Bitcoin has room for further expansion despite recent correction: Glassnode

- Bitcoin retreated near $105,500 after hitting a new all-time high of $111,970, a normal occurrence during price discovery phases.

- The open interest in Bitcoin derivatives has increased, with the value of BTC option contracts reaching an all-time high of $46.2 billion.

- Profit-taking among investors has increased, but it remains below extreme levels, suggesting that Bitcoin still has room for further growth.

Bitcoin (BTC) experienced a further correction on Thursday, dropping more than 1.5% to around $105,500. Glassnode analysts view the decline as a healthy part of Bitcoin's price discovery phase, with profit-taking still at relatively low levels.

Bitcoin maintains potential for upside despite recent pullback

Bitcoin continued its range-bound movement below the $110,000 key level on Thursday, with prices remaining a few thousand dollars below its recent milestone of $111,970, an all-time high reached last week.

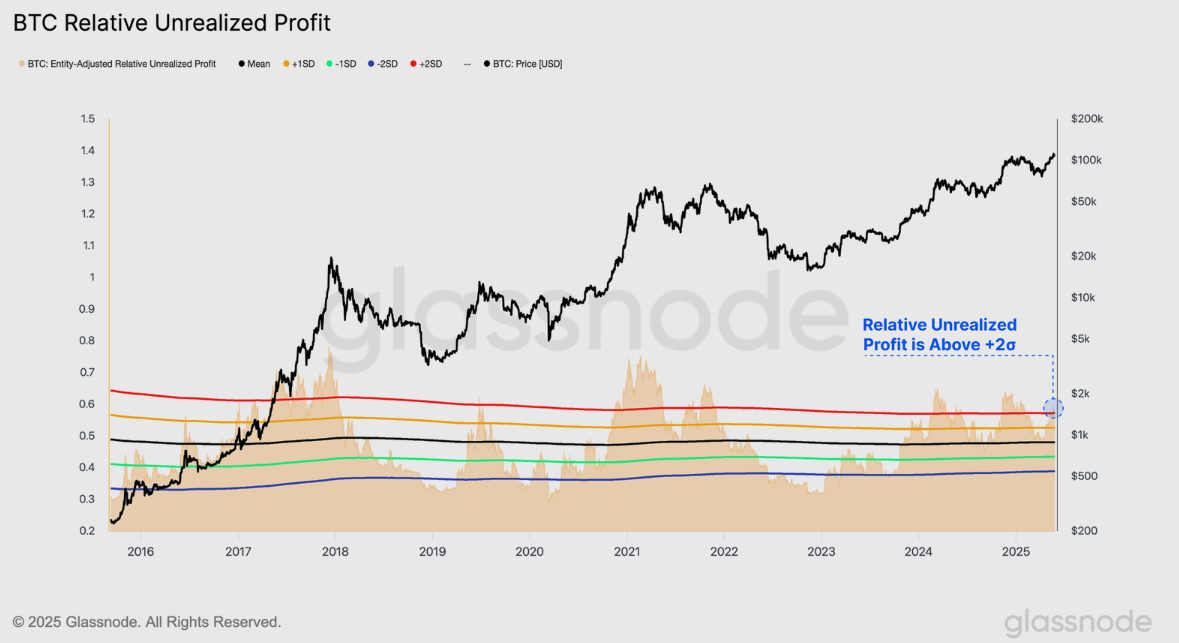

Using the Relative Unrealized Profit metric, Glassnode revealed that Bitcoin is nearing a euphoric phase in the current cycle. The indicator, which measures the level of paper profits held by investors, surged above its +2 standard deviation band. The increase implies unusually high unrealized gains across the market. Rapid price movements and increased volatility often characterize these periods, but they tend to be short-lived.

BTC Relative Unrealized Profits. Source: Glassnode

Market participants matched this uptick by taking profits. Although selling volume is on the rise, it has not yet reached extreme levels, indicating that the broader market has not yet experienced a heavy distribution that typically precedes a peak.

"We are yet to reach the truly euphoric heights seen during prior major price topping formations," Glassnode stated in its weekly report.

Such retracement is part of a healthy correction during a price discovery phase. Bitcoin's price discovery is driven by an increase in unrealized profit among holders, which is often accompanied by a surge in sell-side pressure from investors who want to capitalize on profits. Glassnode stated that larger buying volumes are key to sustaining an upward momentum in Bitcoin's price.

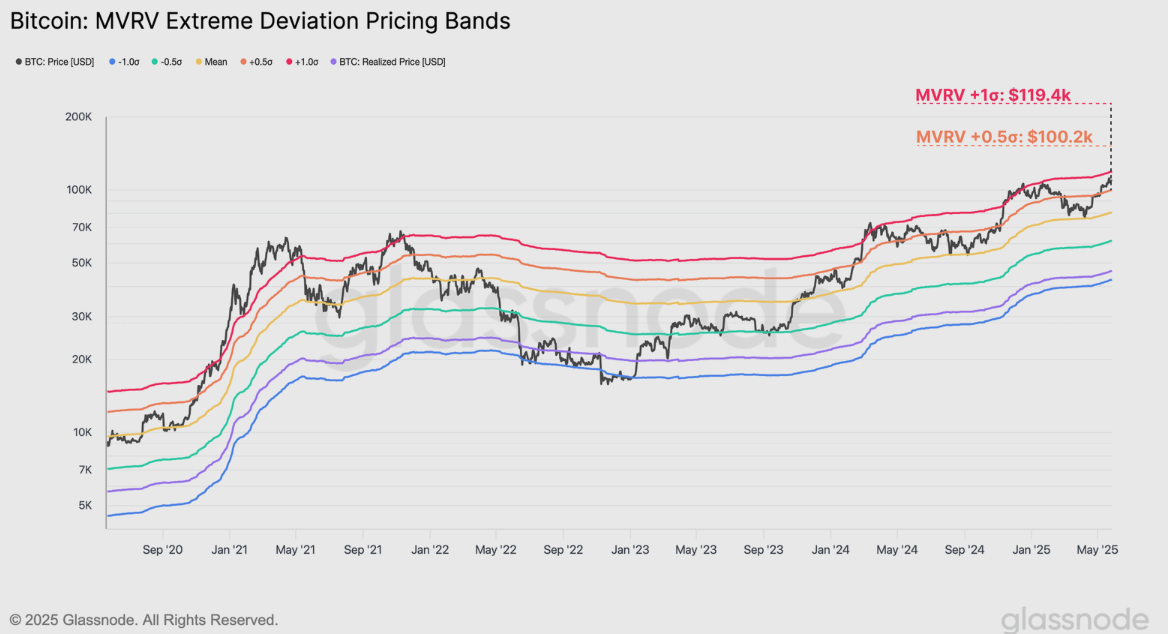

Additionally, Glassnode highlighted that Bitcoin is consolidating within the +0.5σ to +1σ range, as indicated by the Market Value to Realized Value (MVRV) metric. This indicates that the market isn't overheated and has room for further upside before it sees extreme profit-taking.

Bitcoin's open interest (OI) for futures contracts has also surged since its $75,000 low in April, rising from $36.8 billion to $55.6 billion, marking a 51% increase.

BTC MVRV Extreme Deviation Pricing Bands. Source: Glassnode

Likewise, open interest in options contracts reached $46.2 billion, up from $20.4 billion over the same period, marking an all-time high. The $25.8 billion increase in options outpaces futures OI growth. Glassnode noted that the rise signals a maturing market where participants are using these contracts to adjust their risk management strategies.