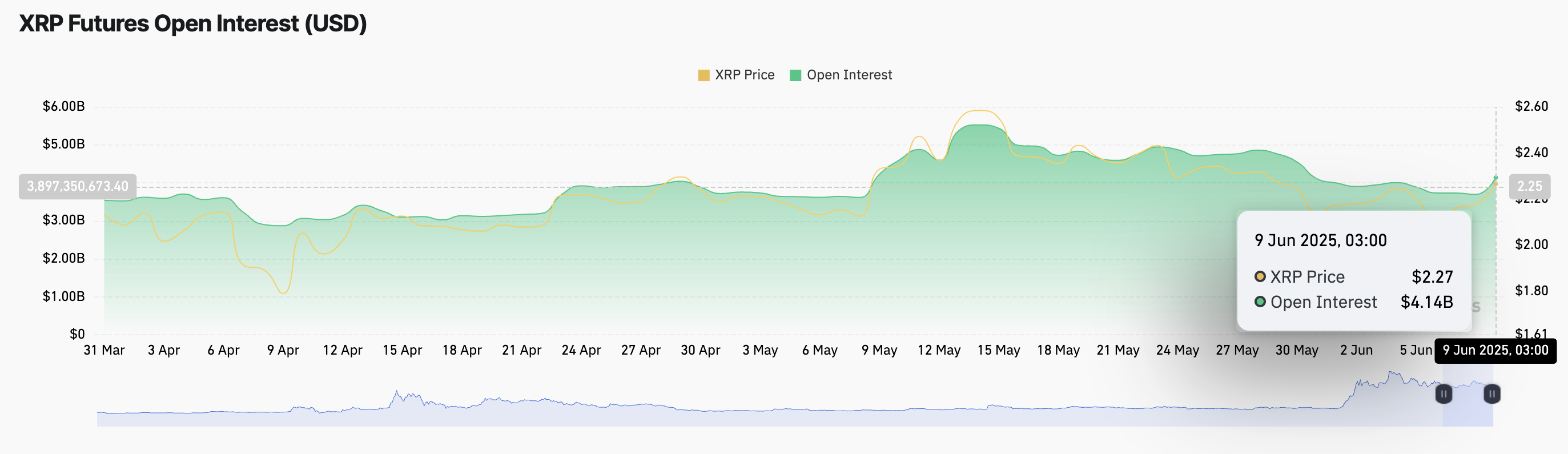

- An increase in XRP futures Open Interest to $4.1 billion indicates improving sentiment and confidence in XRP's price performance.

Ripple (XRP) pared losses following last week's sell-off to trade at around $2.26 at the time of writing on Monday. The sideways trading comes ahead of trade negotiations between the United States (US) and China in London.

Cryptocurrencies, including major assets such as Bitcoin (BTC) and Ethereum (ETH), offered bullish signals during previous sessions, implying optimism for a lasting solution to the trade dispute between the two economic giants.

Ripple targets Japan's startup space with DeFi tokenization and payments support

Ripple has announced a strategic partnership with a Web3 Salon project, backed by JETRO, Japan's External Trade Organization and powered by the Asia Web3 Alliance Japan, a renowned Web3 startup ecosystem.

As part of the collaboration, Ripple has pledged to offer grant funding of up to $200,000 per project over the next year. The development falls under the XRPL Japan and Korea Fund, as well as Ripple's broader $1 billion XRP commitment, designed to offer financial, technical and business development support for startups building on the XRP Ledger (XRPL).

"The funding will be awarded to a select group of early-stage startups based in Japan that are building on the XRPL, particularly in use cases like decentralized finance (DeFi), tokenized real-world assets (RWA), and digital payments," Ripple said in a blog post.

Japan has, over the years, stood out as a global leader in the digital asset industry, fostering regulatory clarity and consumer protection. However, startups often struggle to navigate the highly structured environment. By working hand in hand with Ripple and the strategic Web3 Salon, startups can lower the barrier to entry and speed up development.

Technical outlook: Can XRP's bullish structure accelerate recovery?

XRP's price remains above confluence support established by the 50-day Exponential Moving Average (EMA) and the 100-day EMA, currently at approximately $2.26.

The path of least resistance is steadying upward at the time of writing, underpinned by a buy signal recently confirmed by the Moving Average Convergence Divergence (MACD) indicator. Based on the daily chart below, the blue MACD line crossed above the red signal line on Monday, which significantly increases the probability of a sustainable recovery.

According to the Relative Strength Index (RSI), uptrending above the 50 midline, bulls have the upper hand. Moreover, the RSI has room to move before reaching the overbought territory, indicating that bullish momentum could gain traction in upcoming sessions and days.

XRP/USD daily chart

A daily close above the confluence support at $2.26 would go a long way in affirming the strength of the uptrend. Should the trade talks between top US and Chinese officials provide a path to a long-term agreement between the two economic powerhouses, traders would consider expanding their bullish scope to $2.28 and $ 2.65, the resistances that were tested on May 14 and May 23, respectively.

Meanwhile, data from the derivatives market shows a notable increase in the XRP futures Open Interest (OI) to $4.1 billion, up from $3.69 billion on Sunday.

XRP futures Open Interest | Source: CoinGlass

If the XRP price sustains the uptrend, along with the increase in open interest (OI) this week amid improving sentiment, trader conviction and market optimism, a 30% increase from the current price level could be on the cards.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.